FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

The following information applies to the questions displayed below.]

Warnerwoods Company uses a perpetual inventory system. It entered into the following purchases and sales transactions for March.

| Date | Activities | Units Acquired at Cost | Units Sold at Retail | |||||||||

| Mar. | 1 | Beginning inventory | 190 | units | @ $52.80 per unit | |||||||

| Mar. | 5 | Purchase | 270 | units | @ $57.80 per unit | |||||||

| Mar. | 9 | Sales | 350 | units | @ $87.80 per unit | |||||||

| Mar. | 18 | Purchase | 130 | units | @ $62.80 per unit | |||||||

| Mar. | 25 | Purchase | 240 | units | @ $64.80 per unit | |||||||

| Mar. | 29 | Sales | 220 | units | @ $97.80 per unit | |||||||

| Totals | 830 | units | 570 | units | ||||||||

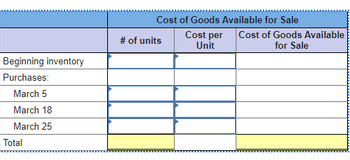

Compute cost of goods available for sale and the number of units available for sale.

Transcribed Image Text:Beginning inventory

Purchases:

March 5

March 18

March 25

Total

Cost of Goods Available for Sale

# of units

Cost per

Unit

Cost of Goods Available

for Sale

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Required information [The following information applies to the questions displayed below.] Warnerwoods Company uses a perpetual inventory system. It entered into the following purchases and sales transactions for March. Date Activities March 1 March 5 Beginning inventory Purchase Units Acquired at Cost 100 units @ $51.00 per unit 225 units @ $56.00 per unit Units Sold at Retail March 9 Sales 260 units @ $86.00 per unit March 18 Purchase March 25 Purchase March 29 Sales Totals 85 units @ $61.00 per unit 150 units @ $63.00 per unit 560 units 130 units @ $96.00 per unit 390 units Required: 1. Compute cost of goods available for sale and the number of units available for sale. Beginning inventory Purchases: March 5 March 18 March 25 Total Cost of Goods Available for Sale # of units Cost per Unit Cost of Goods Available for Sale S Next >arrow_forwardHaynes Company uses the perpetual inventory system. The following information is available for the month the March. March 1 Beginning Inventory 10 units at $2 for $20, March 4 Sold 8 units, March 22 Purchased 50 units at $4 for $200, March 26 Sold 48 units. If Haynes Company uses the LIFO inventory costing method, what is the balance in Ending Inventory at March 31? A. $40 B. $16 C. $12 D. $8arrow_forwardMontoure Company uses a periodic inventory system. It entered into the following calendar-year purchases and sales transactions. Date Activities Units Acquired at Cost Units Sold at Retail January 1 Beginning inventory 630 units @ $45.00 per unit February 10 Purchase 460 units @ $42.00 per unit March 13 Purchase 230 units @ $27.00 per unit March 15 Sales 920 units @ $75.00 per unit August 21 Purchase 130 units @ $50.00 per unit September 5 Purchase 530 units @ $46.00 per unit September 10 Sales 660 units @ $75.00 per unit Totals 1,980 units 1,580 units Required: Compute cost of goods available for sale and the number of units available for sale. Compute the number of units in ending inventory. Compute the cost assigned to ending inventory using (a) FIFO, (b) LIFO, (c) weighted average, and (d) specific identification. For specific identification, units sold consist of 630 units from beginning inventory,…arrow_forward

- The following units of a particular item were availlable for sale during the calendar year: Jan. 1 Inventory 4,100 units at $39 Apr. 19 Sale 2,300 units June 30 Purchase 4,500 units at $43 Sept. 2 Sale 5,200 units Nav. 15 Purchase 2,100 units at $46 The firm maintains a perpetual inventory system. Determine the cost of goods ssold for each sale and the inventory balance after each sale, assuming the last-in, first-out method. Present the illustrated in Exhibit 4. Under LIFO, if units are in inventory at two or more different costs, enter the units with the LOWER unit cost first in the Inventory Unit Cost column. Schedule of Cost of Goods Sold LIFO Method Cost of Goods Sold Inventory Purchases Quantity Total Cos Quantity Unit Cost Total Cost Unit Cost Unit Cost Total Cost Quantity Date Jan. 1 Apr. 19 June 30 Sept. 2 Nov. 15 Dec. 31 Balancesarrow_forwardMontoure Company uses a perpetual inventory system. It entered into the following calendar-year purchases and sales transactions Activities Units Sold at Retail Unita Acquired at Cost 600 unita $35 per unit 300 unite @ $32 per unit 150 units @ $20 per unit Date. Jan. 1 Beginning inventory Feb. 10 Purchase. Mar. 13 Purchase Mar. 15 Sales Aug. 21 Purchase. Sept. 5 Purchase. Sept. 10 Sales Totaln 190 units @ $40 per unit 540 units $37 per unit Cost of goods available for sale Number of units available for sale 1,780 units 725 units @ $80 per unit Required: 1. Compute cost of goods available for sale and the number of units available for sale. units 730 unite $80 per unit 1,455 unitearrow_forwardWarnerwoods Company uses a perpetual inventory system. It entered into the following purchases and sales transactions for March. Date March 1 March 5 March 9 March 18 March 25 March 29 Gross Margin Activities Sales Less: Cost of goods sold Gross profit Beginning inventory Purchase Sales Purchase Purchase Sales Totals FIFO Units Acquired at Cost 240 units @ $53.80 per unit 295 units @ $58.80 per unit HAN LIFO 155 units @ $63.80 per unit 290 units e $65.80 per unit 980 units 4. Compute gross profit earned by the company for each of the four costing methods. For specific identification, units sold include 135 units from beginning inventory, 265 units from the March 5 purchase, 115 units from the March 18 purchase, and 155 units from the March 25 purchase. Note: Round weighted average cost per unit to two decimals and final answers to nearest whole dollar. Weighted Average Units Sold at Retail Specific ID 400 units @ $88.80 per unit 270 units @ $98.80 per unit. 670 unitsarrow_forward

