FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:E

O

$63,900.

$29,200.

$37,200.

$204,100.

$42,600.

83

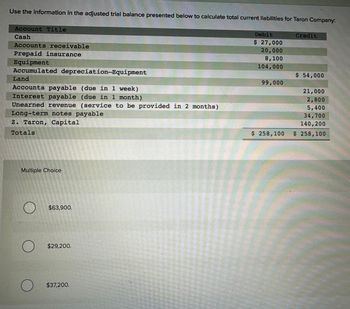

Transcribed Image Text:Use the information in the adjusted trial balance presented below to calculate total current liabilities for Taron Company:

Account Title

Cash

Accounts receivable

Prepaid insurance

Equipment

Accumulated depreciation-Equipment

Land

Accounts payable (due in 1 week)

Interest payable (due in 1 month)

Unearned revenue (service to be provided in 2 months)

Long-term notes payable

Z. Taron, Capital

Totals

Multiple Choice

O

O

O

$63,900.

$29,200.

$37,200.

Debit

$ 27,000

20,000

8,100

104,000

99,000

$ 258,100

Credit

$ 54,000

21,000

2,800

5,400

34,700

140,200

$ 258,100

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Calculate the missing information on the revolving credit account. Interest is calculated on the unpaid or previous month's balance. PreviousBalance AnnualPercentageRate (APR) MonthlyPeriodicRate(as a %) FinanceCharge(in $) Purchasesand CashAdvances PaymentsandCredits NewBalance(in $) $1,026.61 1.75% $322.20 $300.00 Step 1 In the credit account statement below, the values of the annual percentage rate (APR), finance charge, and the new balance must be calculated. PreviousBalance AnnualPercentageRate (APR) MonthlyPeriodicRate(as a %) FinanceCharge(in $) Purchasesand CashAdvances PaymentsandCredits NewBalance(in $) $1,026.61 1.75% $322.20 $300.00 Recall that the annual percentage rate (APR) is tied to the monthly periodic rate by the following formula. monthly periodic rate = APR 12 By solving this equation for the APR, the known value for the monthly periodic rate can be substituted to calculate the APR. APR = monthly periodic rate ✕ 12 The…arrow_forwardJournalize the following transactions for the Scott Company. Assume 360 days per year. November 4: Received a $6,500, 90-day, 6% note from Tim's Co.in payment of the account. If an amount box does not require an entry, leave it blank. Nov. 4 December 31: Accrued interest on the Tim's Co. note. If an amount box does not require an entry, leave it blank. Round your answers to two decimal places. Dec. 31 February 2: Received the amount due from Tim's Co. on the note. If an amount box does not require an entry, leave it blank. Round your answers to two decimal places. Feb. 2arrow_forwardCalculate the missing information on the revolving credit account. Interest is calculated on the unpaid or previous month's balance. (Round dollars to the nearest cent.) Monthly Periodic Annual Finance Purchases Payments New Previous Charge and Cash and Balance Percentage Rate (APR) Balance Rate (in $) Advances Credits (in $) (as a %) $1,029.61 % 1.25% $ $322.20 $200.00 $arrow_forward

- Calculate the missing information on the revolving credit account. Interest is calculated on the unpaid or previous month's balance. (Round dollars to the nearest cent.) Monthly Purchases Payments and New Balance Annual Finance Previous Periodic Percentage Rate (APR) Charge (in $) and Cash Rate (as a %) Balance Advances Credits (in $) $1,023.61 1.25% $322.20 $400.00 24arrow_forwardSuppose you want to estimate your transportation expenses for the year.Explain how you could use this one-month statement to make an estimate for one year of transportation expenses.arrow_forwardCalculate the missing information on the revolving credit account. Interest is calculated on the unpaid or previous month's balance. PreviousBalance AnnualPercentageRate (APR) MonthlyPeriodicRate(as a %) FinanceCharge(in $) Purchasesand CashAdvances PaymentsandCredits NewBalance(in $) $45.00 12% % $ $176.20 $55.00 $arrow_forward

- Calculate the average daily balance (in $) for October for a revolving credit account with a previous month's balance of $120 and the following activity. (Round your answer to the nearest cent.) Date Activity Amount October 3 Cash advance $50.00 October 7 Payment $75.00 October 10 Purchase $26.59 October 16 Credit $10.00 October 25 Purchase $121.60 average daily balance = $arrow_forwardCalculate the average daily balance (in $) for October for a revolving credit account with a previous month's balance of $130 and the following activity. (Round your answer to the nearest cent.) Date Activity Amount October 3 Cash advance $50.00 October 7 Payment $75.00 October 10 Purchase $27.59 October 16 Credit $20.00 October 25 Purchase $124.60 average daily balance = $arrow_forwardOn January 1, 2021, the general ledger of ACME Fireworks includes the following account balances:Accounts Debit CreditCash $ 25,100Accounts Receivable 46,200Allowance for Uncollectible Accounts $ 4,200Inventory 20,000Land 46,000Equipment 15,000Accumulated Depreciation 1,500Accounts Payable 28,500Notes Payable (6%, due April 1, 2022) 50,000Common Stock 35,000Retained Earnings…arrow_forward

- Calculate the average daily balance (in $) for October for a revolving credit account with a previous month's balance of $130 and the following activity. (Round your answer to the nearest cent.) Date Activity Amount October 3 Cash advance $50.00 October 7 Payment $75.00 October 10 Purchase $28.59 October 16 Credit $20.00 October 25 Purchase $122.60 average daily balance = $ ___arrow_forwardA company reports the following: Sales $117,530 Average accounts receivable (net) 16,790 Determine (a) the accounts receivable turnover and (b) the number of days' sales in receivables, Round interim calculations to the nearest dollar and final answers to one dedmal place. Assume a 365-day year.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education