Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

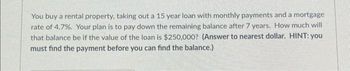

Transcribed Image Text:You buy a rental property, taking out a 15 year loan with monthly payments and a mortgage

rate of 4.7%. Your plan is to pay down the remaining balance after 7 years. How much will

that balance be if the value of the loan is $250,000? (Answer to nearest dollar. HINT: you

must find the payment before you can find the balance.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Please help me stepwise and correct both by formula as welll as excelarrow_forwardSuppose you intend to purchase a house worth $239,900 with a 30-year fixed rate mortgage. You have a down payment of 15%. (a) How much are you planning to finance? (b) Find the monthly payment needed to amortize the loan, at a rate of 2.4% compounded monthly. (c) Approximately how much of the loan will remain after 12 years?arrow_forwardYou want to buy a car, and a local bank will lend you $40,000. The loan will be fully amortized over 10 years, and the nominal interest rate will be 8% with interest paid annually. 1: What will be the annual loan payment? 2: Construct Amortization Schedule Table.arrow_forward

- You found your dream house. It will cost you $300000 and you will put down $45000 as a down payment. For the rest you get a 30-year 4.0% mortgage. What will be your monthly mortgage payment in S (assume no early repayment)?arrow_forwardYou want to buy a new house. You can afford to pay $15,000 per year for 30 years with the first payment being due one year from today. If the interest rate on your loan is 3%, what price of home can you buy today? Enter your answer as a number rounded to 2 decimal places.arrow_forwardSuppose you want to purchase a home for $475,000 with a 30-year mortgage at 5.84% interest. Suppose also that you can put down 25%. What are the monthly payments? (Round your answer to the nearest cent.)$ What is the total amount paid for principal and interest? (Round your answer to the nearest cent.)$ What is the amount saved if this home is financed for 15 years instead of for 30 years? (Round your answer to the nearest cent.)arrow_forward

- You plan to use a 15 year mortgage obtained from a local bank to purchase a house worth $124,000.00. The mortgage rate offered to you is 7.75%. You will make a down payment of 20% of the purchase price. a. Calculate your monthly payments on this mortgage. List in a spreadsheet the cash flow the bank expects to receive from you. Submit the spreadsheet with your answers. b. Calculate the amount of interest and principal for the 60th payment. Show your work. c. Calculate the amount of interest and principal to be paid on the 180th payment. Show your work. d. What is the amount of interest paid over the life of this mortgage?arrow_forwardAnswer the following question using a spreadsheet and the material in the appendix. You would like to buy a house. Assume that given your income, you can afford to pay $12,000 a year to a lender for the next 30 years. If the interest rate is 7% how much can you borrow today based on your ability to pay? What about if the interest rate is 3%? Maximum mortgage at 7%: $ Maximum mortgage at 3%: $arrow_forwardYou are interested in purchasing a house but unfortunately you don't have any money for a down payment. Luckily the house you are looking at buying is only $325, 000 and the bank currently has an offer where they will lock in your interest rate for the entire length of the mortgage. The rate that they are offering is 4.5% interest over 15 years. Develop a worksheet that will show the monthly payment, the beginning and ending balance for each year of the loan, the annual cost of the loan, and the annual interest paid for each year of the loan. Please show Formulasarrow_forward

- You are thinking of purchasing a house. The house costs $300,000. You have $43,000 in cash that you can use as a down payment on the house, but you need to borrow the rest of the purchase price The bank is offering a 30-year mortgage that requires annual payments and has an interest rate of 9% per year. What will be your annual payment if you sign this mortgage? The annual payment is $ (Round to the nearest dollar)arrow_forwardYou can afford monthly payments of $800. If current mortgage rates are 3.06% for a 15-year fixed rate loan, how much can you afford to borrow? If you are required to make a 20% down payment and you have the cash on hand to do it, how expensive a home can you afford? (Hint: You will need to solve the loan payment formula for P.)arrow_forwardYou are thinking of purchasing a house. The house costs $354,000. You have $45,000 in cash that you can use as a down payment on the house, but you need to borrow the rest of the purchase price. The bank is offering a 25-year mortgage that requires annual payments and has an interest rate of 6% per year. What will be your annual payment if you sign this mortgage?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education