Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

please answer the question within 30 minutes with detailed explanation. Make sure calculation form part of the answer and are in details for better understanding. If calculations are not shown or are poorly done i will surely give negative ratings.

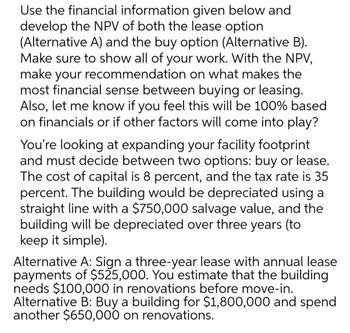

Transcribed Image Text:Use the financial information given below and

develop the NPV of both the lease option

(Alternative A) and the buy option (Alternative B).

Make sure to show all of your work. With the NPV,

make your recommendation on what makes the

most financial sense between buying or leasing.

Also, let me know if you feel this will be 100% based

on financials or if other factors will come into play?

You're looking at expanding your facility footprint

and must decide between two options: buy or lease.

The cost of capital is 8 percent, and the tax rate is 35

percent. The building would be depreciated using a

straight line with a $750,000 salvage value, and the

building will be depreciated over three years (to

keep it simple).

Alternative A: Sign a three-year lease with annual lease

payments of $525,000. You estimate that the building.

needs $100,000 in renovations before move-in.

Alternative B: Buy a building for $1,800,000 and spend

another $650,000 on renovations.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- I have 4 problems that I need help finding the correct answer. In each problem an amount for the different categories has been left out so I have to find the unknown number for that account. This is the second time I am submitting these problems for help. The last person not only made numerous typos making it difficult to understand but they also did not reply in a clear manner to each problem. I am labeling the problems 1) 2) 3) and 4). If you could keep that format so it is less confusing I would appreciate it. Also I feel I was given the wrong answer to one of the the problems. So I will see if you come to the same answer.Problem 1Revenue $3000Dividends $2000Expenses $10001/1 Retained Earnings-amount unknown12/31 Retained Earnings $6000Problem 2Revenue $5000Dividends-amount unknownExpenses- $40001/1 Retained Earnings $800012/31 Retained Earnings $3000Problem 3Revenue $6000Dividends $0Expenses-amount unknown1/1 Retained Earnings $1200012/31 Retained Earnings $8000Problem…arrow_forwardPlease answer completely and correctly for all parts with explanation computation formula steps answer in text no copy paste show explanation and computation clearly for numbers provide full working for all steps with explanation answer in text formarrow_forwardThe software developers of a billing system of ACME Telecom Company would accept at most an error rate of 4% that a sample of invoices would contain some variations that may be present in a large population of total invoices. With a certainty factor of 1.95 how many invoices would they need to examine?arrow_forward

- Tnaif the time,5 minutes, 1 minute, and 30 seconds remain. Cally wrien the time expires. Multiple Attempts Not allowed. This test can only be taken once. Force Completion Once started, this test must be completed in one sitting. Do not leave the test before clicking Save and Submit Remaining Time: 12 minutes, 18 seconds. * Question Completion Status: A Moving to another question will save this response. Quèstion 8 Which of the following statements is not true with regard to the benefits derived from the FASB's conceptual framework of accounting? O It serves as a guide in establishing standards for the FASB. O The Statements of Financial Accounting Concepts is the primary source of GAAP for accountants. O It establishes the objectives of financial reporting. O It enhances comparability between different company's financial statements. A Moving to another question will save this response. e Type here to search acerarrow_forwardFurther info is in the attached images For the Excel part of the question give the solutions in the form of the Excel equations. Please and thank you! :) Download the Applying Excel form and enter formulas in all cells that contain question marks. For example, in cell B34 enter the formula "= B9". After entering formulas in all of the cells that contained question marks, verify that the dollar amounts match the example in the text. Check your worksheet by changing the beginning work in process inventory to 100 units, the units started into production during the period to 2,500 units, and the units in ending work in process inventory to 200 units, keeping all of the other data the same as in the original example. If your worksheet is operating properly, the cost per equivalent unit for materials should now be $152.50 and the cost per equivalent unit for conversion should be $145.50. Thank you!arrow_forwardA manufacturer of potato chips would like to know whether its bag filling machine works correctly at the 428 gram setting. Is there sufficient evidence at the 0.05 level that the bags are overfilled? Assume the population is normally distributed. State the null and alternative hypotheses for the above scenario. Answer Ho: Ha: Tables Keypad Keyboard Shortcutsarrow_forward

- The first part of the assignment is to open Excel and in column A starting in row 1 and down to row 40 generate random values using the RAND() function. Copy and special paste those values onto sheet2. You will turn in the Excel file, but you will use the information below when directed. Say an individual is faced with the decision of whether to buy auto insurance or not (like before laws in many states changed). The states of nature are that no accident occurs (with probability .992) or an accident occurs (with probability .008). Here is the payoff table for the decision maker (where -500 is read minus 500, for example) State of Nature Decision No Accident Accident Purchase insurance -500 -500 Do not purchase Ins. 0 -10000 1. Say the individual is a RISK LOVER. Create a table with plausible values of utility for the risk lover where you pick as the indifference probability for the value -500 the first value that is appropriate from your simulation in Excel (starting in cell A1 on…arrow_forward* no trial balance was given along with case study just tables typed out below or featured in the images* Trying this again... We were asked to calculate the missing values (which I have written down on my copy of the table in the image attached). After attending the lecture with hopes to get a better understanding of how the numbers we obtained, I ended up coming home and copying the answers down as my professor did not review as to how he calculated them. I copied all the numbers down onto excel with hopes to see if I can understand where the numbers came from but to no avail. There are no requirements asked for other than to simply calculate and input the missing values which I have noted down from the answer sheet. I am hoping to get an understanding as to how the numbers were computed for the income statement for now. Table 1: given values 1997 1998 1999 net sales 26820 28966 30703 cogs 21216 23550 26140 gross profit 5604 5416 4563 admin and selling expenses…arrow_forwardOh no! Our expert couldn't answer your question. Don't worry! We won't leave you hanging. Plus, we're giving you back one question for the inconvenience. Here's what the expert had to say: Hi and thanks for your question! It looks like you're asking for help with using the site. You can reach our support team at the Contact Bartleby link at the bottom of the page. We've credited a question back to your account. Apologies for the inconvenience. Ask Your Question Again 13 of 30 questions left until Nov 14, 2021 Question complete a horizontal analysis for brown company. (negative answers should be indicated by a minus sign. leave no cells blank - be certain to enter "0" wherever required. round the "percent" answers to the nearest hundredth percent.) Current assets: 2020 2019 Increase (decrease) amount? Percent? Cash $14,150 $9,300 ?? Accounts receivable 16,950 12,800 ?? Merchandise inventory 18,050 21,450 ?? Prepaid advertising 52,600…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education