Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Ef 311.

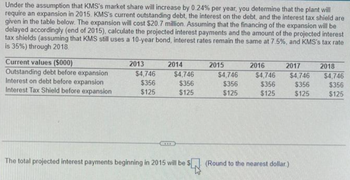

Transcribed Image Text:Under the assumption that KMS's market share will increase by 0.24% per year, you determine that the plant will

require an expansion in 2015. KMS's current outstanding debt, the interest on the debt, and the interest tax shield are

given in the table below. The expansion will cost $20.7 million. Assuming that the financing of the expansion will be

delayed accordingly (end of 2015), calculate the projected interest payments and the amount of the projected interest

tax shields (assuming that KMS still uses a 10-year bond, interest rates remain the same at 7.5%, and KMS's tax rate

is 35%) through 2018.

Current values ($000)

Outstanding debt before expansion

Interest on debt before expansion

Interest Tax Shield before expansion

2013

$4,746

$356

$125

2014

UNE

$4,746

$356

$125

The total projected interest payments beginning in 2015 will be $

2015

$4,746

$356

$125

2016

2017

$4,746 $4,746

$356

$356

$125

$125

(Round to the nearest dollar.)

2018

$4,746

$356

$125

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- 10078+0987=arrow_forwardE9.7(a,b2)arrow_forwardQuestion 3: When is an employer NOT required to file a quarterly Form 941? Answer: А. O When annual tax liability for federal income, Social Security, and Medicare tax is less than $1,000 В. O When annual tax liability for federal income, Social Security, and Medicare tax is less than $1,500 С. O When annual tax liability for federal income, Social Security, and Medicare tax is less than $2,500 D. When annual tax liability for federal income, Social Security, and Medicare tax is less than $100,000arrow_forward

- er 31, 2020 al analysis encil only, ennies blank aper properly. lines asarrow_forwardE10.15arrow_forwardKingcade Corporation keeps careful track of the time required to fill orders. Data concerning a particular order appear below: Hours 18.3 Wait time Process time Move time Queue time 1. 1 Inspection time 0.1 2.0 9.1 The manufacturing cycle efficiency (MCE) was closest to: (Round your intermediate calculations to 1 decimal place.)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education