FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

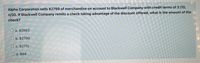

Transcribed Image Text:Alpha Corporation sells $2799 of merchandise on account to Blackwell Company with credit terms of 3 /10,

n/30. If Blackwell Company remits a check taking advantage of the discount offered, what is the amount of the

check?

O a. $2883

O b. $2799

O c. $2715

O d. $84

Transcribed Image Text:The journal entry to record the receipt of a payment from customer within the discount period on a sale of

$2325 with terms of 3/10, n/30 will include a credit to

O a. Sales discounts for $70

O b. Accounts receivable for $2325

O c. Sales Revenue for $2325

O d. Cash for $2255

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- company A sells $1,500 of merchandise on account to company B with credit terms of 2/10, n/30. If company B remits a check taking advantage of the discount offered, what is the amount of Company B's check?? -$1,470 -$1,050 -$1,200 -$1,350arrow_forwardDescribe the transaction recorded. Cash 593.60 Sales Tax Payable 44.80 Sales 560.00 Credit CardExpense 11.20 (Select all your answers.) Sold merchandise for cash, plus sales tax. Purchased goods plus freight. Company deposited cash from the sale. Customer paid by bank credit card. Discount charged by bank to the seller. Interest credited by the bank.arrow_forwardOn May 27, you received your bank statement showing a balance of $1,026.34. Your checkbook shows a balance of $1,056.29. Outstanding checks are $245.50 and $377.20. The account earned $62.59. Deposits in transit amount to $705.24, and there is a service charge of $10.00. Calculate the reconciled balance. $29.95 $943.80 O $1,003.70 O $1,108.88arrow_forward

- A company sells Gizmos to consumers at a price of $117 per unit. The cost to produce Gizmos is $27 per unit. The company will sell 15,000 Gizmos to consumers each year. The fixed costs incurred each year will be $190,000. There is an initial investment to produce the goods $3,400,000 which will be depreciated straight line over the 10-year life of the investment to a salvage value of $0. The opportunity cost of capital is 6% and the tax rate is 34%. What is the operating cash flow each year?arrow_forwardTB MC Qu. 07-137 (Algo) On November 1, Orpheum Company accepted... On November 1, Orpheum Company accepted a $12,000, 90-day, 10% note from a customer to replace an account receivable. What entry should be made by Orpheum on the November 1 to record the acceptance of the note? Multiple Choice ces Debit Notes Receivable $12,000; credit Cash $12,000. Debit Notes Receivable $12,000; credit Accounts Receivable $12,000. Debit Notes Receivable $12,000; credit Sales $12,000. Debit Notes Receivable $12,300; credit Accounts Receivable $12,000; credit Interest Dovonue t200 < Prev 13 of 20 Next 1,069 15 tv MacBook Air 80 F3 DD F2 F4 F5 F6 F7 F8 F9 %23 %24 & 3 4 7 8. W R T Y < coarrow_forwardPlease Do not Give image format and Solve Full detailsarrow_forward

- The trial balance of Pacilio Security Services, Incorporated as of January 1, Year 8, had the following normal balances: $93,708 100 22,540 1,334 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. Cash Petty cash Accounts receivable Allowance for doubtful accounts Supplies Prepaid rent Merchandise inventory (18@ $285) 14. 15. 16. 17. 18. 19. 20. 21. 22. 23. Land Salaries payable Common stock Retained earnings During Year 8, Pacilio Security Services experienced the following transactions: 1. Paid the salaries payable from Year 7. 2. Purchased equipment and a van for a lump sum of $36,000 cash on January 2, Year 8. The equipment was appraised for $10,000 and the van was appraised for $30,000. Requirement 3. Paid $9,000 on May 1, Year 8, for one year's office rent in advance. 4. Purchased $300 of supplies on account 5. Purchased 120 alarm systems at a cost of $280 each. Pald cash for the purchase. 6. After numerous attempts to collect from customers, wrote off $2,350 of uncollectible accounts…arrow_forward53 a. Sent a check to XYZ company for the previous purchase of $3,500 of merchandise less a $70 discount Skipped View transaction list Journal entry worksheet < 1 Sent a check to XYZ company for the previous purchase of $3,500 of merchandise less a $70 discount. Note: Enter debits before credits. Transaction General Journal Debit Credit Record entry Clear entry View general journalarrow_forwardNew Store has the following information at August 31: attached in ss below thanks for help hwrphwtphtowh warrow_forward

- Danica Patrick, Inc. includes the following account among its trade receivables. Hopkins Co. 1/1 Balance forward 700 1/28 Cash (#1710) 1,100 1/20 Invoice #1710 1,100 4/2 Cash (#2116) 1,350 3/14 Invoice #2116 1,350 4/10 Cash (1/1 Balance) 155 4/12 Invoice #2412 1,710 4/30 Cash (#2412) 1,000 9/5 Invoice #3614 490 9/20 Cash (#3614 and 10/17 Invoice #4912 860 part of #2412) 790 11/18 Invoice #5681 2,000 10/31 Cash (#4912) 860 12/20 Invoice #6347 800 12/1 Cash (#5681) 1,250 12/29 Cash (#6347) 800 Instructions Age the balance and specify any items that apparently require particular attention at year-end.arrow_forwardmarc company's checkbook balance at December 31, 2021 was 167,085 in addition marc held the following items in its safe on that date: check payable to Marc dated January 2,2022 in payment of sale made in December 2021 not included in December 31 checkbook balance heck payable to Marc dated January 2,2022 in payment of sale made in December 2021 not included in December 31 checkbook balance P 15,000 Check draw on Marc's account payable to a vendor, dated and recorded in Marc's books on December 31, but not mailed until January 10, 2022 8,275 Included in the book receipts, which was recorded as 54,000 No correction was made yet by marc company 45,000 What is the amount of cash in Marc's December 31, 2021 statement of financial position?arrow_forward24. Baker Company sells merchandise on account for $5,000 to Helix Company with credit terms of 1/10, n/30. Helix Company returns $600 of merchandise that was damaged, along with a check to settle the account within the discount period. What entry does Baker Company make upon receipt of the check? a. Cash... Accounts Receivable. b. Cash...... Sales Returns and Allowances. Accounts Receivable. c. Cash...... Sales Returns and Allowances. Sales Discounts. Accounts Receivable. d. Cash...... Sales Discounts.. Sales Returns and Allowances. Accounts Receivable.... 4,400 4,356 644 4,356 600 44 4,950 50 4,400 5,000 5,000 600 4,400arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education