ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Hand written solutions are strictly prohibited.

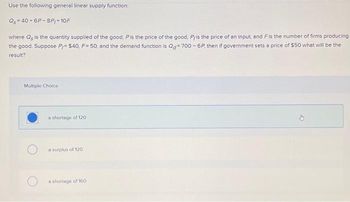

Transcribed Image Text:Use the following general linear supply function:

Qs = 40+6P-8P, +10F

where Qe is the quantity supplied of the good, Pis the price of the good, P/is the price of an input, and Fis the number of firms producing

the good. Suppose P/= $40, F= 50, and the demand function is Qd 700-6P, then if government sets a price of $50 what will be the

result?

Multiple Choice

a shortage of 120

a surplus of 120

a shortage of 160

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Demand curve of electric vehicles versus gas vehiclesarrow_forwardLow involvement purchases typically involve very limited, mostly internal/memory based information search for routinely purchased items such as: A Convenience products В Shopping products C Extended search products D Specialty itemsarrow_forward(a) A monopolist has discovered that the inverse demand function of a person with income Y for the monopolist’s product is P = 0.002Y-Q where P is the price, Y the income, and Q is the output. The monopolist can observe the incomes of its consumers and hence vary its price accordingly. The monopolist has a total cost function C(Q) = 100Q. Calculate the profit maximising price as a function of the consumer’s income Y carefully explaining all the steps in the derivation of the formula. (b) A monopolist has a constant marginal cost of £2 per unit and no fixed costs. He faces two separate markets in the United States and in the UK. The goods sold in one market are never resold in the other. He sets one price P1 for the US market and another price P2 for the UK market (both measured in £). The demand in the United States is given by Q1=7,000-700P1 and the demand in the UK is given by Q2=1,200-200P1. Calculate the profit maximising output produced and price charged in each country by the…arrow_forward

- Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardCountry Motorbikes Incorporated finds that it costs $400 to produce each motorbike, and that fixed costs are $1300 per day. The price function is p(x)= 700-5x, where p the price (in dollars) at which exactly x motorbikes will be sold. Find the quantity Country Motorbikes should produce and the price it should charge to maximize profit. Also find the maximum profit. 40 quantity price profit motorbikes Enter a number.arrow_forward

- A chemical manufacturer uses chemicals 1 and 2 to produce two drugs. Drug 1 must be at least 80% chemical 2 and drug 2 must be at least 75% chemical 1. Up to 70,000 ounces of drug 1 can be sold at $40 per ounce; up to 50,000 ounces of drug 2 can be sold at $15 per ounce. Up to 65,000 ounces of chemical 1 and up to 42,000 ounces of chemical 2 can be purchased. Formulate this problem as a linear programming model (using algebraic notation) to determine how to maximize the manufacturer's revenue. (You only need to formulate this problem as an algebraic model. No Excel spreadsheet model. No need to solve the model.)arrow_forwardFind total revenue when price Is $45 per unit and the total quantity sold is 7arrow_forwardAcquiring a supplier because it becomes more profitable Question 4 options: will raise the asking price to offset any increase in cash flow over time will increase your profits will decrease your profits will make you alter operationsarrow_forward

- The inverse demand function for a homogeneous product Stackelberg duopoly is P = 18, 000 − 5Q. Thecost structure for the leader and follower, respectively, are CL(QL) = 2, 000QL and CF (QF ) = 4, 000QF .(a) What is the follower’s reaction function?(b) Determine the equilibrium output level for both the leader and follower.(c) Determine the equilibrium market price.(d) Determine the profits of the leader and the follower.arrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardCasinos in the US wanted to purchase decks of cards made in Mexico. It costs less than half the price paid to US suppliers. However, the price is based on the product outside the Mexican manufacturing doors. The US firm must find a way to transport the cards to the US. This is a problem given the current US regulations on transportation between Mexico and the US and the strong truck drivers union. In this case, casinos are experiencing: Underinvestment in Mexico. Language and cultural barriers in management. Limited SI in Mexico. High transaction costs and possible hold up problems.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education