FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

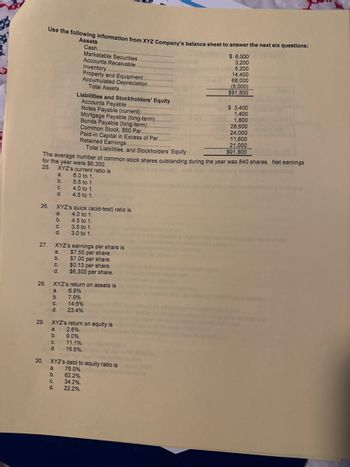

Transcribed Image Text:Use the following information from XYZ Company's balance sheet to answer the next six questions:

Assets

a.

b.

c.

d.

a.

b.

30.

C.

d.

Cash........

Marketable Securities

Accounts Receivable

Inventory........

Property and Equipment.

Accumulated Depreciation.

Total Assets

a.

b.

c.

d.

Liabilities and Stockholders' Equity

Accounts Payable.

Notes Payable (current).

Mortgage Payable (long-term).

Bonds Payable (long-term).

Common Stock, $50 Par..

The average number of common stock shares outstanding during the year was 840 shares. Net earnings

for the year were $6,300.

25. XYZ's current ratio is

6.0 to 1.

5.5 to 1.

26. XYZ's quick (acid-test) ratio is

4.0 to 1.

4.5 to 1.

3.5 to 1.

3.0 to 1.

Paid-in Capital in Excess of Par.........

Retained Earnings............

Total Liabilities, and Stockholders' Equity

4.0 to 1.

4.5 to 1.

*****

27. XYZ's earnings per share is

$7.50 per share.

$7.00 per share.

$0.13 per share.

$6,300 per share.

28. XYZ's return on assets is

a. 6.9%

b. 7.9%

C. 14.6%

d. 23.4%

29. XYZ's return on equity is

a.

2.6%.

b. 9.0%.

C. 11.1%.

d. 15.5%.

62.2%.

C. 34.2%.

d. 22.2%.

*****

XYZ's debt to equity ratio is de profit

a. 75.0%.

b.

$ 6,000

3,200

5,200

14,400

68,000

(5,000)

$91,800

$ 3,400

1,400

1,800

28,600

24,000

11,600

21,000

$91,800

Boots

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A condensed balance sheet for Big World Games Incorporated, and a partially completed vertical analysis are presented below. Required: 1. Complete the vertical analysis by computing each line item as a percentage of total assets. TIP: Accounts Receivable was 5 percent, computed as ($312 ÷ $6,099). 2-a. What percentages of Big World Games assets relate to intangibles versus property and equipment? 2-b. Which of these two asset groups is more significant to Big World Games business? Complete this question by entering your answers in the tabs below. Req 1 Req 2A Complete the vertical analysis by computing each line item as a percentage of total assets. TIP: Accounts Receivable was 5 percent, computed as ($312 ÷ $6,099). (Round your answers to the nearest whole percent.) Cash and Short-Term Investments Accounts Receivable, Net Inventory Other Current Assets Req 2B Intangibles Property and Equipment, Net Other Assets Total Assets $ BIG WORLD GAMES INCORPORATED Balance Sheet (summarized)…arrow_forwardRequired Prepare a vertical analysis of both the balance sheets and income statements for Year 4 and Year 3. Complete this question by entering your answers in the tabs below. Analysis Bal Analysis Inc Sheet Stmt Prepare a vertical analysis of the balance sheets for Year 4 and Year 3. (Percentages may not add exactly due to rounding. Round your answers to 2 decimal places. (i.e., .2345 should be entered as 23.45).) ALLENDALE COMPANY Vertical Analysis of Balance Sheets Year 4 Year 3 Amount % Total Amount % Total Assets Current assets Cash $ 40,000 % $ 36,000 % Marketable securities 20,000 6,000 Accounts receivable (net) 54,000 46,000 Inventories 135,000 143,000 Prepaid items 25,000 10,000 Total current assets 274,000 241,000 Investments 27,000 20,000 Plant (net) 270,000 255,000 Land 29,000 24,000 Total long-term assets 326,000 299,000 Total assets $ 600,000 100.00 $ 540,000 100.00 Liabilities and stockholders' equity Liabilities Current liabilities Notes payable $ 17,000 $ 6,000…arrow_forwardThe following information was taken from Slater Company's balance sheet:Fixed assets (net) $1,706,568Long-term liabilities 404,400Total liabilities 763,420Total stockholders' equity 2,009,000 Determine the company's (a) ratio of fixed assets to long-term liabilities and (b) ratio of liabilities to stockholders' equity. Round your answers to two decimal places. a. Ratio of fixed assets to long-term liabilities b. Ratio of liabilities to stockholders' equityarrow_forward

