FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

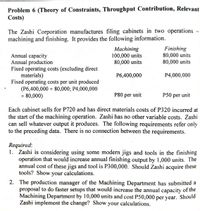

Transcribed Image Text:Problem 6 (Theory of Constraints, Throughput Contribution, Relevant

Costs)

The Zashi Corporation manufactures filing cabinets in two operations

machining and finishing. It provides the following information.

Machining

100,000 units

80,000 units

Finishing

80,000 units

80,000 units

Annual capacity

Annual production

Fixed operating costs (excluding direct

materials)

Fixed operating costs per unit produced

(P6,400,000 ÷ 80,000; P4,000,000

÷ 80,000)

P6,400,000

P4,000,000

P80 per unit

P50 per unit

Each cabinet sells for P720 and has direct materials costs of P320 incurred at

the start of the machining operation. Zashi has no other variable costs. Zashi

can sell whatever output it produces. The following requirements refer only

to the preceding data. There is no connection between the requirements.

Required:

1. Zashi is considering using some modern jigs and tools in the finishing

operation that would increase annual finishing output by 1,000 units. The

annual cost of these jigs and tool is P300,000. Should Zashi acquire these

tools? Show your calculations.

2. The production manager of the Machining Department has submitted a

proposal to do faster setups that would increase the annual capacity of the

Machining Department by 10,000 units and cost P50,000 per year. Should

Zashi implement the change? Show your calculations.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 9arrow_forwardRequired information [The following information applies to the questions displayed below.] Kubin Company's relevant range of production is 18,000 to 22,000 units. When it produces and sells 20,000 units, its average costs per unit are as follows: Average Cost per Unit $ 7.00 $ 4.00 $ 1.50 $ 5.00 $ 3.50 $ 2.50 $ 1.00 $ 0.50 Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Fixed selling expense Fixed administrative expense Sales commissions Variable administrative expensearrow_forwardProvide tablearrow_forward

- Subject :- Accountingarrow_forward3 ! 3 of 10 Required information [The following information applies to the questions displayed below.] Cane Company manufactures two products called Alpha and Beta that sell for $240 and $162, respectively. Each product uses only one type of raw material that costs $5 per pound. The company has the capacity to annually produce 131,000 units of each product. Its average cost per unit for each product at this level of activity are given below: Direct materials Direct labor Variable manufacturing overhead Book Traceable fixed manufacturing overhead Variable selling expenses Common fixed expenses -int Total cost per unit ences Alpha Beta $ 35 $ 15 48 23 27 25 35 38 32 28 35 30 $ 212 $ 159 The company considers its traceable fixed manufacturing overhead to be avoidable, whereas its common fixed expenses are unavoidable and have been allocated to products based on sales dollars. 4. Assume that Cane expects to produce and sell 110,000 Betas during the current year. One of Cane's sales…arrow_forward! Required information [The following information applies to the questions displayed below.] A company produces two products. Product 1 sells for $140 and Product 2 sells for $100. Each product uses only one type of raw material that costs $8 per pound. The company has the capacity to annually produce 106,000 units of each product. Its average cost per unit for each product at this level of activity are given below: Product Product 1 2 Direct materials $ 32 $ 16 Direct labor 24 19 Variable manufacturing overhead Traceable fixed manufacturing overhead Variable selling expenses Common fixed expenses 10 20 22 16 12 19 14 Total cost per unit $121 $ 92 The company considers its traceable fixed manufacturing overhead to be avoidable, whereas its common fixed expenses are unavoidable and have been allocated to products based on sales dollars. Consider each of the following questions separately. 3. Assume the company normally produces and sells 94,000 unit of Product 2 per year. What is the…arrow_forward

- Required Information The following information applies to the questions displayed below.] Cane Company manufactures two products called Alpha and Beta that sell for $225 and $175, respectively. Each product uses only one type of raw material that costs $6 per pound. The company has the capacity to annually produce 130,000 units of each product Its average cost per unit for each product at this level of activity are given below. Beta $24 32 Direct materials Direct labor Variable manufacturing overhead Traceable fFixed manufacturing overhead Variable selling expenses Common fixed expenses %2442 42 34 31. Total cost per unit $173 607$ The company considers its traceable fixed manufacturing overhead to be avoidable, whereas its common fixed expenses are unavoidable and have been allocated to products based on sales dollars. Assume that Cane normally produces and sells 59,000 Betas per year. What is the financial advantage (disadvantage) of iscontinuing the Beta product line? o search 近arrow_forward! Required information [The following information applies to the questions displayed below.] Martinez Company's relevant range of production is 7,500 units to 12,500 units. When it produces and sells 10,000 units, its average costs per unit are as follows: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Fixed selling expense Fixed administrative expense Sales commissions Variable administrative expense Average Cost Per Unit $ 6.30 $ 3.80 $ 1.50 $ 4.00 $ 3.30 $ 2.00 Contribution margin per unit $ 1.00 $ 0.50 13. If the selling price is $22.30 per unit, what is the contribution margin per unit? (Do not round intermediate calculations. Round your answer to 2 decimal places.)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education