FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

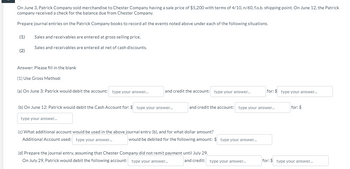

Transcribed Image Text:On June 3, Patrick Company sold merchandise to Chester Company having a sale price of $5,200 with terms of 4/10, n/60, f.o.b. shipping point. On June 12, the Patrick

company received a check for the balance due from Chester Company.

Prepare journal entries on the Patrick Company books to record all the events noted above under each of the following situations.

(1)

(2)

Sales and receivables are entered at gross selling price.

Sales and receivables are entered at net of cash discounts.

Answer: Please fill in the blank

(1) Use Gross Method:

(a) On June 3: Patrick would debit the account: type your answer...

and credit the account: type your answer...

(b) On June 12: Patrick would debit the Cash Account for: $ type your answer...

type your answer...

and credit the account: type your answer...

(c) What additional account would be used in the above journal entry (b), and for what dollar amount?

Additional Account used: type your answer...

would be debited for the following amount: $ type your answer...

(d) Prepare the journal entry, assuming that Chester Company did not remit payment until July 29.

On July 29, Patrick would debit the following account: type your answer...

for: $ type your answer...

and credit: type your answer...

for: $

for: $ type your answer...

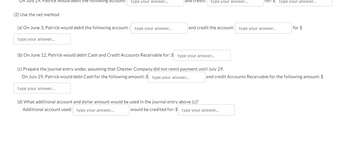

Transcribed Image Text:July 29, Patrick would debit the following account: type your answer...

(2) Use the net method

(a) On June 3, Patrick would debit the following account: type your answer...

type your answer...

type your answer...

dit: type your answer...

(b) On June 12, Patrick would debit Cash and Credit Accounts Receivable for: $ type your answer...

(c) Prepare the journal entry under, assuming that Chester Company did not remit payment until July 29.

On July 29, Patrick would debt Cash for the following amount: $ type your answer...

and credit the account: type your answer...

(d) What additional account and dollar amount would be used in the journal entry above (c)?

Additional account used: type your answer...

Tor: > type your answer...

would be credited for: $ type your answer...

for $

and credit Accounts Receivable for the following amount: $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Entries for Uncollectible Receivables, using Allowance Method Journalize the following transactions in the accounts of Sedona Interiors Company, a Restaurant Supply Company that uses the allowance method of accounting for uncollectible receivables: May 1. Sold merchandise on account to Beijing Palace Co., $18,900. The cost of the merchandise sold was $11,200. Aug. 30. Received $8,000 from Beijing Palace Co. and wrote off the remainder owed on the sale of May 1 as uncollectible. Dec. 8. Reinstated the account of Beijing Palace Co. that had been written off on August 30 and received $10,900 cash in full payment. For a compound transaction, if an amount box does not require an entry, leave it blank. May 1-sale May 1-cost Aug. 30 Dec. 8-reinstate Dec. 8-collection. 10 0 0000 0000 0 00arrow_forwardOn April 7, Rainforest Co. sold merchandise in the amount of $4,200 to Stellar Co. with credit terms 1/10, n/30. the cost of the items sold is $2,900. Stellar pays the invoice on April 14. The journal entry Rainforest Co. makes on April 14 is: Accounts Payable Cash Cash Accounts Receivable Cash Sales Discount Accounts Receivable Cash Accounts Receivable Cash Sales Discount Accounts Receivable 77 4,200 4,200 4,158 42 2,900 4,120 29 4,200 4,200 4,200 2,900 4,149arrow_forwardABC Company is a merchandising firm. On June 3, the company sells, on account, merchandise for $2,200, credit terms 2/10, n/30. The cost of merchandise sold is $1,200. On June 8, ABC Company collects the amount due from June 3 sale. Which of the following is correct regarding the journal entry to record the transaction on June 8:arrow_forward

