FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

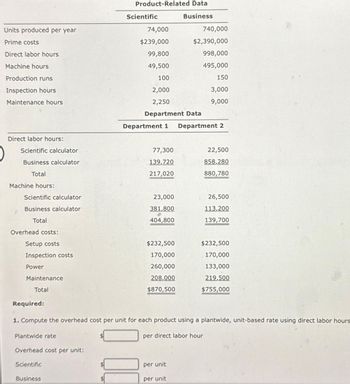

Transcribed Image Text:Units produced per year

Prime costs

Direct labor hours

Machine hours

Production runs

Inspection hours

Maintenance hours

Direct labor hours:

Scientific calculator

Business calculator

Total

Machine hours:

Scientific calculator

Business calculator

Total

Overhead costs:

Setup costs

Inspection costs

Power

Maintenance

Total

Required:

Plantwide rate

Overhead cost per unit:

Scientific

Product-Related Data

Business

Business

Scientific

74,000

$239,000

99,800

49,500

100

2,000

2,250

Department Data

Department 1 Department 2

77,300

139,720

217,020

23,000

381,800

404,800

$232,500

170,000

260,000

208,000

$870,500

1. Compute the overhead cost per unit for each product using a plantwide, unit-based rate using direct labor hours

per direct labor hour

740,000

$2,390,000

998,000

495,000

150

3,000

9,000

per unit

per unit

22,500

858,280

880,780

26,500

113,200

139,700

$232,500

170,000

133,000

219,500

$755,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 3 Kamili Company has the following three manufacturing overhead cost drivers. Cost Driver Design changes Machine setups Electricity usage Level of Activity $2,680 $3,080 $3,260 $1,550 $3,580 $2,860 100 changes per year 2,000 setups per year 12,000 kilowatt-hours per year Overhead Cost $ 5,000 18,000 36,000 Kamili Company started and completed work on 25 different jobs during the year. One of these jobs was Job #781. Job #781 required 16 design changes, 40 machine setups, and 700 kilowatt-hours of electricity. How much manufacturing overhead should be allocated to Job #781? Note: Kamili uses activity-based costing.arrow_forwardWatson's Computer Company uses ABC to account for its manufacturing process. Activities Indirect activitybudget Allocation base (cost driver) Materials handling $55,000 Based on number of parts Machine setup $32,000 Based on number of setups Assembling $9820 Based on number of parts Packaging $15,100 Based on number of finished units Watson's Computer Company expects to produce 2330 computers. Watson's Computer Company also expects to use 11,000 parts and have 10 setups.The allocation rate for materials handling will be (Round all answers to two decimal places.) Question 16 options: $5.00 $6.48 $8.40 $23.61arrow_forwardProblem 1 Brabensky Company produces a product in two departments: (1) Assembly and (2) Painting. The company uses a process cost accounting system. Purchased raw materials for $90,000 on account. Raw materials requisitioned for production were: Direct materials Assembly department $77,000 Factory labor used: Assembly department $34,000 Painting department 18,000 Manufacturing overhead is applied to the product based on machine hours used in each department: Assembly department—320 machine hours at $40 per machine hour. Painting department—120 machine hours at $15 per machine hour. Units costing $86,000 were completed in the Painting Department and were transferred to the Finished Good. Finished goods costing $70,000 were sold on cash for $102,000. Instructions Prepare the journal…arrow_forward

- Cornerstones of Cost Management 4th Ed. - Chapter 4 Scenario II: Goodmark Company produces two types of birthday cards: scented and regular. Goodmark uses the Overhead Control account to accumulate both actual and applied overhead. The company has the following data for the past year: Actual overhead $760,000 Sales $3,500,000 Materials used $1,100,000 Applied Overhead (in each account): Work in process $72,000 Finished goods 216,000 Cost of goods sold 432,000 Required: 1. Calculate the overhead variance for the year and label it under- or overapplied. Overhead variance: $ ________ (underpaid or overpaid) 2. Assuming the variance is not material, the following closing entry would be made: Debit _________ for $___________ and credit _______ for $ __________ 3. If the overhead variance is material, indicate how much of the variance would be __________ to each of the following accounts (if an amount is zero, enter "0"): Work in…arrow_forwardRequired information [The following information applies to the questions displayed below.] Arctica manufactures snowmobiles and ATVS. These products are made in different departments, and each department has its own manager. Each responsibility performance report includes only those costs that the department manager can control: direct materials, direct labor, supplies used, and utilities. Budget For Year Ended December 31 Direct materials Direct labor Totals Department manager salaries Supplies used Utilities Rent Totals Snowmobile $ 19,810 10,700 ▸ 4,600 3,630 Controllable Costs Responsibility Accounting Performance Report Manager, Snowmobile Department For Year Ended December 31 Budgeted $ 390 6,000 $ 45,130 Prepare a responsibility accounting performance report for the snowmobile department. Note: Under budget amounts should be indicated by a minus sign. 0 $ ATV $ 27,800 20,800 5,500 Actual 930 570 6,600 $ 62,200 Actual Snowmobile $ 19,720 10,990 4,700 3,470 360 5,600 $ 44,840 Over…arrow_forwardNonearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education