ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Note:-

- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism.

- Answer completely.

- You will get up vote for sure.

Transcribed Image Text:600

Use the blue points (circle symbol) and the preceding table to plot the relationship between bond prices and interest rates on the following graph.

Note: Plot your points in the order in which you would like them connected. Line segments will connect the points automatically.

?

Interest Rate (Percent)

40

36

32

20

24

16

A

8

4

0

500 600

700 800 900 1000

Price of Bond (Dollars)

1100 1200 1300

Relationship

The line showing the relationship between bond prices and interest rates has a

relationship between bond prices and interest rates.

slope; in other words, there is

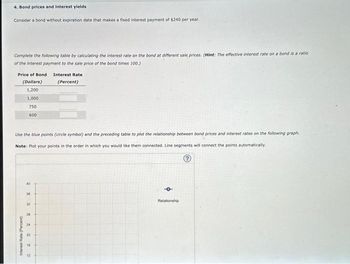

Transcribed Image Text:4. Bond prices and interest yields

Consider a bond without expiration date that makes a fixed interest payment of $240 per year.

Complete the following table by calculating the interest rate on the bond at different sale prices. (Hint: The effective interest rate on a bond is a ratio

of the interest payment to the sale price of the bond times 100.)

Price of Bond

(Dollars)

1,200

1,000

750

600

Use the blue points (circle symbol) and the preceding table to plot the relationship between bond prices and interest rates on the following graph.

Note: Plot your points in the order in which you would like them connected. Line segments will connect the points automatically.

Interest Rate (Percent)

40

36

32

28

24

20

16

Interest Rate

(Percent)

12

Relationship

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardWhat are the Different Techniques to compare multiple alternatives?arrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

- Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism.Answer completely.You will get up vote for sure.arrow_forwardplease help Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for surearrow_forwardPls help ASAParrow_forward

- Typed plz and asap please provide a quality solution and take care of plagiarism alsoarrow_forwardIf a consumer's Engle curve for a certain product is downward sloping then (a) the product must be a normal good. (b) the product must be an inferior good. (c) the product must be a bad. (d) the product must be a neuter. +arrow_forwardPLS HELP ASAParrow_forward

- Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward1arrow_forwardAccordingtothetextbook,whichofthefollowingstatementsis(are)correct? (x) When a taxpayer attempts to legally reduce her tax liability, she is engaging in “tax evasion” and when an individual fraudulently avoids paying taxing, she is engaging in “tax avoidance”. (y) One tax system is considered more efficient than another if it raises the same amount of tax revenue at a lower cost to taxpayers. (z) Part of the administrative burden of a tax is associated with the headache of filling out tax forms imposed on taxpayers who comply with the tax. (x), (y) and (z) (x) and (y) only (x) and (z) only (y) and (z) only (x) onlyarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education