ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

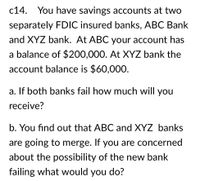

Transcribed Image Text:**Case Study c14**

You have savings accounts at two separately FDIC-insured banks, ABC Bank and XYZ Bank. At ABC, your account has a balance of $200,000. At XYZ Bank, the account balance is $60,000.

**a. If both banks fail, how much will you receive?**

**b. You find out that ABC and XYZ Banks are going to merge. If you are concerned about the possibility of the new bank failing, what would you do?**

**Explanation:**

This scenario involves understanding FDIC insurance limits and the potential impact of bank mergers on your insured deposits. The FDIC (Federal Deposit Insurance Corporation) insures accounts up to $250,000 per depositor, per insured bank. If both banks fail, your total insured amount will be determined based on these limits.

In the case of a bank merger, it is important to reassess the total amount held in the new entity to ensure it remains within FDIC insurance limits. You might consider diversifying your accounts across different banks to maintain full insurance coverage.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Question 1. Bob has $50,000 in a checking account and $150,000 in his savings account at Big Bank. What is the total amount of FDIC insurance he has on these two accounts? Question 2. Sue has $50,000 in her checking account at Small Bank and $150,000 in a savings account at Big Bank. What is the total amount of FDIC insurance she has on these two accounts?arrow_forwardFree rider problem is an issue that occurs when people who do not pay for information take advantage of the information that other people have paid for Banks reduce the free-rider problem in information production by A making private, nontraded loans so other lenders cannot benefit from the information they have collected about the borrower B. charging others for information about the financial condition of potential borrowers C. buying tradable securities with their depositors' funds D. serving as an intermediary that holds scarcely any nontraded loansarrow_forwardHow does a bank adjust its pricing of a loan with high default risk? Use average historical cost of funds instead of marginal cost. Add 1.5% to the applicable cost irrespective of the risk level. Add a default risk premium to the applicable weighted marginal cost of funds. None of the above.arrow_forward

- Explain the functions of financialintermediaries?arrow_forwardIn your own words, please define the following terms: asset, balance sheet, credit risk, excess reserves, interest- rate risk, liquidity risk, required reserves,Federal deposit insurance. Please make it simple and no plagiarism thank youarrow_forwardrefer to the photoarrow_forward

- 1. What are the possible consequences for international banks seeking to operate across borders? 2. How can banks effectively navigate across borders regulatory environments to manage risks and ensure compliance?arrow_forward2arrow_forwardA bank that wishes to reduce its credit risk could: A. Sell risky loans from its loan portfolio B. Enter into a repurchase agreement O. Buy a credit default swap D. Sell a credit default swap E. Both A and C will reduce credit riskarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education