- Required information [The following information applies to the questions displayed below.] Warnerwoods Company uses a perpetual inventory system. It entered into the following purchases and sales transactions for March. Date: March 1 March 5 March 9 March 18 March 25 March 29 Gross Margin Activities. Beginning inventory Purchase Sales Sales Less: Cost of goods sold Gross profit Purchase. Purchase Sales Totals FIFO Units Acquired at Cost 140 units @ $51.80 per unit 245 units @ $56.80 per unit LIFO 105 units@ $61.80 per unit 190 units@ $63.80 per unit 680 units 4. Compute gross profit earned by the company for each of the four costing methods. For specific identification, units sold include 85 units from beginning inventory, 215 units from the March 5 purchase, 65 units from the March 18 purchase, and 105 units from the March 25 purchase. (Round weighted average cost per unit to two decimals and final answers to nearest whole dollar.) Weighted Average Units Sold at Retail Specific ID 300…arrow_forwardWarnerwoods Company uses a periodic inventory system. It entered into the following purchases and sales transactions for March. Date Activities Units Acquired at Cost Units Sold at Retail March 1 Beginning inventory 165 units @ $55 per unit March 5 Purchase 465 units @ $60 per unit March 9 Sales 485 units @ $90 per unit March 18 Purchase 250 units @ $65 per unit March 25 Purchase 330 units @ $67 per unit March 29 Sales 290 units @ $100 per unit Totals 1,210 units 775 units For specific identification, units sold include 70 units from beginning inventory, 415 units from the March 5 purchase, 105 units from the March 18 purchase, and 185 units from the March 25 purchase. Required: 1. Compute cost of goods available for sale and the number of units available for sale.arrow_forwardWarnerwoods Company uses a periodic inventory system. It entered into the following purchases and sales transactions for March. Date March 1 March 5 March 9 March 18 March 25 March 29 Activities Beginning inventory Purchase Sales Purchase Purchase Answer: Sales Totals Units Acquired at Cost 90 units @ $50.80 per unit 220 units @ $55.80 per unit 80 140 units @ $60.80 per unit units @ $62.80 per unit 530 units Calculate the total cost of goods available for sale Units Sold at Retail 250 units @ $85.80 per unit 120 units 370 units @ $95.80 per unitarrow_forward

- PLEASE FILL OUT THE CHART. use the following information to complete it. Thank you! Warnerwoods Company uses a perpetual inventory system. It entered into the following purchases and sales transactions for March. Date Activities Units Acquired at Cost Units Sold at Retail March 1 Beginning inventory 160 units @ $52.20 per unit March 5 Purchase 255 units @ $57.20 per unit March 9 Sales 320 units @ $87.20 per unit March 18 Purchase 115 units @ $62.20 per unit March 25 Purchase 210 units @ $64.20 per unit March 29 Sales 190 units @ $97.20 per unit Totals 740 units 510 unitsarrow_forwardPerpetual FIFO Perpetual LIFO Weighted Average Specific Identification Compute the cost assigned to ending Inventory using FIFO. Note: Round your average cost per unit to 2 decimal places. Perpetual FIFO: Cost of Goods Sold Goods Purchased Date # of units Cost per unit # of units sold January 1 February 10 Total February 10 March 13 Total March 13 March 15 Total March 15 August 21 Total August 21 Inventory Balance Cost per Cost of Goods Sold Cost per # of units unit 630 at unit Inventory Balance $50.00 = $31,500.00arrow_forwardRequired information [The following information applies to the questions displayed below.] Warnerwoods Company uses a perpetual inventory system. It entered into the following purchases and sales transactions for March. Date Activities Mar. 1 Beginning inventory Mar. 5 Purchase Mar. 9 Sales Mar. 18 Purchase Mar. 25 Purchase Mar. 29 Sales Totals Units Acquired at Cost 60 units @ $50.20 per unit 205 units @ $55.20 per unit 65 units @ $60.20 per unit 110 units @ $62.20 per unit 440 units Units Sold at Retail 220 units @ $85.20 per unit 90 units @ $95.20 per unit 310 units 4. Compute gross profit earned by the company for each of the four costing methods. For specific identification, the March 9 sale consisted of 45 units from beginning inventory and 175 units from the March 5 purchase; the March 29 sale consisted of 25 units from the March 18 purchase and 65 units from the March 25 purchase. (Round weighted average cost per unit to two decimals and final answers to nearest whole dollar.)…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education