ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

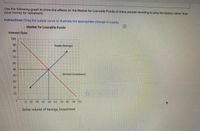

Transcribed Image Text:Use the following graph to show the effects on the Market for Loanable Funds of many people deciding to play the lottery rather than

save money for retirement:

Instructions: Drag the supply curve to illustrate the appropriate change in supply.

Market for Loanable Funds

Interest Rate

100

90

Supply (Savings)

80

70

60

50

Demand (Investment)

40

30

20

10

10 20 30 40 50 60 70 80 90 100

Dollar volume of Savings, Investment

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Similar questions

- (Explain with graphics) A consumer, who is initially a lender, remains a lender even after a decline in interest rates. Is this consumer better off or worse off after the change in interest rates? If the consumer becomes a borrower after the change is he better off or worse off? (Explain with graphics)arrow_forwardI need the answer as soon as possiblearrow_forwardAs the real interest rate falls: a) the supply of loanable funds increases. b) the quantity supplied of loanable funds decrease! c) more saving is supplied to the market. d) the supply of loanable funds decreases.arrow_forward

- The table below shows Demand and Supply for loanable fund at given time. Real interest rate Quantity of loanable fund demanded (billion $) Quantity of loanable fund supplied (billion $) 0.01 1000 400 0.02 950 450 0.03 900 500 0.04 850 550 0.05 800 600 0.06 750 650 0.07 700 700 0.08 650 750 0.09 600 800 0.10 550 850 0.11 500 900 0.12 450 950 0.13 400 1000 0.14 350 1050 0.15 300 1100 Instructions: Using excel, find the equilibrium real interest rate and quantity of loanable fund. show the equilibrium on a graph. If this country experiences a recession business cycle phase that decreases the demand for loanable fund by $200 billion. Find the new equilibrium real interest rate and quantity of loanable fund. Show the shift on the graph. list Two factors that shift SLF rightward and two factors that shift DLF rightward What is the meaning of crowding out?…arrow_forwardHide Assignment Information Instructions The table below is broken down by Month, Real Interest Rate (%), Loanable Funds (trillions of $), Exogenous Change, Equilibria (increases, decreases, or no change. Use the data table to determine the equilibrium real interest rate after certain factors change: Month Real Interest Rate (%) Loanable Funds (trillions of $) Exogenous Change Equilibria (increases, decreases, or no change) January 3% 3 no change no change April 3% 4 increased fund supply ? July 4% 2 decreased fund supply ? December 3% 3 increased fund demand ?arrow_forward1. In the model of the market for loanable funds, which of the following best describes why the supply curve is upward sloping? a The higher the interest rate, the more likely households are to spend b The higher the interest rate, the less likely firms are invest c The higher the interest rate, the more likely households are to borrow d The higher the interest rate, the more likely households are to savearrow_forward

- Assume that a firm is considering building a factory that will cost $5 million. It believes that it can get a profit from this factory of $600,000 per year for many years. The interest rate at which the firm can borrow money is 15 percent. After evaluating whether it should build the factory, the firm decides that it should Select one: a. build b. not buildarrow_forwardShow the effect on the real interest rate and equilibrium quantity of loanable funds of an increase in the demand for loanable funds and a smaller increase in the supply of loanable funds. Draw a demand for loanable funds curve. Label it DLF. Draw a supply of loanable funds curve. Label it SLF. Draw a point at the equilibrium real interest rate and quantity of loanable funds. Label it 1. Real interest rate (percent per year) 12.0 Draw a curve that shows an increase in the demand for loanable funds. Label it DLF,. 10.0- Draw a curve that shows a smaller increase in the supply of loanable funds. Label it SLF,. Draw a point at the new equilibrium real interest rate and quantity of loanable funds. Label it 2. 8.0- 6.0- 4.0- 2.0- 0.0+ 0.0 1.0 2.0 3.0 Loanable funds (trillions of 2012 dollars) 4.0 5.0 >>> Draw only the objects specified in the question. Click the graph, choose a tool in the palette and follow the instructions to create your graph. MacBook Air DD DII F11 F10 F9 000 000 F8 F7…arrow_forwardIn the loanable funds market, if firms become more optimistic about future profitability, then the a demand for loanable funds will increase, interest rates will increase, and private sector investment spending will increase. b demand for loanable funds will decrease, interest rates will decrease, and the equilibrium quantity of borrowing will decrease. c supply of loanable funds will increase, interest rates will decrease, and the equilibrium quantity of borrowing will increase. d supply of loanable funds will increase, interest rates will increase, and private sector investment spending will increase.arrow_forward

- (Q#4) Banks have become much less strict about issuing new credit cards. They are issuing far more cards, with lower rates and more generous credit limits. First predict how this will impact the demand for money balances. The expansion of credit cards will end up: [a] increasing the demand for money balances since more items will be purchased and more money will be needed to pay for them [b] reducing the demand for money balances as the delay of payment with them reduces the immediate need for money in a bank checking асcountarrow_forwardConsider the supply and the demand in the market for loanable fund. If Mari purchased construction company’s stocks, to which is it added: Supply or Demand? If Mari borrowed to build her new house, which is it added to: Supply or Demand? Stock: House:arrow_forwardIf an economic expansion in the economy caused an increase in the demand for loanable funds, what would be the effect on the interest rate and the quantity of funds loaned in the credit market? Question 20 options: Interest rates would decrease and the quantity of funds loaned would increase Interest rates and the quantity of funds loaned would decrease Interest rates and the quantity of funds loaned would increase Interest rates would increase and the quantity of funds loaned would decreasearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education