FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

How much is the cost of the qualifying asset on initial recognition? *

15,045,000

13,010,000

14,970,900

14,920,000

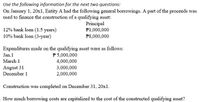

Transcribed Image Text:Use the following information for the next two questions:

On January 1, 20x1, Entity A had the following general borrowings. A part of the proceeds was

used to finance the construction of a qualifying asset:

Principal

P1,000,000

12% bank loan (1.5 years)

10% bank loan (3-year)

P8,000,000

Expenditures made on the qualifying asset were as follows:

Jan.1

P 5,000,000

4,000,000

March 1

August 31

December 1

3,000,000

2,000,000

Construction was completed on December 31, 20x1.

.How much borrowing costs are capitalized to the cost of the constructed qualifying asset?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- If a commercial railway property has a property tax bill of $55477 and the mill rate is 11.02, what is the assessed value of the property? Select one: a. 493352.63 b. 453078.95 c. 478250.00 d. 503421.05 Checkarrow_forwardPlease read instructions and answer each question show work.arrow_forwardWhich of the following is included in determining the fair value of a biological asset that does not have an active market and which has a 5 year production cycle? 1. Revenue from sale in 5 years’ time2. Costs of growing for 5 years3. Financing costs on borrowings taken out to fund the growing costs4. Taxation on taxable income generated from sale in 5 years’ time5. Discount rate that reflects expected variability in cash flows.arrow_forward

- 4. A company is considering one of the following 3 mutually exclusive alternatives. Project Initial Investment operating Cost per year Revenue per year Salvage value Life (years) A B $63,000.00 $61,000.00 $15,000.00 $11,000.00 $38,000.00 $26,000.00 $12,000.00 $17,500.00 6 4 C $85,000.00 $13,000.00 $35,000.00 $16,000.00 12 If the company uses a MARR of 8%, which of the alternatives will they select using Present Worth Analysis?arrow_forwardV6. A company purchases land, building and equipment for $1,500,000. An independent appraisal shows that the best available indications of fair value at the time of purchase are: land: $760,000; building: $540,000; and equipment: $320,000. The purchase is financed through long-term debt. Required: Prepare the journal entry to record the purchase Prepare the journal entry to record the purchase:arrow_forwardInput area: Installation cost Pretax salvage value Operating cost per year Initial NWC Tax rate Discount rate *Depreciation straight-line over life Output area: Annual depreciation charge Aftertax salvage value OCF NPV $ SA SA SA GA $ 385,000 $ 60,000 $ 135,000 35,000 21% 10% ᏌᏊ Ꮚ Ꮚ $ 77,000 $ 47,400 $ 122,820 5arrow_forward

- A machine acquired for £480,000 on 1st May 2018 and depreciated at 10% per annum using the straight-line method, has a market value of £600,000 on 1st May 2022. How much is the revaluation gain to be included in the Revaluation Surplus account, if the machine is to be revalued on 1st May 2022? £312,000 £72,000 £360,000 £120,000arrow_forwardSuppose the subject's net operating income is $100,000, the direct capitalization rate of the land is 3.5%, the direct capitalization rate of the improvements is 6.0%, and the value of the improvements is $750,000. What is the overall value of the subject property (round to the nearest thousand)? A. $2,321,000 ⒸB. $2,036,000 OC. $1,571,000 OD.$1,286,000arrow_forwardQ6. Land was acquired for $200 000 on 1 July 2017. On 30 June 2018 it has a fair value of $150 000. On 30 June 2020, due to increased population, the land is considered to have a fair value of $270 000. Write the journal entries needed.arrow_forward

- 10arrow_forward______21. The acquisition costs of property, plant, and equipment should include all normal, reasonable and necessary costs to get the asset in place and ready for use. ____ 22. An estimate of the amount which an asset can be sold at the end of its useful life is called residual value. ____ 23. Federal unemployment taxes are paid by the employer and the employee. ____ 24. When minor errors occur in the estimates used in the determination of depreciation, the amounts recorded for depreciation expense in the past should be corrected. ____ 25. Residual value is not relevant when calculating the annual depreciation expense using the double declining-balance method (do not consider the calculation for the final year). True and False questionsarrow_forwardA bridge that was constructed at a cost of P 75,000 is expected to last 30 years, at the end of which time its renewal cost will be P 40,000. Annual repairs and maintenance are P 3,000. What is the capitalized cost of the bridge at an interest of 6%? 133,433.00 50,000.00 125,000.00 140,625.00 75,948.67 58,433.00arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education