Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

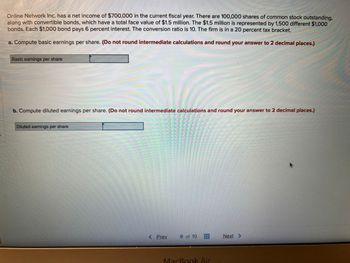

Transcribed Image Text:Online Network Inc. has a net income of $700,000 in the current fiscal year. There are 100,000 shares of common stock outstanding,

along with convertible bonds, which have a total face value of $1.5 million. The $1.5 million is represented by 1,500 different $1,000

bonds. Each $1,000 bond pays 6 percent interest. The conversion ratio is 10. The firm is in a 20 percent tax bracket.

a. Compute basic earnings per share. (Do not round intermediate calculations and round your answer to 2 decimal places.)

Basic earnings per share

C

b. Compute diluted earnings per share. (Do not round intermediate calculations and round your answer to 2 decimal places.)

200

Diluted earnings per share

< Prev

8 of 10

MacBook Air

Next >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The total book value of WTC's equity is $13 million, and book value per share is $20. The stock has a market-to-book ratio of 1.5, and the cost of equity is 9%. The firms bonds have a face value of $9 million and sell at a price of 110% of face value. The yield to maturity on the bonds is 7% andthe firm's tax rate is 21%. What is the company's WACC? (Don't round intermediate calculations, enter final answers as a percent rounded to 2 decimal places.)arrow_forwardGranite Works maintains a debt-equity ratio of .65 and has a tax rate of 32%. The pretax cost of debt is 9.8%. There are 25,000 shares of stock outstanding with a beta of 1.2 and a market price of $19 a share. The current market risk premium is 8.5% and the current risk-free rate is 3.6%. This year, the firm paid an annual dividend of $1.10 a share and expects to increase that amount by 2% each year. Using an average expected cost of equity, what is the WACC?arrow_forwardBadger Corp. has an issue of 6% bonds outstanding with 6 months left to maturity. The bonds are currently priced at $993.02, and pay interest semiannually. The firm's marginal tax rate is 40%. The estimated risk premium between the company's stock and bond returns is 5%. The firm's expects to maintain a capital structure with 40% debt and 60% equity going forward. The company's W.A.C.C. is ____%.arrow_forward

- Badger Corp. has an issue of 6% bonds outstanding with 6 months left to maturity. The bonds are currently priced at $1,008.11, and pay interest semiannually. The firm's marginal tax rate is 40%. The estimated risk premium between the company's stock and bond returns is 5%. The firm's expects to maintain a capital structure with 40% debt and 60% equity going forward. The company's W.A.C.C. is %. Margin of error for correct responses: +/-.10(%) Rounding and Formatting instructions: Do not enter dollar signs, percent signs, commas, X, or any words in your response. Do not round any intermediate work, but round your "final response to 2 decimal places (example: if your answer is 12.3456, 12.3456%, or $12.3456, you should enter 12.35).arrow_forwardJerry Jeff, Inc. has 14,900 shares of common stock outstanding at a price per share of $77 and the rate of return on the stock is 11.69 percent. The value of Jerry Jeff's debt is $586,800 and the required rate of return on the debt is 6.17 percent. What is the Jerry Jeff's WACC if the tax rate is 21 percent? Multiple Choice 9.82% 8.53% 8.70% 9.38%arrow_forwardCharter Corp. has issued 1,554 debentures with a total principal value of $1,554,000. The bonds have a coupon interest rate of 9%. a. What dollar amount of interest per bond can an investor expect to receive each year from Charter? b. What is Charter's total interest expense per year associated with this bond issue? c. Assuming that Charter is in a 39% corporate tax bracket, what is the company's net after-tax interest cost associated with this bond issue?arrow_forward

- The total book value of WTC's equity is $13 million, and book value per share is $26. The stock has a market-to-book ratio of 1.5, and the cost of equity is 15%. The firm's bonds have a face value of $9 million and sell at a price of 110% of face value. The yield to maturity on the bonds is 10%, and the firm's tax rate is 21%. What is the company's WACC? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.)arrow_forwardCalculate the weighted average cost of capital for the following Dunkie company (WACC). The Dunkie company's bond is currently selling for 102% of par. The bond is a semi-annual, 20-year bond issued 7 years ago with a face value of $1000.00 with a coupon of 8%. There were 95,000 bonds issued. The company's corporate tax rate is 32%. The Dunkie company has issued both preferred and common stock. The preferred stock pays $3.35 per share and is selling for $97.00. There are 100,000 shares of preferred stock. The company has a beta of .95. You've calculated the return of the market to be 9.5% and the market risk premium is 5.75%. The Dunkie company stock is selling for $15.75 and there are 5,000,000 shares outstanding. What is the weighted average cost of capital for the Dunkie company?arrow_forwardYou are given the following information for Huntington Power Company. Assume the company's tax rate is 25 percent. Debt: Common stock: Market: 30,000 4.9 percent coupon bonds outstanding, $2,000 par value, 25 years to maturity, selling for 104 percent of par; the bonds make semiannual payments. 470,000 shares outstanding, selling for $76 per share; the beta is 1.10. 6 percent market risk premium and 4.1 percent risk-free rate. What is the company's WACC?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education