- Identify how each of the following separate transactions 1 through 10 affects financial statements. For increases, place a “+” and the dollar amount in the column or columns. For decreases, place a “−” and the dollar amount in the column or columns. Some cells may contain both an increase (+) and a decrease (−) along with dollar amounts. The first transaction is completed as an example.arrow_forwardRequired Prepare a vertical analysis of both the balance sheets and income statements for Year 4 and Year 3. Complete this question by entering your answers in the tabs below. Analysis Bal Analysis Inc Sheet Stmt Prepare a vertical analysis of the balance sheets for Year 4 and Year 3. (Percentages may not add exactly due to rounding. Round your answers to 2 decimal places. (i.e., .2345 should be entered as 23.45).) PEREZ COMPANY Vertical Analysis of Balance Sheets Year 4 Year 3 Percentage of Total Percentage of Total Amount Amount Assets Current assets Cash $ 17,400 % $ 12,600 % Marketable securities 21,000 7,600 Accounts receivable (net) 54,700 46,900 Inventories 136,200 144,400 Prepaid items 25,700 11,800 Total current assets 255,000 223,300 Investments 28,100 21,000 Plant (net) 270,500 255,100 Land 29,700 24,900 Total long-term assets 328,300 301,000 Total assets $ 583,300 $ 524,300 Liabilities and stockholders' equity Liabilities Current liabilities Notes payable $ 16,100 $ 5,000…arrow_forwardPrepare a horizontal analysis of both the balance sheet and income statement. Complete this question by entering your answers in the tabs below. Analysis Bal Analysis Inc Sheet Stmt Prepare a horizontal analysis of the income statement. (Negative answers should be indicated by a minus sign. Round your answers to 1 decimal place. (i.e., .234 should be entered as 23.4).) ALLENDALE COMPANY Horizontal Analysis of Income Statements Year 4 Year 3 % Change Revenues Sales (net) $ 230,000 $ 210,000 % Other revenues 8,000 5,000 Total revenues 238,000 215,000 Expenses Cost of goods sold 120,000 103,000 Selling, general, and administrative expenses 55,000 50,000 Interest expense 8,000 7,200 Income tax expense 23,000 22,000 Total expenses 206,000 182,200 Net income (loss) $ 32,000 $ 32,800 %arrow_forward

- Fill out income statement please and thank youarrow_forwardAnswer the following question a. Return on equityb. Total assets turnoverc. Return on assetsd. Current ratioe. Receivables turnoverarrow_forwardVertical Analysis of Balance Sheet Balance sheet data for a company for the years ended December 31, 20Y2 and 20Y1, are shown below. 20Y2 20Υ1 Current assets $ 752,000 $ 602,000 Property, plant, and equipment 6,248,000 5,397,000 Intangible assets 1,000,000 1,001,000 Current liabilities 504,000 427,000 Long-term liabilities 1,504,000 1,197,000 Common stock 1,248,000 1,253,000 Retained earnings 4,744,000 4,123,000 | Prepare a comparative balance sheet for 20Y2 and 20Y1, stating each asset as a percent of total assets and each liability and stockholders' equity item as a percent of the total liabilities and stockholders' equity. Round your answers to one decimal place. Comparative Balance Sheet December 31, 20Y2 and 20Y1 20Y2 Amount 20Y2 Percent 20Y1 Amount 20Y1 Percent Assets Current assets $752,000 % $602,000 % Property, plant, and equipment 6,248,000 5,397,000 Intangible assets 1,000,000 1,001,000arrow_forward

- Jones Corp. reported current assets of $184,000 and current liabilities of $127,500 on its most recent balance sheet. The current assets consisted of $63,800 Cash; $45,700 Accounts Receivable; and $74,500 of Inventory. The acid-test (quick) ratio is: Multiple Choice 1.4: 1. 0.86: 1. 0.60: 1. ...arrow_forwardFormulating Financial Statements from Raw Data and Calculating Ratios Following is selected financial information from JM Smucker Co. for the year ended April 30, 2018 ($ millions). Current assets, end of year Cash, end of year $1,710.5 Long-term liabilities, end of year 211.9 Stockholders' equity, end of year (305.4) Cash from operating activities 4,973.1 Total assets, beginning of year 8,151.1 Revenue (1,006.1) Total expenses, other than cost of product sold Dividends paid 385.3 * Cash from financing activities includes the effects of foreign exchange rate fluctuations. Cash from investing activities Cost of products sold Total liabilities, end of year Cash from financing activities* Stockholders' equity, beginning of year 7,535.2 a. Prepare the income statement for the year ended April 30, 2018. Note: Do not use negative signs with any of your answers. JM Smucker Co Income Statement ($ millions) For the year ended April 30, 2018 Revenues $ Cost of product sold Gross profit Expenses…arrow_forwardwhat are the three sections for debits, credits, and total. Here is a picture with an empy cells for what it should look like. The blue cells should be from the chart of accountsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education