FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

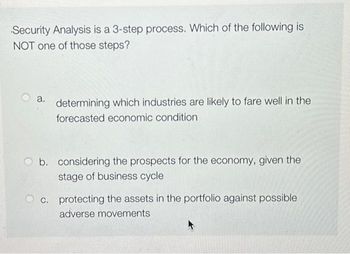

Transcribed Image Text:Security Analysis is a 3-step process. Which of the following is

NOT one of those steps?

a.

determining which industries are likely to fare well in the

forecasted economic condition

b. considering the prospects for the economy, given the

stage of business cycle

c. protecting the assets in the portfolio against possible

adverse movements

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Examine the main problems in risk management. Discussion What role does risk management play in formulating a company's strategy?arrow_forwardWhich are functions of financial markets? Check all that apply: Maturity intermediation ORisk allocation O Separation of ownership and management O Resource allocation Consumption timingarrow_forwardWhich of the following are the key factors when determining asset allocation for an investment? I. Time an investor has until he needs to use the money from the investment (time horizon) II. Risk preferences (tolerance for risk) III. Current financial situation a. I., II., & III. b. I. & III. c. II. & III. d. I. & II.arrow_forward

- In a few sentences, answer the following question as completely as you can. According to the CAPM, the expected return on a risky asset depends on three components. Describe each component, and explain the role of each one in determining expected return.arrow_forwardThe risks below faced the financial institutions: Credit Risk Liquidity Risk Interest Rate Risk Off-Balance-Sheet Risk Market Risk Foreign Exchange Risk Sovereign Risk Technology Risk Operational Risk FinTech Risk Insolvency Risk What causes these risks, and How to mitigate them? I understand these risks are interdependent to each others.arrow_forwardWhich of the followings is the LEAST considered when developing financial strategiesa.Risk of industry-comparable employee turnoverb. Relationships with business partnersc. Current and forecasted financial positiond. Need for long-term financing of potential projects and current operationsarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education