FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

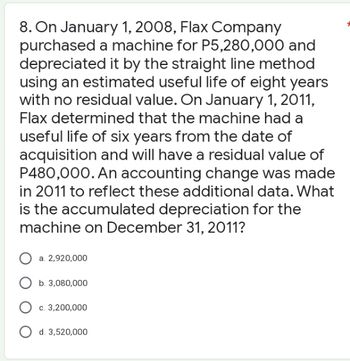

Transcribed Image Text:8. On January 1, 2008, Flax Company

purchased a machine for P5,280,000 and

depreciated it by the straight line method

using an estimated useful life of eight years

with no residual value. On January 1, 2011,

Flax determined that the machine had a

useful life of six years from the date of

acquisition and will have a residual value of

P480,000. An accounting change was made

in 2011 to reflect these additional data. What

is the accumulated depreciation for the

machine on December 31, 2011?

O a. 2,920,000

b. 3,080,000

c. 3,200,000

d. 3,520,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A machine with a cost of $100 000 has an estimated residual value of $10 000 and an estimated life of five years or 45 000 hours. It is to be depreciated by the units-of-activity method. What is the amount of depreciation for the third full year, during which the machine was used 9 500 hours? O $19,000 O $21,111 O None of the other alternatives O $16,000arrow_forwardThe Weber Company purchased a mining site for $534,246 on July 1. The company expects to mine ore for the next 10 years and anticipates that a total of 98,745 tons will be recovered. During the first year the company extracted 4,912 tons of ore. The depletion expense is a.$41,701.00 b.$49,254.50 c.$24,501.30 d.$26,573.92arrow_forwardA machine with a cost of $50,000 has an estimated residual value of $3,743 and an estimated life of 5 years or 18,397 hours. What is the amount of depreciation for the second full year, using the double-declining-balance method? a.$12,000.00 b.$20,000.00 c.$10,000.00 d.$18,502.80arrow_forward

- A machine with a cost of $70,887.00 has an estimated residual value of $4,907.00 and an estimated life of 7 years or 16,219 hours. It is to be depreciated by the units-of-output method. What is the amount of depreciation for the second full year, during which the machine was used 3,855 hours? Do not round your intermediate calculations. $9,425.71 $18,851.43 $15,682.40 $16,848.72arrow_forwardA machine with a cost of $67,523.00 has an estimated residual value of $4,597.00 and an estimated life of 3 years or 15,348 hours. It is to be depreciated by the units-of-production method. What is the amount of depreciation for the second full year, during which the machine was used 3,228 hours? Select the correct answer. $14,201.48 $20,975.33 $41,950.67 $13,234.63arrow_forwardA machine with a cost of $64,800 has an estimated residual value of $4,863 and an estimated life of 5 years or 18,281 hours. What is the amount of depreciation for the second full year, using the double-declining-balance method? a. $12,960.00 b. $23,974.80 c. $15,552.00 d. $25,920.00arrow_forward

- Wardell Company purchased a minicomputer on January 1, 2022, at a cost of $57,000. The computer was depreciated using the straight-line method over an estimated five-year life with an estimated residual value of $6,000. On January 1, 2024, the estimate of useful life was changed to a total of 10 years, and the estimate of residual value was changed to $1,200. Required: 1. Prepare the year-end journal entry for depreciation on December 31, 2024. No depreciation was recorded during the year. Record depreciation expense for 2024. Event General Journal Debit Credit 1 Depreciation expense 4,425 Accumulated depreciation—computer 4,425 Prepare the year-end journal entry for depreciation on December 31, 2024. Assume that the company uses the double-declining-balance method instead of the straight-line method. Event General Journal Debit Credit 1 Depreciation…arrow_forwardWhat is the proper solution for this problemarrow_forwardA machine with a cost of $180,000 has an estimated residual value of $20,000 and an estimated life of 4 years or 20,000 hours. It is to be depreciated by the units-of-activity method. What is the amount of depreciation for the second full year, during which the machine was used 5,000 hours? $5,000 b. $50,000 $20,000 Od $40,000arrow_forward

- Maggie Sharrer Company expects to extract 20 million tons of coal from a mine that cost $12 million. Ifno salvage value is expected and 2 million tons are mined in the first year, the entry to record depletion will include a O a. Debit to inventory of $1,200,000 O b. Debit to accumulated depletion of $2,000,000 Oc. Credit to accumulated depletion of $2,000,000 Od. Credit to depletion expense of $1,200,000arrow_forwardA machine originally had an estimated useful life of 5 years, but after 3 complete years, it was decided that the original estimate of useful life should have been 10 years. At that point the remaining cost to be depreciated should be allocated over the remaining: A. 2 years.B. 5 years.C. 7 years.D. 8 years.E. 10 yearsarrow_forwardMorris Associates bought a machine for $82,000 cash. The estimated useful life was five years and the estimated residual value was $7,000. Assume that the estimated useful life in productive units is 171,000. Units actually produced were 45,600 in year 1 and 51,300 in year 2. Required: 1. Determine the appropriate amounts to complete the following schedule.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education