FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

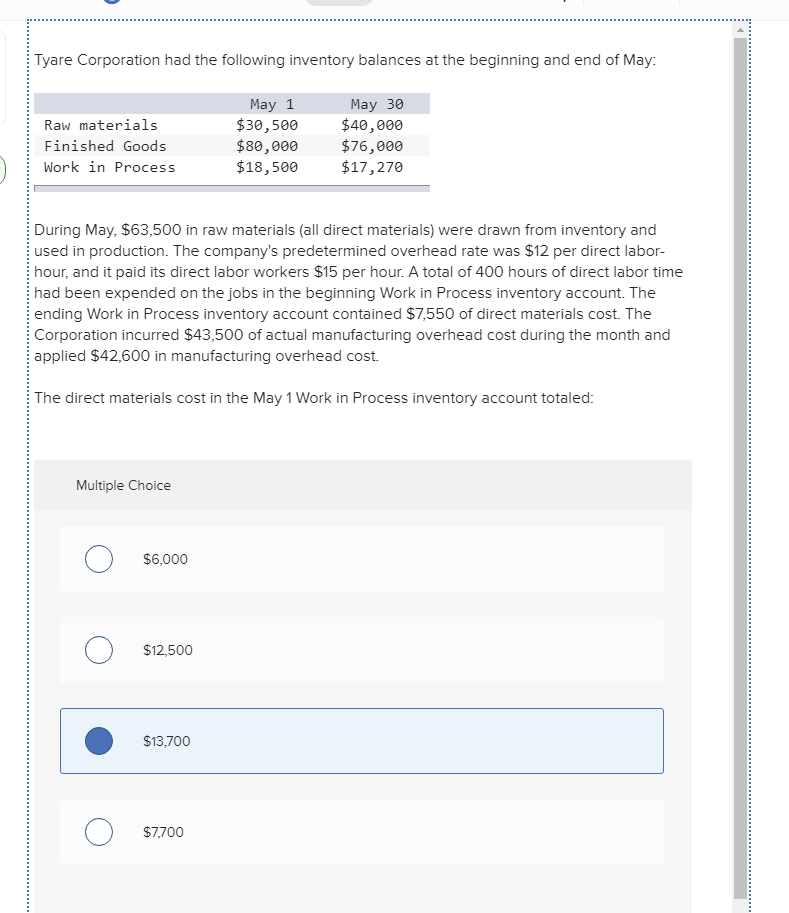

Transcribed Image Text:Tyare Corporation had the following inventory balances at the beginning and end of May:

May 1

$30,500

$80,000

$18,500

May 30

$40,000

$76,000

$17,270

Raw materials

Finished Goods

Work in Process

During May, $63,500 in raw materials (all direct materials) were drawn from inventory and

used in production. The company's predetermined overhead rate was $12 per direct labor-

hour, and it paid its direct labor workers $15 per hour. A total of 400 hours of direct labor time

had been expended on the jobs in the beginning Work in Process inventory account. The

ending Work in Process inventory account contained $7,550 of direct materials cost. The

Corporation incurred $43,500 of actual manufacturing overhead cost during the month and

applied $42,600 in manufacturing overhead cost.

The direct materials cost in the May 1 Work in Process inventory account totaled:

Multiple Choice

O $6,000

$12,500

$13,700

O $7,700

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Vinubhaiarrow_forwardSurfsUp Specialty Products has the following inventory account balances and related manufacturing cost flow information for the month of October: Raw Materials, October 1 $ 20,000 Raw Materials, October 31 $ 25,000 Work in Process, October 1 $ 45,000 Work in Process, October 31 $ 40,000 Finished Goods, October 1 $ 68,000 Finished Goods, October 31 $ 62,000 Raw materials purchased ? Raw materials used $ 75,000 Direct labor incurred ? Manufacturing overhead incurred $ 120,000 Cost of goods manufactured $ 300,000 Cost of goods sold ? Direct labor incurred in October is:arrow_forwardConsider the following information for June: Work-in- Raw Process Finished Material (WIP) Goods Beginning inventory $ 60,000 $ 24,000 $ 60,000 Ending inventory $ 90,000 $ 45,000 $ 80,000 Other information: Net income (after adjustment) $ 779,000 Purchases $ 600,000 Cost of goods sold (before adjustment) $ 1,420,000 Sales $ 2,800,000 Direct labor $ 95,000 Compute APPLIED manufacturing overhead.arrow_forward

- The manufacturing operations of Wildhorse, Inc. had the following balances for the month of January: Inventories Raw Materials Work in Process Finished Goods January 1 January 31 $15,600 27,300 18,200 $16,900 Cost of goods sold $ 29,900 20,800 Wildhorse transferred $377,000 of completed goods out of Work in Process Inventory during January. Compute the cost of goods sold.arrow_forwardFactory overhead is applied at 75% of direct labor cost. How much is the total cost of purchases for the month of August?arrow_forwardDuring the year, a company purchased raw materials of $77,319, and incurred direct labor costs of $125,900. Overhead is applied at the rate of 75% of the direct labor cost. These are the inventory balances: Ending $17,433 $16,428 Raw materials inventory Work in process inventory 241,437 234,422 Finished goods inventory 312,844 342,386 Compute the cost of materials used in production, the cost of goods manufactured, and the cost of goods sold. Cost of materials used in production Cost of goods manufactured Cost of goods sold Beginning $arrow_forward

- The following information pertains to Acme Manufacturing Company for June. Assume actual overhead equaled applied overhead. June 1 June 30 Inventory Balances Raw Materials $100,000 $60,000 Work in Process 120,000 145,000 Finished Goods 78,000 80,000 Activity during June: Raw materials purchased $120,000 Direct labor costs 100,000 Manufactured overhead 63,000 Complete the following Schedule of Cost of Goods Manufactured and Soldarrow_forwardCOGM?arrow_forwardOn April 1, Sangvikar Company had the following balances in its inventory accounts: Materials Inventory $12,730 21,340 Work-in-Process Inventory Finished Goods Inventory Work-in-process inventory is made up of three jobs with the following costs: Direct materials Direct labor Job 114 8,700 $2,411 1,800 1,170 Job 115 $2,640 1,560 1,014 Job 116 $3,650 4,300 2,795 Applied overhead During April, Sangvikar experienced the transactions listed below. a. Materials purchased on account, $29,000. b. Materials requisitioned: Job 114, $16,500; Job 115, $12,200; and Job 116, $5,000. c. Job tickets were collected and summarized: Job 114, 150 hours at $12 per hour; Job 115, 220 hours at $14 per hour; and Job 116, 80 hours at $18 per hour. d. Overhead is applied on the basis of direct labor cost. e. Actual overhead was $4,415. f. Job 115 was completed and transferred to the finished goods warehouse. g. (1) Job 115 was shipped, and (2) the customer was billed for 125 percent of the cost.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education