FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Please help me with show all calculation thanku

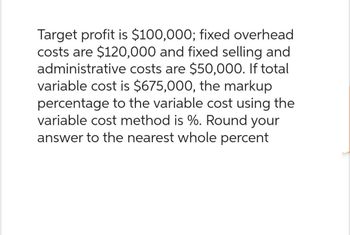

Transcribed Image Text:Target profit is $100,000; fixed overhead

costs are $120,000 and fixed selling and

administrative costs are $50,000. If total

variable cost is $675,000, the markup

percentage to the variable cost using the

variable cost method is %. Round your

answer to the nearest whole percent

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- If the variable cost is P15/unit, fixed cost is 265,000; and Sales is P55. Find the BEPs, and BEPx. Use the Target Profit Analysis Equation Method. Compute for the following: • Contribution Margin Ratio • Break-Even Point in Sales • Break-Even Point in Units IMPORTANT NOTE: PLEASE REFER TO THE GIVEN LESSON. USE THE FORMULA FROM THE LESSON IN THE PHOTE ATTACHED. THANK YOU. I will give you upvote for this.arrow_forwardAssume that the linear cost and revenue models apply. An item costs $13 to make. If fixed costs are $1600 and profits are $5700 when 100 items are made and sold, find the revenue equation. (Let x be the number of items.)R(x) =arrow_forwardTotal fixed cost of a product is IDR 10,000,000 and variable cost is IDR 50,000 per unit. The sale price is IDR.75,000 per unit . How much products should be produced to get BEP? Prove your answer and make a graphic. ..And If the company need profit IDR 10,000,000. How much is the sales price? Prove your answer.arrow_forward

- Management believes it can sell a new product for $6.50. The fixed costs of production are estimated to be $5,500, and the variable costs are $2.50 a unit. Complete the following table at the given levels of output and the relationships between quantity and fixed costs, quantity and variable costs, and quantity and total costs. Round your answers to the nearest dollar. Enter zero if necessary. Use a minus sign to enter losses, if any. Quantity Total Revenue Variable Costs Fixed Costs Total Costs Profits (Losses) 0 $ $ $ $ $ 500 $ $ $ $ $ 1,000 $ $ $ $ $ 1,500 $ $ $ $ $ 2,000 $ $ $ $ $ 2,500 $ $ $ $ $ 3,000 $ $ $ $ $ Determine the break-even level using the above table and use the Exhibit 19.5 to confirm the break-even level of output. Round your answers for the break-even level to the nearest whole number. Round your answers for the fixed costs, variable costs, total costs,…arrow_forwardBloom Company predicts it will incur fixed costs of $255,000 and earn income of $427,500 in the next period. Its expected contribution margin ratio is 65%. 1. Compute the amount of expected total dollar sales. 2. Compute the amount of expected total variable costs. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the amount of expected total dollar sales. Dollar Sales Numerator: Denominator: Total Dollar Sales %3D Total dollar sales %3D Required 1 Required 2 >arrow_forwardIf sales are $30,000, fixed costs are $10,000, and variable costs are $7,000 what is the contribution margin ratio? O 0.594 O 0.767 O 0.612 0.659arrow_forward

- The ratio of variable cost to sales is 70%. The break-even point 1occurs at 60% of thecapacity sales when fixed costs are Rs. 90,000.Also compute profit at 75% of the capacity sales2)| Define the GAAP & IFRSarrow_forwardAssume the following (1) variable expenses = $300,000, (2) unit sales = 10,000, (3) the contribution margin ratio = 20%, and (4) net operating income = $10,000. Given these four assumptions, which of the following is true? Multiple Choice The total fixed expenses = $60,000 The variable expense ratio is 400% The total contribution margin = $240,000 The total sales = $375,000arrow_forwardBloom Company management predicts that it will incur fixed costs of $267,000 and earn pretax income of $353,100 in the next period. Its expected contribution margin ratio is 53%. Required: 1. Compute the amount of total dollar sales. 2. Compute the amount of total variable costs. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the amount of total dollar sales. Dollar Sales Choose Numerator: / Choose Denominator: = 1 of 5 F8 Next > F9 18 F10 F11 F12 Fn Lock 3:25 PM 6/16/2022 Insertarrow_forward

- If sales are $500,000, variable cost are $200,000, and fixed costs are $240,000, what is the contribution margin ratio?arrow_forwardGiven the following information, find dollar sales: a. Fixed costs, $60,000; profit, $18,000; sales price per unit, $8.00; variable cost per unit, $5.00 b. Variable rate, .45; profit, $21,578.10; fixed costs, $58,382 c. Sales price per unit, $16.60; profit, $21,220; contribution margin, $9.29; fixed costs, $126,000arrow_forward1. Calculate the contribution margin rate, the sales dollar breakeven point, and the unit sales breakeven point. 2. Use the following information to perform your calculations. a. Net Sales: $50,000.00 b. Contribution Margin: $20,000.00 c. Total Fixed Costs: $15,500.00 d. Unit Sales Price: $25.00 3. Provide the formula and write out the equation that you use for each calculation. a. Contribution Margin Rate: b. Sales Dollar Breakeven Point: C. Unit Sales Breakeven Point:arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education