Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

If ABC Bank’s ALCO targets the market value of shareholders’ equity in its interest rate risk management, is the bank positioned to gain or lose if interest rates fall?

b. If interest rates rise by 1% for all assets and liabilities, what is the approximate expected change in the bank’s economic value of equity?

c. Provide a specific transaction that the bank could implement in order to immunize its interest rate risk exposure.

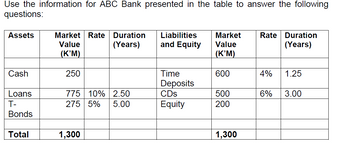

Transcribed Image Text:Use the information for ABC Bank presented in the table to answer the following

questions:

Assets

Market Rate Duration

Liabilities

Market

Rate Duration

Value

(K'M)

(Years)

and Equity

Value

(Years)

(K'M)

Cash

250

Time

600

4%

1.25

Deposits

Loans

775 10%

2.50

CDs

500

6%

3.00

T-

275 5% 5.00

Equity

200

Bonds

Total

1,300

1,300

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- please answer asap for a good ratingarrow_forwardhow do banks improve asset utilisation to increase Return on Equity and what are the risk implications?arrow_forwardHow might thetreasurer of a multinational firm use the interest rate parity concept (a) when deciding howto invest the firm’s surplus cash and (b) whendeciding where to borrow funds on a short-termbasis?arrow_forward

- What are the risk implications/shortcomings of financial institutions in increasing their financial leverage to increase return on equity?arrow_forwardHow is securitization supposed to help banks and S&Ls manage risks andincrease homeowners’ access to capital?arrow_forwardThe risks below faced the financial institutions: Credit Risk Liquidity Risk Interest Rate Risk Off-Balance-Sheet Risk Market Risk Foreign Exchange Risk Sovereign Risk Technology Risk Operational Risk FinTech Risk Insolvency Risk What causes these risks, and How to mitigate them? I understand these risks are interdependent to each others.arrow_forward

- What is the relationship of business risk, financial risk, and stand-alone risk? How to calculate the financial risk for a firm?arrow_forwardThe investment banker does all of the following except a. make long-term investments for banking institutions b. advise clients c. bear the risk of selling a security issue d. act as a middleman between the issuer and buyer of a new securityarrow_forwardThe risks below faced the financial institutions: Off-Balance-Sheet Risk Market Risk Foreign Exchange Risk What causes these risks, and How to mitigate them? I understand these risks are interdependent on each other.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education