Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Use the following to solve questions a. and b. and please buid an excel spreadsheet and please show the formulas on the excel spreadsheet.

- A house with price of $250,000

- 20% down payment, loan amount $200.000

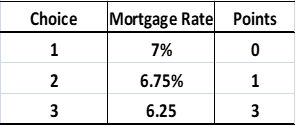

- 30-year fixed rate mortgage with interest rate as follows:

Suppose that there is $2,500 origination cost.

a. Which choice would you like to choose if you will live in the house for 30 years?

b. Which choice would you like to choose if you will live in the house for 5 years?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 1 steps

Knowledge Booster

Similar questions

- Explain well with proper step by step Answer.arrow_forwardAn investor plans to purchase a 2-bedroom condo in San Francisco. The price of the property is $300,000. She will have a 15-year 3% APR mortgage with a 20% down payment. The investor will keep the condo in the next 15 years and lease the condo. Suppose the rent collected by the renter will just cover the mortgage payment and other expenses (e.g., condo fee, tax, maintenance). In other words, in- and out- cash flows just cancelled out. The value of the house is expected to inflate by 50%. What is the monthly return to the investor? Group of answer choices 14.377% 1.198% 1.126% 13.508%arrow_forwardYogesharrow_forward

- Let’s assume that you plan to purchase a house which is selling for $350,000 today. You will make a monthly payment for the next 30 years, with an annual interest rate of 3%. What will be the amount of your monthly mortgage (i.e., home loan) payment? answer choices $1,890.37 $1,400.01 $1,475.61 $1,228.14arrow_forwardAnswer the following question using a spreadsheet and the material in the appendix. You would like to buy a house. Assume that given your income, you can afford to pay $12,000 a year to a lender for the next 30 years. If the interest rate is 7% how much can you borrow today based on your ability to pay? What about if the interest rate is 3%? Maximum mortgage at 7%: $ Maximum mortgage at 3%: $arrow_forwardPlease stepsarrow_forward

- You plan to purchase a house with the following information. Calculate the interest on the 127th payment. Price Years Down Payment Rate Payment Interest in 127th Payment Year Price Rate Down Payment $100,000.00 You plan to purchase a house using the following information. What is the dollar difference between the total interest paid for both mortgage options? Total Interest Difference 30 20% 4.5% 30 $200,000 6.25% $40,000 15 $200,000 4.00% $40,000arrow_forwardGive typing answer with explanation and conclusion Assume you want to borrow $300,000 and have been presented with two options. The first option is a fully amortizing loan with an interest rate of 3% and $4000 of origination fees and points. The second option is an interest only loan with an interest rate of 4% and $5000 of origination fees and points. Both loans are for 30 years and have monthly payments. Further assume that if the borrower chooses the interest only loan, any money saved on the monthly payment can be invested with a projected return of 7%. Also assume that the proceeds from the investment will first be used to pay off any remaining balance on the loan. How much money will the investor have left at the end of 30 years after repaying the loan? Group of answer choices None, the investor will owe $12,373.42 $323,060.72 $22,063.08 $30,750.78arrow_forwardSuppose you want to purchase a home for $375,000 with a 30-year mortgage at 5.14% interest. Suppose also that you can put down 25%. What are the monthly payments? (Round your answer to the nearest cent.) $ What is the total amount paid for principal and interest? (Round your answer to the nearest cent.) $ What is the amount saved if this home is financed for 15 years instead of for 30 years? (Round your answer to the nearest cent.) $arrow_forward

- ← You need a loan of $150,000 to buy a home. Calculate your monthly payments and total closing costs for each choice below. Briefly discuss how you would decide between the two choices. Choice 1: 20-year fixed rate at 6% with closing costs of $2900 and no points. Choice 2: 20-year fixed rate at 5.5% with closing costs of $2900 and 4 points. What is the monthly payment for choice 1? A (Do not round until the final answer. Then round to the nearest cent as needed.)arrow_forwardSubject: Financearrow_forwardSuppose you want to purchase a home for $525,000 with a 30-year mortgage at 4.84% interest. Suppose also that you can put down 30%. What are the monthly payments? (Round your answer to the nearest cent.) $ What is the total amount paid for principal and interest? (Round your answer to the nearest cent.) $ What is the amount saved if this home is financed for 15 years instead of for 30 years? (Round your answer to the nearest cent.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education