tudent question

Hauswirth Corporation sold (or exchanged) a warehouse in year 0. Hauswirth bought the warehouse several years ago for $102,000, and it has claimed $33,800 of

Note: Loss amounts should be indicated by a minus sign. Leave no answer blank. Enter zero if applicable. Round your final answers to the nearest whole dollar amount.

Required:

Assuming that Hauswirth receives $80,500 in cash for the warehouse, compute the amount and character of Hauswirth's recognized gain or loss on the sale.

Assuming that Hauswirth exchanges the warehouse in a like-kind exchange for some land with a fair market value of $80,500, compute Hauswirth's realized gain or loss, recognized gain or loss, deferred gain or loss, and basis in the new land.

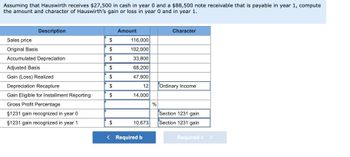

Assuming that Hauswirth receives $27,500 in cash in year 0 and a $88,500 note receivable that is payable in year 1, compute the amount and character of Hauswirth's gain or loss in year 0 and in year 1.

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

- Har Don't upload any imagearrow_forward7arrow_forwardMay 21st Transaction: Bought a laptop, paying $15751 cash as a down payment and signed a 8 month $52501, 7% note payable for the balance. The company paid $901 to have its company logo painted on the side of the van. The residual value is $12001. The old laptop was sold for $12001; it cost $67501 and accumulated depreciation until the date of disposal was $60001. Produce a journal entry for this transaction.arrow_forward

- Your staff person has provided you with the following journal entry for January 20x1 depreciation. The monthly deprecation is supposed to be $100.00. What is wrong with this entry?arrow_forwardPlease provide answer in text (Without image)arrow_forwardPlease don't give images in Solutions thank youarrow_forward

- Vishuarrow_forward< Champion Company purchased and installed carpet in its new general offices on March 31 for a total cost of $18,000. The carpet is estimated to have a 15- year useful life and no residual value. a. Prepare the journal entries necessary for recording the purchase of the new carpet. If an amount box does not require an entry, leave it blank Mar. 311 b. Record the December 31 adjusting entry for the partial-year depreciation expense for the carpet assuming that Champion Company uses the straight-line method. If an amount box does not require an entry, leave it blank Dec. 31arrow_forwardVikrambhaiarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education