Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

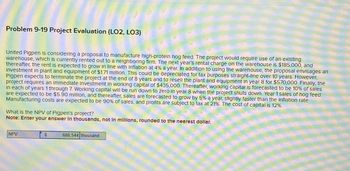

Transcribed Image Text:Problem 9-19 Project Evaluation (LO2, LO3)

United Pigpen is considering a proposal to manufacture high-protein hog feed. The project would require use of an existing

warehouse, which is currently rented out to a neighboring firm. The next year's rental charge on the warehouse is $185,000, and

thereafter, the rent is expected to grow in line with inflation at 4% a year. In addition to using the warehouse, the proposal envisages an

Investment in plant and equipment of $1.71 million. This could be depreciated for tax purposes straight-line over 10 years. However,

Pigpen expects to terminate the project at the end of 8 years and to resell the plant and equipment in year 8 for $570,000. Finally, the

project requires an immediate Investment in working capital of $435,000. Thereafter, working capital is forecasted to be 10% of sales

In each of years 1 through 7. Working capital will be run down to zero in year 8 when the project shuts down. Year 1 sales of hog feed

are expected to be $5.90 million, and thereafter, sales are forecasted to grow by 5% a year, slightly faster than the Inflation rate.

Manufacturing costs are expected to be 90% of sales, and profits are subject to tax at 21%. The cost of capital is 12%.

What is the NPV of Pigpen's project?

Note: Enter your answer in thousands, not in millions, rounded to the nearest dollar.

NPV

$

686,544 thousand

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 7 images

Knowledge Booster

Similar questions

- This alternative involves purchasing new aquaculture equipment for $500,000, with a forecasted useful life of 10 years, to replace old equipment that could be disposed of at an estimated salvage value of $60,000. If GBEI acquires the new equipment, it could take on a bigger service area that was not previously feasible, thus leading to an annual increase in sales of $200,000. With the improvements in technology built into the equipment, GBEI’s annual operating expenses would be reduced by $100,000. Operation of the new equipment would require GBEI to maintain inventory levels $100,000 higher than usual over the life of the project. The new equipment could be sold at the end of its useful life for $40,000. Assume straight line depreciation. Assume gross margin on incremental revenues is 60%. The cost of capital for this investment is 11.65%. 1. Calculate the NPV, Payback Period, and Profitability Index of the purchase of the new aquaculture equipment.arrow_forwardYou must evaluate the purchase of a proposed Spectrometer for R&D department. The purchase. Price of the spectrometer including modifications is $200,000, and the equipment will be depreciated at the time of purchase. The equipment would be sold after 3 years for $51,000. The equipment would require a $15,000 increase in net operating working capital (spare parts inventory). The project would have no effect on revenues, but it should save firm $49,000 per year in before-tax laber casts. The firm's marginal fecteral-plus-state tarrate is 25% a) What is the initial investment outlay for the Spectrumeter after bonus depreciation is considered, that is the Year 0 project cash flow? the Enter your answer as a a positive value. Rand answer to the nearest dollar. $ b.) What are the project's annual cash flows in Years Round 1, 2, and 3? Do not round intermediate calculations. your answers to the nearest dollar. Year 1: 9 Year 2: $ Year 3: $ 10 4 yourarrow_forwardArnold Inc. is considering a proposal to manufacture high-end protein bars used as food supplements by body builders. The project requires use of an existing warehouse, which the firm acquired three years ago for $3 million and which it currently rents out for $137,000. Rental rates are not expected to change going forward. In addition to using the warehouse, the project requires an upfront investment into machines and other equipment of $1.4 million. This investment can be fully depreciated straight-line over the next 10 years for tax purposes. However, Arnold Inc. expects to terminate the project at the end of eight years and to sell the machines and equipment for $440,000. Finally, the project requires an initial investment into net working capital equal to 10% of predicted first-year sales. Subsequently, net working capital is 10% of the predicted sales over the following year. Sales of protein bars are expected to be $4.7 million in the first year and to stay constant for eight…arrow_forward

