Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

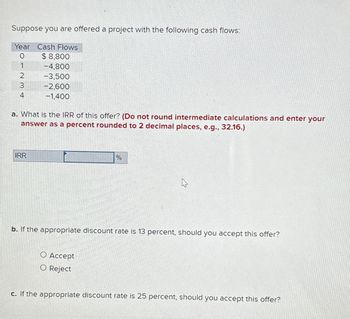

Transcribed Image Text:Suppose you are offered a project with the following cash flows:

Year Cash Flows

0

1

2

3

4

$8,800

-4,800

-3,500

-2,600

-1,400

a. What is the IRR of this offer? (Do not round intermediate calculations and enter your

answer as a percent rounded to 2 decimal places, e.g., 32.16.)

IRR

%

O Accept

O Reject

☆

b. If the appropriate discount rate is 13 percent, should you accept this offer?

c. If the appropriate discount rate is 25 percent, should you accept this offer?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Determine the future value of the following single amounts. Note: Use tables, Excel, or a financial calculator. Round your final answers to nearest whole dollar amount. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) 1. 2. 3 4. Invested Amount 15,000 20,000 30,000 50,000 $ $ $ U $ i = 6% 8% 12% 4% n = 12 10 20 12 Future Valuearrow_forwardDetermine the future value of the following single amounts. Note: Use tables, Excel, or a financial calculator. Round your final answers to nearest whole dollar amount. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) 1. 2. 3. 4. Invested Amount 15,500 23,000 35,000 56,000 $ 67 67 $ $ $ i = 5% 5% 11% 6% n = 12 6 18 14 Future Valuearrow_forwardA characteristic of the payback method is that it: (See your Chapter 25 notes, page 9) Uses accrual accounting inflows in the numerator of the calculation Uses the estimated expected useful life of the asset in the denominator of the calculation Incorporates cash flows received after the payback period has been reached Is based on accounting income Incorporates the time value of money Ignores total project profitabilityarrow_forward

- Determine the present value of the following single amounts. Note: Use tables, Excel, or a financial calculator. Round your final answers to nearest whole dollar amount. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) 1. 2. 3. 4. Future Amount $ 24,000 $ 18,000 $ 29,000 $ 44,000 i 5% 9% 11% 10% n= 10 13 25 9 Present Valuearrow_forwardHere are cash flows for a project under consideration. C(0)= -$8160, C(1)=6180, and C(2)=20280. What is the IRR of the project?arrow_forwardPlease solve step by step for clarity, thank you!arrow_forward

- The answer is project B but please answer why that is the correct answer. Engineering economic questionarrow_forwardBlinding Light Company has a project available with the following cash flows: Year Cash Flow 0 12345 2 3 4 5 -$ 34,110 8,150 9,810 13,980 15,850 10,700 What is the project's IRR?arrow_forwardQUESTION 3 If the cash flows for Project M are CO= -2,000; C1 = +400; C2 = +1,400; and C3= +1,300, calculate the IRR for the project. Please input the percentage format for your answer. And there is no need to put the percentage sign (%).arrow_forward

- Determine the future value of the following single amounts Note: Use tables, Excel, or a financial calculator. Round your final answers to nearest whole dollar amount. (EV of $1. PV of $1. EVA of $1.PVA of $1. EVAD of $1 and PVAD of $1) Invested Amount 15.000 20,000 30.000 50,000 1 S 3 234 $ 4 S 1 = ON 0% 12% 4% n = 12 10 20 12 Future Valuearrow_forwardMAKE SURE YOU ANSWER THIS QUESTION IN EXCEL FORMULA, NOT ALGEBRAICALLY!!!!!arrow_forwardInformation on four investment proposals is given below: Investment required. Present value of cash inflows Net present value Life of the project Answer is complete but not entirely correct. Profitability Index Investment Proposal ABCO A В Required: 1. Compute the profitability index for each investment proposal. (Round your answers to 2 decimal places.) 2. Rank the proposals in terms of preference. с D 3 0.41 0.38 0.50 0.33 Rank Preference A $ (240,000) 337,300 $ 97,300 Second Third First Fourth ✓ ✔ 5 years Investment Proposal $ (73,500) 110,250 $36,750 B $ (105,000) 144,900 $ 39,900 7 years 6 years $ (126,000). 168,000 $ 42,000 6 yearsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education