Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

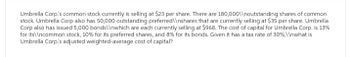

Transcribed Image Text:Umbrella Corp.'s common stock currently is selling at $23 per share. There are 180,000\\noutstanding shares of common

stock. Umbrella Corp also has 50,000 outstanding preferred\\nshares that are currently selling at $35 per share. Umbrella

Corp also has issued 5,000 bonds\\nwhich are each currently selling at $968. The cost of capital for Umbrella Corp. is 13%

for its\\ncommon stock, 10% for its preferred shares, and 8% for its bonds. Given it has a tax rate of 30%, \ \nwhat is

Umbrella Corp.'s adjusted weighted-average cost of capital?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Online Network Inc. has a net income of $700,000 in the current fiscal year. There are 100,000 shares of common stock outstanding, along with convertible bonds, which have a total face value of $1.5 million. The $1.5 million is represented by 1,500 different $1,000 bonds. Each $1,000 bond pays 6 percent interest. The conversion ratio is 10. The firm is in a 20 percent tax bracket. a. Compute basic earnings per share. (Do not round intermediate calculations and round your answer to 2 decimal places.) Basic earnings per share C b. Compute diluted earnings per share. (Do not round intermediate calculations and round your answer to 2 decimal places.) 200 Diluted earnings per sharearrow_forwardSimone's sweets is an all-equity firm that has 6700 shares of stock outstanding at a market price of $18 per share. The firm's management has decided to issue $56000 worth of debt at an interest rate of 6 percent. The funds will be used to repurchase shares of the outstanding stock. What are the earnings per share at the break--even EBIT?arrow_forwardFarCry Industries, a maker of telecommunications equipment, has 5 million shares of common stock outstanding, 2 million shares of preferred stock outstanding, and 20,000 bonds. Suppose the common shares are selling for $25 per share, the preferred shares are selling for $13.50 per share, and the bonds are selling for 97 percent of par.What would be the weight used for equity in the computation of FarCry’s WACC? (Round your answer to 2 decimal places.)arrow_forward

- Western Electric has 34,000 shares of common stock outstanding at a price per share of $83 and a rate of return of 12.80 percent. The firm has 7,500 shares of 8.20 percent preferred stock outstanding at a price of $97.00 per share. The preferred stock has a par value of $100. The outstanding debt has a total face value of $416,000 and currently sells for 113 percent of face. The yield to maturity on the debt is 8.20 percent. What is the firm's weighted average cost of capital if the tax rate is 40 percent?arrow_forwardXRT Infrastructure Corp. has 80,000 bonds outstanding that are selling at 90% of the par value (Bonds are selling at discount). Bonds with similar characteristics are yielding 10.8%. The company also has 4 million shares of common stock outstanding. The stock has a beta of 1.1 and sells for $50 per share. The common shareholder anticipates receiving a dividend that will growth at 0%, based on the fact they received $5 dividend last year. The capital market analysts predict that dividends will continue to grow at the same rate into the foreseeable future. The firm’s tax rate is 28 percent. What would be your estimate of the cost of common stock (cost of equity)? What would be the estimate cost of capital (WACC)?arrow_forwardFlora Fountain has 26,000 shares of equity priced at $67 per share and the cost of equity is 13.60 percent. Flora Fountain also has 6,700 shares of preferred stock with a face value of $100, paying a coupon interest of 6.60 percent and selling in the market for $89.00 per share. The debt's YTM is 7.72 percent, its total nominal value is $368,000 and is priced in the market for 105 percent of its par value. If the tax rate is 35 percent, find WACC.arrow_forward

- Ahmed Company has 8.5 million shares of common stock outstanding, 250,000 shares of 5 percent preferred stock outstanding, and 135,000 7.5 percent semiannual bonds outstanding, par value $5,000 each. The common stock currently sells for $34 per share (Par value= $10) and has a beta of 1.25, the preferred stock currently sells for $91 per share, and the bonds have 15 years to maturity and sell for 114 percent of par. The market risk premium is 7.5 percent, T-bills are yielding 4 percent, and Ahmed Company tax rate is 36 percent. a. What is the firm's market value capital structure? b. If Ahmed Company is evaluating a new investment project that has the same risk as the firm's typical project, what rate should the firm use to discount the project's cash flows? If we use debt 35%, preferred stock 15% and common stock 50%, what will be the discount rate by assuming same cost of each financing?arrow_forwardEnscoe Enterprises, Incorporated (EEI) has 280,000 shares authorized, 250,000 shares issued, and 20,000 shares of treasury stock. At this point, EEI has $2,120,000 of assets. $280,000 liabilities, $540,000 of common stock, and $1,300,000 of retained earnings. Further, assume that the market value of EEI's common stock is $10 per share. Requiredarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education