Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

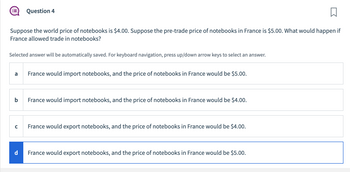

Suppose the world price of notebooks is $4.00. Suppose the pre-trade price of notebooks in France is $5.00. What would happen if France allowed trade in notebooks?

Transcribed Image Text:□

Suppose the world price of notebooks is $4.00. Suppose the pre-trade price of notebooks in France is $5.00. What would happen if

France allowed trade in notebooks?

Selected answer will be automatically saved. For keyboard navigation, press up/down arrow keys to select an answer.

a

b

C

Question 4

d

France would import notebooks, and the price of notebooks in France would be $5.00.

France would import notebooks, and the price of notebooks in France would be $4.00.

France would export notebooks, and the price of notebooks in France would be $4.00.

France would export notebooks, and the price of notebooks in France would be $5.00.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A laptop computer costs £1,100 in Europe. The same computer cost GHC 1,540 in Ghana. If we assume that the law of one price (LOP) holds, what is the spot exchange rate between the GHC and the euro?arrow_forwardSuppose that Cloudastries Bank is a U.S.-based financial intermediary that serves the foreign exchange market. Assume that this bank is willing to both purchase and sell currency for the same rate. In other words, assume there is no bid/ask spread. Suppose Cloudastries has made the following direct quotations: Currency Dollar Spot Rate $0.55 $1.65 Mexican Peso Euro Additionally, Cloudastries has quoted a cross exchange rate of 1 euro = 3.01 pesos. After exchanging euros for pesos, the last step in triangular arbitrage is to exchange those pesos for dollars. If you exchange your 36,484.84 for dollars from Cloudastries, you would receive This represents a profit ofarrow_forwardCOURSE: INTERNATIONAL FINANCE Today you learned about following exchange rate quotes: (a) 1 KWD (Kuwaiti dinar) = 6.51747 Belarusian rubles (BYN).b) 1 BYN = 166.913 Kazakhstani tenges (KZT)You need to buy 2,000,000 Kazakh tenges (KZT) with Kuwaiti dinars (KWD), so how many dinars do you need for your purchase?arrow_forward

- On January 31, 2019 the exchange rate between the US dollar and the euro was 1.14 USD/EUR. At the end of 2014, it was at 1.23 USD/EUR. Couple of years ago, A Big Mac cost 3.54 USD in the US. The price in the Euro Area was 3.42 EUR. Exchange rate was 1.28 USD/1 EUR. c) If law of one price would be true how much should it cost in the Euro Area? d) If Big Mac prices are perfect for determining PPP, is the Euro in comparison to the USD overvalued or undervalued? For how much? e) What is a definition of a nominal exchange rate in the value notation? Write an example.arrow_forwardSuppose that the interest rates in the U.S. and Germany are equal to 5%, that the forward (one year) value of the € is F$/€ = 1$/€ and that the spot exchange rate is E$/€ = 0.75$/€. Please answer the following questions by explaining all steps of your analysis: Does the covered interest parity condition hold? Why or why not? How could you make a riskless profit without any money tied up assuming that there are no transaction costs in buying and or selling foreign exchange? PLEASE SHOW ALL STEPSarrow_forwardD3) The spot rate of Kenya shillings to Euros was 132kes = 1 euro. The forward rate was Ke, 131 = 1 Euro. Calculate and explain the appreciation or depreciation of Euros against Kenya shillings. State the implications of European investors in Kenya Explain the implication of the above scenario on Kenyan coffee exportersarrow_forward

- In February 2022 the €/$ (euro/dollar) exchange rate was 0 88€/$ In France, a country that uses Euros as currency, the average price of a cinema ticket was 7€, while in the United States, a country that uses dollars as currency, the average price of a cinema ticket was $9 5 From this information we can infer that: Select one answer: 8. O The exchange rate is too low. The dollar should appreciate to ensure that purchasing power parity holds. O None of the above O The exchange rate is too low. The euro should appreciate to ensure that purchasing power parity holds. O The exchange rate is too high The dollar should appreciate to ensure that purchasing power parity holds.arrow_forwardA US based investor plans to invest $44,400 in Russia, where the interest rate is 6.65%. If the current exchange rate is $1 US buys 55 Rubles and the future expected exchange rate is $1 US buys 51.5 Rubles, then what is the future value of this investment? $50,570.7 $52,225.5 $52,990.0 O $54,040.4arrow_forwardSuppose a U.S. firm purchases some Chinese handicrafts. The china costs 1,000 Chinese yuan. At the exchange rate of $1.00 = 6.2 yuan, the dollar price of the goods is:arrow_forward

- If one U.S. dollar buys 0.6 euro, hoe many dollars can you purchase for one euro?arrow_forwardYour company sells specialized electronic components to South Africa payable in South African Rands (ZAR). The following information is available on the $/ZAR exchange rates expected to prevail at the end of the year. The local prices of the electronic components are affected by the value of ZAR as shown below. Qi (Prob) Si Local Price (P’i) Pi (price in dollars) 0.20 $0.0550 ZAR 30,000.00 $1,650.00 0.30 $0.0600 ZAR 27,500.00 $1,650.000.30 $0.0650 ZAR 25,000.00 $1,625.00 0.20 $0.0700 ZAR 22,500.00 $1,575.00 a. What is relationship, as measured by β, between $/ZAR rates and the component prices in US dollars. b. Explain how you can hedge the above exposure using currency futures. The one-year forward rate…arrow_forwardSuppose the Japanese yen exchange rate is ¥122 = $1 and the British pound exchange rate is £1 = $1.53. Suppose the cross-rate is ¥140 = £1. If there is, what would be the profit of the mispricing?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education