Question 1

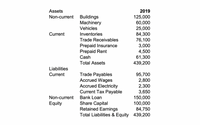

Use the following list of transactions and the

-

a) The income statement for 2020

-

b) The balance sheet for 2020

-

Insurance is paid on 1/7/2019 for 8,000 £. The policy covers the period until 31/6/2020

-

Rent for the year is 24,000 £. During the year, the company paid 23,000 £ to its landlord

-

ABC Ltd. employs 4 members of staff, each with a yearly salary of 45,500 £. At the end of

the year, ABC owes its staff one week of wages.

-

Inventories were bought for 35,000 £ in cash and 176,000 £ on credit.

-

Cash sales were 67,500 £ (cost of sales 32,000) and credit sales 383,400 (cost of sales

112,300).

-

A customer returned 5,700 £ worth of goods receiving a cash refund.

-

The company received payments of 343,500 £ from trade receivables. A customer paid

early and the company granted him a discount of 2,000 £.

-

ABC paid 134,600 £ towards trade payables.

-

Electricity expenses were 7,500 £ for the first three quarter of the year. The bill for Q4 will

be paid in January and the company expects electricity costs to be constant.

-

ABC paid 3% interest over its loan balance at the beginning of the year. Over the year, the

company paid back 20,000 £ to the bank.

-

ABC sold its vehicle in December for 15,000 £ in cash. Depreciation on the vehicle is

charged in full during the year.

-

Corporation tax is 20%. Taxes are paid 50% in arrears.

-

Vehicles are

depreciated using thereducing balance method , with 30% yearly.depreciation. Depreciation on machinery is 5,000 £ and on building 3,000 £.

-

ABC paid a dividend of 15,000 £ to shareholders.

Show your workings clearly and explain your answers.

Step by stepSolved in 3 steps with 3 images

- karan subject-Accountingarrow_forwardProblems 1). Record the journal entries for the following current liabilities for Company Z A). Company Z is required by law to collect and remit sales taxes to the state. If $78,000 of cash sales are subject to a 6% sales tax B). Company Z faces a probalble loss on a pending lawsuit where the amount of the loss is estimated to be $500,000. C). Employees earn vacation pay at the rate of one day per month. During the month, 25 employees quality for one vacation day each. Their average daily wage is $100 per day. D). Z company estimates thatt warranty expense will be 4% of sales. The company's sales for the current period are $185,000.. E). Z Company receives $48, 000 cash in advance ticket sales for 12 home games. Record the advance ticket sales on April :30. Record the revenue earned for the first home game played on August 14. "V B. C. D. E.arrow_forwardRequired Information [The following Information applies to the questions displayed below.] Agrico Incorporated accepted a 10-month, 11% (annual rate), $5,650 note from one of its customers on July 15, 2022; Interest is payable with the principal at maturity. a-2. Prepare the Journal entry to record the Interest earned by Agrico during its year ended December 31, 2022. Note: If no entry is required for a transaction/event, select "No Journal entry required" in the first account field. Do not round your Intermediate calculation. Round your answers to 2 decimal places. View transaction list View journal entry worksheet No A Event 1 Accumulated depreciation General Journal Debit Creditarrow_forward

- Record journal entries for the following transactions of Telesco Enterprises. Jan. 1, 2018 Issued a $330,700 note to customer Abe Willis as terms of a merchandise sale. The merchandise’s cost to Telesco is $120,900. Note contract terms included a 36-month maturity date, and a 4% annual interest rate. Dec. 31, 2018 Telesco records interest accumulated for 2018. Dec. 31, 2019 Telesco records interest accumulated for 2019. Dec. 31, 2020 Abe Willis honors the note and pays in full with cash.arrow_forwardOn October 1, 2023 PT. Leci borrowed $500,000 from Pineapple Bank by signing a 10-month, 6% note. If on December 31 PT. Leci makes adjusting entries, then on August 1, 2024 what is the amount of interest expense recorded by PT. Lychee when paying off the notes? a. 17.500 b. 21 000 c. 9.000 d. 30.000 e. 7.500arrow_forwardPlease provide the following journal entries for these transactions, you can draw the T- Accounts or journal entries; A) Mortgage Company funded a loan for $100,000 and the company only advance 98% of the loan through financing (Warehouse Line). Remaining 2% is gathered from Companys funds. B) The same loan was sold to investor at 102 % 15 days later, please prepare the journal entries. C) The Company has expenses at the end of the month in the amount of $20,000 but has not paid until 30 days later. Please prepare journal entries at the end of the month and 30 days payment. D) The company received funds and has a trust liability account for borrowers in the amount of $10,000. 30 days later the trust liability is being transferred to the final investors. E) Company Prepaid Insurance for 12 months and paid in January for $1,200. You are now in the March 31 st of the year.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education