Unilever Wall's Ice Cream in Vietnam

In April 1996, whers first proposal to set up a

The factory was to be equipped with the latest production technology and designed to have an initial capacity of some 12 million liters annually, expected to rise to around 20 million litres About 80% of the necessary raw and packaging materials would be available locally.

In late 1997, it was estimated that Vietnamese ice cream consumption stood at around 0.1 litres per capita annually, or about 10-15 million litres. This level was considerably lower than that of other countries in the region - Thailand and Malaysia, for example, had an annual consumption of 2.5 litres per capita per year (as against over 25 litres in Australia and 20 litres in the United States) However, ice cream consumption in Vietnam was expected to rise to some 50 million litres annually over the next decade, and with its investment of tens of millions of dollars in the country,Unilever looked forward to capitalizing on this potential market.

Several factors made Vietnam an ideal market for ice cream. It was a country with a tropical climate and a high population density, of which a large proportion were young - 70% under 30 years old - and who regarded ice cream as a nutritious as well as appetizing form of snack food. "We intend to open up the market," said Unilever's general manager in Vietnam. "I think the market is ripe."

The Competition

Baskin Robbins: the U.S. ice cream maker, had three franchises in Ho Chi Minh City and one in Hanoi at the time of the Wall's launch. In April 1997, it was selling around 100 6kg boxes of ice cream in 31 different flavours per month. It imported all its equipment and ice cream directly from the United States. It claimed its customers preferred American ice cream, which was "real" ice cream. About half its customers were Vietnamese.

Vinamilk: the state-run dairy products company, made around 5.5 million litres of ice cream annually for the domestic market.

Dong was a typical Vietnamese manufacturer, with acerage sales of 150-200 k of of various type of ice cream per day. It imported refrigeration equipment only.

Domestic manufacturers such as Vinamilk and Dach Ding had the grow, with the imported Baskin Robbins 20 times more expetarve, and beyond the reach of many.

Goody ice cream an Italian brand unufactured in Ho Chi Minh City with raw material, technology and machinery imported from Italy, was 20-30% expensive than local brands.

In early 1997, Baskin Robbins reduced the price of a 75g ice cream come from VND 18,000 to VND 15,000. Bach Dang ice cream sold at VND 10,000 - VND 20,000 per cup, and Vinamilk at VND 11,400 per litre

Question:

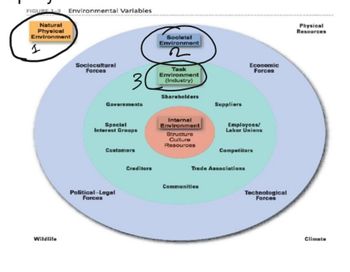

5. Analyze Wall's ice cream elements of the organization environment with respect to ?

a)natural environment

b).Societal environment

c. Task environment

Step by stepSolved in 2 steps

- if a furniture company from romania wanted to choose direct export as an entry strategy for the polish market , to expand in europe , what would be the reasons to choose direct export ?arrow_forward1. Name recent international trade policies between the United States and Germany? 2. Does the Germany have a trade agreement with the United States? If yes, what is it? 3. Does Germany have a trade surplus or deficit relative to the United States?arrow_forwardassignment: topic: 1.promoting china's reunification. 2. modern economic policy and system in china 3. natural landscap in china 4.indomitable modern struggle in chinaarrow_forward

- Wal Mart leaves South Korea In May 2006, Wal-Mart announced that it had agreed to sell all sixteen of its South Korean stores to its biggest competitor there. Shinsegae. Wal-Mart is not the only outsider that fared poorly in South Korea. The French retailer Carrefour, the second largest retailer worldwide after Wal-Mart, sold its 32 South Korean stores a month earlier. Wal-Mart arrived in Korea in 1998 by taking a majority stake in four supermarkets and six plots of land. It left Korea after grabbing a 3.8 percent market share and two years of huge losses. Wal-Mart aimed to become one of Korea’s three largest discount retailers. Wal-Mart and Carrefour faced an uphill climb against local retailers. Both Wal-Mart and Carrefour were slow in broadening the scope of their operations. With a network of only sixteen stores (and just one in Seoul, Korea’s capital), Wal-Mart failed to build…arrow_forward(10 points) In the realm of FDI, what is a “greenfield” investment?arrow_forwardThe 25-year-old NAFTA agreement is set to be replaced with a new agreement, the USMCA. Which countries belong to NAFTA and, going forwa USMCA?arrow_forward

Principles Of MarketingMarketingISBN:9780134492513Author:Kotler, Philip, Armstrong, Gary (gary M.)Publisher:Pearson Higher Education,

Principles Of MarketingMarketingISBN:9780134492513Author:Kotler, Philip, Armstrong, Gary (gary M.)Publisher:Pearson Higher Education, MarketingMarketingISBN:9781259924040Author:Roger A. Kerin, Steven W. HartleyPublisher:McGraw-Hill Education

MarketingMarketingISBN:9781259924040Author:Roger A. Kerin, Steven W. HartleyPublisher:McGraw-Hill Education Foundations of Business (MindTap Course List)MarketingISBN:9781337386920Author:William M. Pride, Robert J. Hughes, Jack R. KapoorPublisher:Cengage Learning

Foundations of Business (MindTap Course List)MarketingISBN:9781337386920Author:William M. Pride, Robert J. Hughes, Jack R. KapoorPublisher:Cengage Learning Marketing: An Introduction (13th Edition)MarketingISBN:9780134149530Author:Gary Armstrong, Philip KotlerPublisher:PEARSON

Marketing: An Introduction (13th Edition)MarketingISBN:9780134149530Author:Gary Armstrong, Philip KotlerPublisher:PEARSON

Contemporary MarketingMarketingISBN:9780357033777Author:Louis E. Boone, David L. KurtzPublisher:Cengage Learning

Contemporary MarketingMarketingISBN:9780357033777Author:Louis E. Boone, David L. KurtzPublisher:Cengage Learning