ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

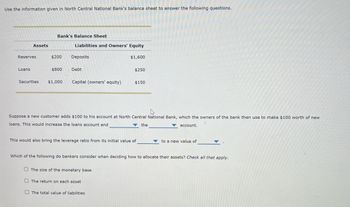

Transcribed Image Text:Use the information given in North Central National Bank's balance sheet to answer the following questions.

Bank's Balance Sheet

Assets

Liabilities and Owners' Equity

Reserves

$200

Deposits

$1,600

Loans

$800

Debt

$250

Securities

$1,000

Capital (owners' equity)

$150

Suppose a new customer adds $100 to his account at North Central National Bank, which the owners of the bank then use to make $100 worth of new

loans. This would increase the loans account and

account.

the

This would also bring the leverage ratio from its initial value of

to a new value of

Which of the following do bankers consider when deciding how to allocate their assets? Check all that apply.

The size of the monetary base

The return on each asset

The total value of liabilities

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- c14. You have savings accounts at two separately FDIC insured banks, ABC Bank and XYZ bank. At ABC your account has a balance of $200,000. At XYZ bank the account balance is $60,000. a. If both banks fail how much will you receive? b. You find out that ABC and XYZ banks are going to merge. If you are concerned about the possibility of the new bank failing what would you do?arrow_forwardA bank has a reserve ratio of 10 percent, and it has received $5,000 of deposits. What is the bank's assets? Group of answer choices It has $500 in reserves and $4,500 in loans. It has $50 in reserves and $4,950 in loans. It has $50 in reserves and $5,000 in loans. It has $10 in reserves and $4,990 in loans.arrow_forwardOnly typed answerarrow_forward

- Reserves $ 100 Checkable Deposits 1,000 300 Loans (to customers) Property Securities (owned) Stock Shares 400 300 100 Refer to the accompanying table of information for the Moolah Bank. Assume that the listed amounts constitute this bank's complete set of accounts. Moolah's assets are $1,100. liabilities are $1,100. net worth is $300. profit is $1,000.arrow_forwardUse the information presented in Midwestern Mutual Bank's balance sheet to answer the following questions. Bank's Balance Sheet Assets Liabilities and Owners' Equity Reserves $150 Deposits $1,200 Loans $600 Debt $200 Securities $750 Capital (owners' equity) $100 Suppose the owners of the bank borrow $100 to supplement their existing reserves. This would increase the reserves account and the асcount. This would also bring the leverage ratio from its initial value of to a new value of Which of the following do bankers take into account when determining how to allocate their assets? Check all that apply. The size of the monetary base The total value of liabilities The return on each assetarrow_forwardA3arrow_forward

- 22. Which of the following entries would appear on the liabilities side of a commercial bank's balance sheet? Government of Canada securities demand deposits cash reserves mortgage loans foreign currency reservesarrow_forwardPlease no written by hand Use the information presented in Northeastern Mutual Bank's balance sheet to answer the following questions. Bank’s Balance Sheet Assets Liabilities and Owners' Equity Reserves $150 Deposits $1,200 Loans $600 Debt $200 Securities $750 Capital (owners' equity) $100 Suppose the owners of the bank borrow $100 to supplement their existing reserves. This would increase the reserves account and ? the ? account. This would also bring the leverage ratio from its initial value ? of to a new value of ? . Which of the following do bankers take into account when determining how to allocate their assets? Check all that apply. The total value of liabilities The riskiness of each asset The size of the monetary basearrow_forwardWhat are the primary differences between different types of banks (savings, commercial, investment, contractual, intermediary, national, credit unions, etc.)? How are insurance companies acting in the capacity of banks?arrow_forward

- 11arrow_forwardIf a customer came into the bank to withdraw more from their demand deposits than the bank currently has on hand in vault cash, what are the sources for getting the cash to cover the withdraws(Check ALL That Apply)? Print New Money Borrow from another Bank Borrow from the Federal Reserve Convert(Liquidate) Loansarrow_forwardUse the information given in North Central National Bank's balance sheet to answer the following questions. Assets Reserves Loans Securities Bank's Balance Sheet $200 $800 Liabilities and Owners' Equity $1,600 Deposits Debt $1,000 Capital (owners' equity) $250 $150 Suppose the owners of the bank borrow $100 to supplement their existing reserves. This would increase the reserves account and account. This would also bring the leverage ratio from its initial value of to a new value of Which of the following statements regarding the capital requirement is true? Check all that apply. Its intended goal is to protect the interests of those who hold equity in the bank. It specifies a minimum leverage ratio for all banks. The higher the percentage of assets a bank holds as loans, the higher the capital requirement. thearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education