- 4arrow_forwardBlossom Company is considering buying a new farm that it plans to operate for 10 years. The farm will require an initial investment of $11.95 million. This investment will consist of $2.60 million for land and $9.35 million for trucks and other equipment. The land, all trucks, and all other equipment are expected to be sold at the end of 10 years for a price of $5.20 million, which is $2.25 million above book value. The farm is expected to produce revenue of $2.05 million each year, and annual cash flow from operations equals $1.95 million. The marginal tax rate is 25 percent, and the appropriate discount rate is 9 percent. Calculate the NPV of this investment. (Do not round factor values. Round final answer to 2 decimal places, e.g. 5,275.25.) NPV $ The project should b accepted rejectedarrow_forwardMunch N' Crunch Snack Company is considering two possible investments: a delivery truck or a bagging machine. The delivery truck would cost $43,056 and could be used to deliver an additional 95,000 bags of pretzels per year. Each bag of pretzels can be sold for a contribution margin of $0.45. The delivery truck operating expenses, excluding depreciation, are $1.35 per mile for 24,000 miles per year. The bagging machine would replace an old bagging machine, and its net investment cost would be $61,614. The new machine would require three fewer hours of direct labor per day. Direct labor is $18 per hour. There are 250 operating days in the year. Both the truck and the bagging machine are estimated to have 7-year lives. The minimum rate of return is 13%. However, Munch N' Crunch has funds to invest in only one of the projects. Present Value of an Annuity of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 2 3 4 5 6 7 8 9 10 0.943 1.833 2.673 3.465 4.212 4.917 5.582 6.210 6.802 7.360…arrow_forward

- Warmack Machine Shop is considering a four-year project to improve its production efficiency. Buying a new machine press for $480,000 is estimated to result in $195,000 in annual pretax cost savings. The press falls in the MACRS five- year class, and it will have a salvage value at the end of the project of $81,000. The press also requires an initial investment in spare parts inventory of $21,000, along with an additional $2,600 in inventory for each succeeding year of the project. The shop's tax rate is 30 percent and its discount rate is 8 percent. MACRS schedule : 1st year = 20% 2nd year = 32% 3rd year = 19.2% 4th year = 11.52% 5th year = 5.76%arrow_forwardYou must evaluate the purchase of a proposed spectrometer for the R&D department. The purchase price of the spectrometer including modifications is $120,000, and the equipment will be fully depreciated at the time of purchase. The equipment would be sold after 3 years for $24,000. The equipment would require a $12,000 increase in net operating working capital (spare parts inventory). The project would have no effect on revenues, but it should save the firm $64,000 per year in before-tax labor costs. The firm's marginal federal-plus-state tax rate is 25%. a. What is the initial investment outlay for the spectrometer after bonus depreciation is considered, that is, what is the Year 0 project cash flow? Enter your answer as a positive value. Round your answer to the nearest dollar. $ b. What are the project's annual cash flows in Years 1, 2, and 3? Do not round intermediate calculations. Round your answers to the nearest dollar. Year 1: $ Year 2: $ Year 3: $ c. If the WACC is 11%, should…arrow_forwardMoose Pastures Inc. is considering a seven-year project to improve its production efficiency. Buying a new assembly machine for $708, 000 is estimated to result in $213,000 in annual pre-tax cash flows. The machine has a CCA rate of 30% per year, and it will have a salvage value of $70,000 at the end of the project. The machine also requires an initial investment in inventory of $20, 000 (in year zero), which will be recovered at the end of the project (in year 7). If the tax rate is 40% and the discount rate is 10%, what is the NPV of the machine purchase? (Assume the CCA pool remains open and that there are no capital gains/losses.) Correct answer is $132, 337. (My question) Hi I am confused on how it got 132, 337. I know there's a formula but can you walk me through the steps to get this correct answer?arrow_forward

- Tanaka Machine Shop is considering a four-year project to improve its production efficiency. Buying a new machine press for $510,000 is estimated to result in $210,000 in annual pretax cost savings. The press falls in the MACRS five-year class, and it will have a salvage value at the end of the project of $86,000. Refer to Table 8.3. The press also requires an initial investment in spare parts inventory of $24,000, along with an additional $2,900 in inventory for each succeeding year of the project. The shop's tax rate is 24 percent and the project's required return is 8 percent. Calculate the NPV of this project. Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. d NPV cesarrow_forwardCrane Company is considering buying a new farm that it plans to operate for 10 years. The farm will require an initial investment of $12.10 million. This investment will consist of $2.65 million for land and $9.45 million for trucks and other equipment. The land, all trucks, and all other equipment are expected to be sold at the end of 10 years for a price of $5.15 million, which is $2.20 million above book value. The farm is expected to produce revenue of $2.10 million each year, and annual cash flow from operations equals $2.00 million. The marginal tax rate is 25 percent, and the appropriate discount rate is 9 percent. Calculate the NPV of this investment. (Do not round factor values. Round final answer to 2 decimal places, e.g. 5,275.25.) NPV LAarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education