FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

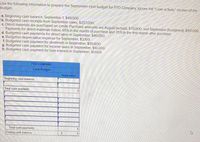

Transcribed Image Text:Use the following information to prepare the September cash budget for PTO Company. Ignore the "Loan activity" section of the

budget

a. Beginning cash balance, September 1, $49,000.

b. Budgeted cash receipts from September sales, $257,000.

c. Direct materials are purchased on credit Purchase amounts are August (actual), $70,000; and September (budgeted). $101,000.

Payments for direct materials follow. 65% in the month of purchase and 35% in the first month after purchase.

d. Budgeted cash payments for direct labor in September, $40,000.

e. Budgeted depreciation expense for September, $3.100.

f. Budgeted cash payment for dividends in September, $50,000.

g. Budgeted cash payment for income taxes in September, $10,200.

h. Budgeted cash payment for loan interest in September, $1,600.

PTO COMPANY.

Cash Budget

September

Beginning cash balance

Total cash available

Total cash payments

Ending cash balance

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- required: Use this information to prepare a cash budget for the first two quarters of the yeararrow_forwardSubject: acountingarrow_forwardThe management of Palind Ltd decide to prepare a Cash Budget for November and December. The following information is available: Sales: Cash Credit Purchases Salaries & Wages Sundry Expenses WY Actual August September October R 194 500 287 300 510 000 72 600 17 800 R 235 700 350 000 490 000 72 600 18 400 R 275 000 410 000 495 000 72 600 22 000 Additional information: 1. Cash in respect of credit sales is collected as follows: • 50% within 30 days • 30% within 60 days • 15% within 90 days • The balance is written off as irrecoverable. 2. The following discounts are allowed on sales: Budgeted 7. The cash in the bank on 31 October was R44 500. November December R 250 500 400 400 520 000 72 600 22 600 R 368 000 697 000 680 000 72 600 25 700 • 10% on cash sales • 7.5% on credit sales if accounts are settled within 30 days. 3. All salaries, wages and sundry expenses are paid in cash. 4. Sundry expenses include depreciation of R4 200 per month. 5. Seventy-five (75%) of all purchases are on…arrow_forward

- sh On March 1 of the current year, Spicer Corporation compiled information to prepare a cash budget for March, April, and May. All of the company's sales are made on account. The following infor- mation has been provided by Spicer's management. Month January February March April May Credit Sales Collections in the month of the sale Collections one month after the sale Collections two months after the sale Uncollectible accounts ary. The company's collection activity on credit sales historically has been as follows. $300,000 (actual) 400,000 (actual) 600,000 (estimated) 700,000 (estimated) 800,000 (estimated) 50% 30 15 5 Spicer's total cash expenditures for March, April, and May have been estimated at $1,200,000 (an average of $400,000 per month). Its cash balance on March 1 of the current year is $500,000. No financing or investing activities are anticipated during the second quarter. Compute Spicer's budgeted cash balance at the ends of March, April, and May.arrow_forwardOn October 1 of the current year, Molloy Corporation prepared a cash budget for October, November, and December. All of Molloy's sales are made on account. The following information was used in preparing estimated cash collections: August sales (actual) September sales (actual) October sales (estimated) November sales (estimated) December sales (estimated) $ 40,000 $ 50,000 $ 20,000 $ 70,000 $ 60,000 Approximately 60% of all sales are collected in the month of the sale, 30% is collected in the following month, and 10% is collected in the month thereafter. Budgeted collections from customers in October total:arrow_forwardZisk Company purchases direct materials on credit. Budgeted purchases are April, $83,000, May, $113,000; and June, $123,000. Cash payments for purchases are: 70% in the month of purchase and 30% in the first month after purchase. Purchases for March are $73,000. Prepare a schedule of cash payments for direct materials for April, May, and June. ZISK COMPANY Schedule of Cash Payments for Direct Materials April May Materials purchases Cash payments for Total cash payments Junearrow_forward

- Mecca 4 Company, a retailer of specialty wall-papers, prepares a monthly master budget. Data for the September master budget are given below: a. The August 31st balance sheet (Actual): cash accounts receivable inventory building and equipment (net) $25,000 133,000 32,813 203,500 e. accounts payable August-Actual September-Projected October-Projected November-Projected capital stock retained earnings b. Actual sales for August and budgeted sales for September, October, and November are given below: $62,016 $190,000 375,000 405,000 310,000 295,372 36,925 C. Sales are 30% for cash and 70% on credit. All credit sales are collected in the month following the sale. There are no bad debts. d. The gross margin percentage is 65% of sales. The desired ending inventory is equal to 25% of the following month's COGS. One fourth of the purchases are paid for in the month of the purchase and the remaining 75% are purchased on account and paid in full the following month. The monthly operating…arrow_forwardBudget balance help!arrow_forwardPrepare a master budget for the three-month period ending June 30 that includes a budgeted balance sheet as of June 30.arrow_forward

- Zisk Company purchases direct materials on credit. Budgeted purchases are April, $89,000; May, $119,000; and June, $129,000. Cash payments for purchases are: 70% in the month of purchase and 30% in the first month after purchase. Purchases for March are $79,000. Prepare a schedule of cash payments for direct materials for April, May, and June.arrow_forward2.cengagenow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker-assignments&takeAssignmentS... A Estimated cash payments budget Grow Inc. was organized on February 28. Budgeted selling and administrative expenses for each of the first three months of operations are as follows: March April May $101,500 93,400 85,000 Depreciation, insurance, and property taxes represent $21,000 of the estimated monthly expenses. The annual insurance premium was paid on February 28, and property taxes for the year will be paid in November. The remainder of the expenses are expected to be paid 71% in the month in which they are incurred, with the balance to be paid in the following month. Prepare a schedule indicating cash payments for selling and administrative expenses for March, April, and May. Enter all amounts as positive numbers. 4 0 GROW INC. Schedule of Cash Payments for Selling and Administrative Expenses For the Three Months Ending May 31 Line Item Description March March expenses: Paid in…arrow_forwardUse the following information to prepare the September cash budget for PTO Company. Ignore the “Loan activity” section of the budget. Beginning cash balance, September 1, $47,000. Budgeted cash receipts from September sales, $262,000. Direct materials are purchased on credit. Purchase amounts are August (actual), $77,000; and September (budgeted), $103,000. Payments for direct materials follow: 60% in the month of purchase and 40% in the first month after purchase. Budgeted cash payments for direct labor in September, $35,000. Budgeted depreciation expense for September, $3,400. Budgeted cash payment for dividends in September, $57,000. Budgeted cash payment for income taxes in September, $10,900. Budgeted cash payment for loan interest in September, $1,100.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education