Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

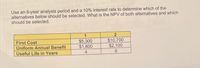

Transcribed Image Text:Use an 8-year analysis period and a 10% interest rate to determine which of the

alternatives below should be selected. What is the NPV of both alternatives and which

should be selected.

1

First Cost

Uniform Annual Benefit

$5,300

$1,800

4

$10,700

$2,100

8

Useful Life in Years

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- DONE IN EXCEL especify how to donthe graph step by step okease 5. (a) Use rate of return analysis to decide which one will you select if your MARR is 14% per year? (b) Graph interest rate vs. present value for both option 1 and 2. (c) Discuss how your selection between option 1 and 2 will change when MARR is changed and at which interest rate the two options are the same economically. The following two alternatives are mutually exclusive. Annual Benefit Salvage Value Alternative Initial Life, Cost years 4. Option 1 Option 2 $42,000 $45,000 $10,000 $11,500 $4,000 $4,200 6.arrow_forwardCompute the value of a real option using the following information: PV(project cash flows) = 51.6, NPV(project cash flows) = 1.6, Project upfront cost = 50, Risk-free rate = 4%, NPV volatility = 45.9%, Years to expiration = 1, d1 = 0.0674, d2 = -0.3795, N(d1) = 0.5269, N(d2) = 0.3522, el-04"1) – 0.960789 Round your answer to two decimal places, e.g. 92.993 --> 92.99, 92.987 --> 92.99arrow_forwardWhat is the payback period on each of the above projects? Given that you wish to use the payback rule with a cutoff period of two years, which projects would you accept? Why? If you use a cutoff period of three years, which projects would you accept? Why? If the opportunity cost of capital is 10%, which projects have positive NPVs? How do you know? “If a firm uses a single cutoff period for all projects, it is likely to accept too many short-lived projects.” Is this statement true or false? How do you know? If the firm uses the discounted-payback rule, will it accept any negative NPV projects? Will it turn down any positive NPV projects? How do you know?arrow_forward

- A project has a beta of 1.25, the risk-free rate is 5.0%, and the market rate of return is 9.2%. What is the project's expected rate of return?arrow_forwardA project under consideration has an internal rate of return of 16% and a beta of 0.9. The risk free rate is 6% and the expected rate of return on the market portfolio is 16%. A. What is the required rate of return? B. Should the project be accepted? C. What is the required rate of return on the project if it's beta is 1.90? D. If the projects beta is 1.90 should the project be accepted?arrow_forwardCompare alternatives A and B with the present worth method if the MARR is 14% per year. Which one would you recommend? Assume repeatability and a study period of 16 years. Capital Investment Operating Costs The PW of Alternative A is $ - 108236. (Round to the nearest dollar.) The PW of Alternative B is $ -95429. (Round to the nearest dollar.) Alternative B should be selected. A $55,000 $6,000 at end of year 1 and increasing by $600 per year thereafter $6,000 every 4 years 16 years $12,000 if just overhauled Overhaul Costs Life Salvage Value Click the icon to view the interest and annuity table for discrete compounding when the MARR is 14% per year. B $15,000 $12,000 at end of year 1 and increasing by $1,200 per year thereafter None 8 years negligible Darrow_forward

- A project under consideration has an internal rate of return of 17% and a beta of 0.5. The risk-free rate is 9% and the expected rate of return on the market portfolio is 17%. A. What is the required rate of return on the project? B. Should the project be accepted? C. What is the required rate of return on the project if the beta is 1.50? D. If projects beta is 1.50, should the project be accepted?arrow_forwardUse these data to compute for each (a) the NPV at discount rates of 10 and 5 percent, (b) the BCR at the same rates, and (c) the internal rate of return for each. Describe the facts about the projects that would dictate which criterion is appropriate, and indicate which project is preferable under each circumstance.arrow_forwardA project under consideration has an internal rate of return of 18% and a beta of 0.5. The risk-free rate is 6%, and the expected rate of return on the market portfolio is 18%. a. What is the required rate of return on the project? (Do not round intermediate calculations. Enter your answer as a whole percent.) b. Should the project be accepted? c. What is the required rate of return on the project if its beta is 1.50? (Do not round intermediate calculations. Enter your answer as a whole percent.) d. If project's beta is 1.50, should the project be accepted?arrow_forward

- Net Present Value-Unequal Lives Project 1 requires an original investment of $65,200. The project will yield cash flows of $14,000 per year for 5 years. Project 2 has a computed net present value of $15,700 over a three-year life. Project 1 could be sold at the end of three years for a price of $65,000. Use the Present Value of $1 at Compound Interest and the Present Value of an Annuity of $1 at Compound Interest tables shown below. Present Value of $1 at Compound Interest 10% 0.909 0.826 0.751 0.683 Year 1 2 3 4 5 6 7 8 9 10 1 2 3 4 5 6 7 8 9 6% 10 0.943 0.890 0.840 0.792 0.747 0.705 0.665 0.627 0.592 0.558 2.673 3.465 4.212 4.917 5.582 6.210 0.621 0.564 0.513 0.467 0.424 0.386 Present Value of an Annuity of $1 at Compound Interest Year 6% 10% 12% 15% 20% 0.943 0.870 1.833 1.626 2.283 2.855 6.802 7.360 0.909 1.736 2.487 3.170 3.791 4.355 4.868 12% 5.335 5.759 6.145 0.893 0.797 0.712 0.636 0.567 0.507 0.452 0.404 0.361 0.322 0.893 1.690 2.402 3.037 3.605 4.111 4.564 4.968 15% 5.328…arrow_forwardThe terminal cap rate used for valuation purposes in a DCF is fundamentally different than the discount rate used in that same DCF. The assumed sale of the property takes place at the end of your hold period, generally 10 years later in most models. The property is older and the market and the economy have changed. With that said, what do you believe to be the right approach for terminal cap rate selection in a DCF on a development project and why?arrow_forwardProject Analysis. Assume that you are evaluating the following three mutually exclusive projects: A. Complete the following analyses. (For the last two lines, Terminal Value, please write in the dollar amount of the terminal value.) B. Compare and explain the conflicting rankings of the NPVs and TRRs versus the IRRs. C. Using different discount rates, is it possible to get different rankings within the NPV calculation? Why or why not? D. If 10 percent is the required return, which project is preferred? E. Which is the fairer representation of these two projects, TRR or IRR? Why?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education