- On June 3, Pearl Company sold to Chester Company merchandise having a sale price of $5,600 with terms of 3/10, n/60, f.o.b. shipping point. An invoice totaling $95, terms n/30, was received by Chester on June 8 from John Booth Transport Service for the freight cost. On June 12, the company received a check for the balance due from Chester Company. (a) Prepare journal entries on the Pearl Company books to record all the events noted above under each of the following bases. (1) Sales and receivables are entered at gross selling price. (2) Sales and receivables are entered at net of cash discounts.arrow_forwardRecord the following transactions in general journal form for Ford Education Outfitters and Romero Textbooks, Inc. Ford Educational Outfitters bought merchandise on account from Romero Textbooks, Inc., invoice no. 10594, $1,888.13; terms net 30 days; FOB destination. Romero Textbooks, Inc., paid $90.31 for shipping. Ford Education Outfitters received credit memo no. 513A from Romero Textbooks, Inc., for merchandise returned, $149.93. Required: 1. For Ford Education Outfitters. Round your answers to the nearest cent. GENERAL JOURNAL PAGE DATE DESCRIPTION DOC. NO. POST. REF. DEBIT CREDIT (a) Purchased merchandise from Romero Textbooks, Inc., invoice no. 10594, terms n/30. (b) Credit memo no. 513A for return of merchandise. 2. For Romero Textbooks, Inc. Round your answers to the nearest cent.…arrow_forwardOn March 1, Sally Co. sold merchandise to Buck Co. on account, $58,900, terms 2/15, n/30. The cost of the merchandise sold is $35,200. The merchandise was paid for on March 14. Assume all discounts are taken. Required: Journalize the entries for Sally Co. and Buck Co. for the sale, purchase, and payment of amount due. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a joumal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered.arrow_forward

- es Vail Company recorded the following transactions during November. Date General Journal Debit Credit November 5 Accounts Receivable-Ski Shop 5,775 Sales 5,775 November 10 Accounts Receivable-Welcome Incorporated Sales 1,706 1,706 November 13 Accounts Receivable-Zia Company Sales 1,000 1,000 November 21 Sales Returns and Allowances 258 November 30 Accounts Receivable-Zia Company Accounts Receivable-Ski Shop 258 3,557 Sales 3,557 1. Post these entries to both the general ledger accounts and the accounts receivable ledger subsidiary ledger accounts. 2. Prepare a schedule of accounts receivable. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Post these entries to both the general ledger accounts and the accounts receivable ledger subsidiary ledger accounts. General Ledger Accounts Receivable Accounts Receivable Subsidiary Ledger Ski Shop Ending Balance 0 0 Sales Ending Balance 0 0 Zia Company Ending Balance 0 0arrow_forwardJournalize the following transactions in the accounts of Arrow Medical Co., a medical equipment company that uses the direct write-off method of accounting for uncollectible receivables: Jan. 19. Sold merchandise on account to Dr. Sinclair Welby, $38,700. The cost of the merchandise sold was $20,900. July 7. Received $8,100 from Dr. Sinclair Welby and wrote off the remainder owed on the sale of January 19 as uncollectible. Nov. 2. Reinstated the account of Dr. Sinclair Welby that had been written off on July 7 and received $30,600 cash in full payment. If an amount box does not require an entry, leave it blank. Jan. 19-sale - Select - - Select - - Select - - Select - Jan. 19-cost - Select - - Select - - Select - - Select - July 7 - Select - - Select - - Select - - Select - - Select - - Select - Nov. 2-reinstate - Select - - Select - - Select - - Select - Nov. 2-collection - Select - - Select -…arrow_forwardThe following data were selected from the records of Fluwars Company for the year ended December 31, current year: Balances at January 1, current year: Accounts receivable (various customers) $ 116,000 Allowance for doubtful accounts 12,700 The company sold merchandise for cash and on open account with credit terms 1/10, n/30, without a right of return. The following transactions occurred during the current year: Sold merchandise for cash, $258,000. Sold merchandise to Abbey Corp; invoice amount, $42,000. Sold merchandise to Brown Company; invoice amount, $53,600. Abbey paid the invoice in (b) within the discount period. Sold merchandise to Cavendish Inc.; invoice amount, $56,000. Collected $119,100 cash from customers for credit sales made during the year, all within the discount periods. Brown paid its account in full within the discount period. Sold merchandise to Decca Corporation; invoice amount, $48,400. Cavendish paid its account in full after the…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education