FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

I need answer of last three question

I need answer of last three question

I need answer of last three question

please answer within the format by providing formula the detailed working

Please provide answer in text (Without image)

Please provide answer in text (Without image)

Please provide answer in text (Without image)

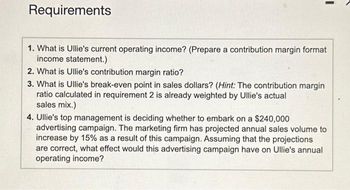

Transcribed Image Text:Requirements

1. What is Ullie's current operating income? (Prepare a contribution margin format

income statement.)

2. What is Ullie's contribution margin ratio?

3. What is Ullie's break-even point in sales dollars? (Hint: The contribution margin

ratio calculated in requirement 2 is already weighted by Ullie's actual

sales mix.)

4. Ullie's top management is deciding whether to embark on a $240,000

advertising campaign. The marketing firm has projected annual sales volume to

increase by 15% as a result of this campaign. Assuming that the projections

are correct, what effect would this advertising campaign have on Ullie's annual

operating income?

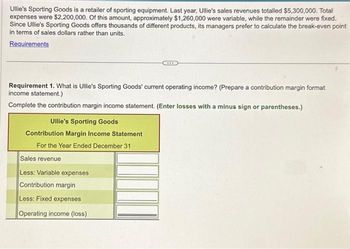

Transcribed Image Text:Ullie's Sporting Goods is a retailer of sporting equipment. Last year, Ullie's sales revenues totalled $5,300,000. Total

expenses were $2,200,000. Of this amount, approximately $1,260,000 were variable, while the remainder were fixed.

Since Ullie's Sporting Goods offers thousands of different products, its managers prefer to calculate the break-even point

in terms of sales dollars rather than units.

Requirements

Requirement 1. What is Ullie's Sporting Goods' current operating income? (Prepare a contribution margin format

income statement.)

Complete the contribution margin income statement. (Enter losses with a minus sign or parentheses.)

Ullie's Sporting Goods

Contribution Margin Income Statement

For the Year Ended December 31

Sales revenue

Less: Variable expenses

CO

Contribution margin

Less: Fixed expenses

Operating income (loss)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- Can i have the steps in formula form pleasearrow_forwardFurther info is in the attached images For the Excel part of the question give the solutions in the form of the Excel equations. Please and thank you! :) Download the Applying Excel form and enter formulas in all cells that contain question marks. For example, in cell B34 enter the formula "= B9". After entering formulas in all of the cells that contained question marks, verify that the dollar amounts match the example in the text. Check your worksheet by changing the beginning work in process inventory to 100 units, the units started into production during the period to 2,500 units, and the units in ending work in process inventory to 200 units, keeping all of the other data the same as in the original example. If your worksheet is operating properly, the cost per equivalent unit for materials should now be $152.50 and the cost per equivalent unit for conversion should be $145.50. Thank you!arrow_forwardTopic: Uni X U2_AS i Topic: Uni X M Question X M Question x M Question √x ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https% 253A%252F%252Flms.mheducation.com%252Fmghmiddle Complete this question by entering your answers in the tabs below. Required 1 Required 2 F2 Moab Incorporated manufactures and distributes high-tech biking gadgets. It has decided to streamline some of its operations so that it will be able to be more productive and efficient. Because of this decision it has entered into several transactions during the year. a. Moab Incorporated sold a machine that it used to make computerized gadgets for $30,600 cash. It originally bought the machine for $21,400 three years ago and has taken $8,000 in depreciation. b. Moab Incorporated held stock in ABC Corporation, which had a value of $23,000 at the beginning of the year. That same stock had a value of $26,230 at the end of the year. c. Moab Incorporated sold some of its inventory for $9,200…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education