FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

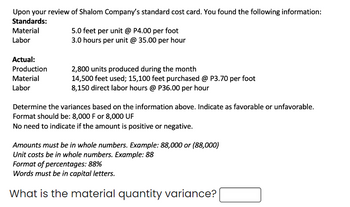

Transcribed Image Text:Upon your review of Shalom Company's standard cost card. You found the following information:

Standards:

Material

Labor

Actual:

Production

Material

Labor

5.0 feet per unit @ P4.00 per foot

3.0 hours per unit @ 35.00 per hour

2,800 units produced during the month

14,500 feet used; 15,100 feet purchased @ P3.70 per foot

8,150 direct labor hours @ P36.00 per hour

Determine the variances based on the information above. Indicate as favorable or unfavorable.

Format should be: 8,000 F or 8,000 UF

No need to indicate if the amount is positive or negative.

Amounts must be in whole numbers. Example: 88,000 or (88,000)

Unit costs be in whole numbers. Example: 88

Format of percentages: 88%

Words must be in capital letters.

What is the material quantity variance?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Acme Inc. has the following information available: Actual price paid for material Standard price for material Actual quantity purchased and used in production Standard quantity for units produced Actual labor rate per hour Standard labor rate per hour Actual hours Standard hours for units produced Variance Material Price NOTE: All dollar amounts are rounded to whole dollars and shown with "$" and commas as needed (i.e. $12,345). For the variance conditions, your answer is either "F" (for Favorable) or "U" (for Unfavorable) - capital letter and no quotes. Complete the following table of variances and their conditions: Material Quantity Total DM Cost Variance Labor Rate Labor Efficiency Total DL Cost Variance $1.00 $0.90 100 90 15 14 Variance Amount $ $ 200 190 Favorable (F) or Unfavorable (U)arrow_forwardSunny Corporation has collected the following data for one of its products: Direct materials standard (3 pounds per unit @ $0.40/lb.) Actual direct materials purchased Actual Direct Materials Used (AQU) Actual Price (AP) paid per pound How much is the direct materials price variance? O A. $1,610 unfavorable B. $2,240 favorable C. $1,610 favorable O D. $2,240 unfavorable $1.20 per finished good 32,000 pounds 23,000 pounds $0.47arrow_forwardCan you show me how this is done? Bailey’s standard labor cost of producing one unit of Product DD is 1.7 hours at a rate of $12.9 per hour. During August, 1,462 hours were incurred at a cost of $11.8 per hour to produce 1,257 units of Product DD. Bailey’s direct labor rate variance is $__________ Indicate the amount and whether it is Favorable or Unfavorable by placing F or U by amount, do not skip a space and do not use $ in your answer. For example, if your answer is $1,000 favorable, answer 1000F Selected Answer: 8.24 Correct Answer: 1,608 ± 1 (F)arrow_forward

- The following standard costs were used for one of its products: Standard Cost per Unit Fixed overhead Total 9 hours @ $13 per hour $ 117 Overhead is applied to products on the basis of standard direct labor hours for actual production. The following information is available regarding the company's operations for the period: Actual units produced Total actual direct labor hours Actual fixed manufacturing overhead incurred Budgeted fixed manufacturing overhead for the period Budgeted units for the period Required: Calculate the fixed overhead variances. Use your answer to answer the following questions. 1,200 units 8,500 hours $110,000 $122,850 1,050 unitsarrow_forwardFor direct labor:a. Compute the actual direct labor cost per hour for the month.b. Compute the labor rate variance. Julia Company uses a standard cost system in which manufacturing overhead is applied to units of product on the basis of standard machine-hours. At standard, each unit of product requires one machine-hour to complete. The standard variable overhead is $1.75 per machine-hour and Budgeted Fixed Manufacturing Costs are $300,000 per year. The denominator level of activity is 150,000 machine-hours, or 150,000 units. Actual data for the year were as follows: Actual variable overhead cost $ 211,680 Actual fixed manufacturing overhead cost $ 315,000 Actual machine-hours 126,000 Units produced 120,000 Required: What are the predetermined variable and fixed manufacturing overhead rates for the year? Compute the variable overhead rate and efficiency variances for the year. Compute the fixed…arrow_forwardThe following actual and standard cost data for direct material and direct labor relate to the production of 4,000 units of product: Actual Costs Standard Costs 4,900 lb. @ $5.85 5,000 lb. @ $5.90 2,000 hrs. @ $20.00 Direct Material Direct Labor 1,900 hrs. @ $20.50 Determine the labor efficiency variance. Select one: a. $2,000 F b. $2,000 U c. $2,050 F d. $2,050 U e. None of the abovearrow_forward

- Direct Material Direct Labor Standard Cost Data per 1 Unit Quantity Price 3 lbs $2.00/lb 2 hrs $4.00/hr Actual Data: Units produced Material purchase & usage Direct Labor Show all computations. 25 100 lbs at $2.20 per lb 30 hrs; total cost $129 a) Compute price variance, quantity variance, direct material variance b) Compute rate variance, efficiency variance, direct labor variancearrow_forwardThe following data relate to labor cost for production of 20,000 cellular telephones: 8,450 hrs. at $22.50 8,400 hrs. at $23.00 Actual: Standard: a. Determine the direct labor rate variance, direct labor time variance, and total direct labor cost variance. Enter a favorable variance as a negative number using a minus sign and an unfavorable variance as a positive number. Rate variance Time variance Total direct labor cost variance b. The employees may have been less-experienced or poorly trained, thereby resulting in a lower training may have resulted in less ✔efficient performance. Thus, the actual time required was more 50 X Favorable Unfavorable Favorable V ✓ ✓ ✓labor rate than planned. The lower level of experience or ✓than standard.arrow_forwardThe following data relate to a product manufactured by Kent Corporation: Direct material standard: 3.5 square feet at $2.50 per square foot Direct material purchased & used: 33,000 square feet at $2.60 per square foot Manufacturing activity: 9,600 units completed SHOW ALL COMPUTATIONS Compute price variance, quantity variance, direct material variance.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education