Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN: 9781305506381

Author: James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

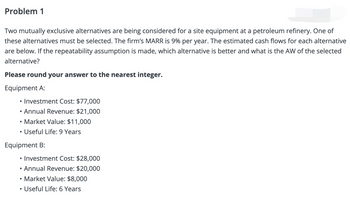

Transcribed Image Text:Problem 1

Two mutually exclusive alternatives are being considered for a site equipment at a petroleum refinery. One of

these alternatives must be selected. The firm's MARR is 9% per year. The estimated cash flows for each alternative

are below. If the repeatability assumption is made, which alternative is better and what is the AW of the selected

alternative?

Please round your answer to the nearest integer.

Equipment A:

• Investment Cost: $77,000

• Annual Revenue: $21,000

• Market Value: $11,000

Useful Life: 9 Years

Equipment B:

Investment Cost: $28,000

• Annual Revenue: $20,000

• Market Value: $8,000

• Useful Life: 6 Years

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- :[A] { > Incremental analysis ([ B Alternative], [B wins ]): C A company considering 2 different machines at MARR at 12% Both life spans = 10 years Initial Cost Annual Operating lost Benefits per yin ar Salvage Value \table MM If you are and of frying investment to company decide More than 2 alternatives if the additional increment is worth while, compare Alternative: A Incremental analysis (Alternative) pairs then B C A MARR Company at Considering 2 different machines at 12% Both life spans = 10 years. M/C X м/с у Initial Cost 160000 285000 Annual Operating Cost Benefits per year Salvage Value 45 000 90000 45000 105000 20000 40000arrow_forwardam. 122.arrow_forwardCan some one please help me to answer each question correctly? please and thank you.arrow_forward

- A project is being planned that has an initial investment at time 0, annual revenuesand expenses, and a salvage value at the end of the project lifespan (20 years). The financialvalues are summarized below:Initial investment amount at time 0 $150,000Estimated annual revenue $34,500 per yearEstimated annual expenses $8,700 per yearEstimated salvage value at end of lifespan $10,000Minimum attractive rate of return (MARR) 15%a. Calculate the capital recovery amount CR(i%).b. Using the annual worth (AW) method, determine whether purchasing the equipmentis economically justified.c. Repeat part (a) using the internal rate of return (IRR) method based on annual worth(AW).d. Using the present worth (PW) method, determine the break-even time period afterwhich purchase of the equipment generates a profit. (Find N when PW = 0) year period.arrow_forwardAnswer the problems on the basis of the above graph and the most likely estimates given as follows: If the profit (R−E) is decreased by 5%, this projectis not profitable. (a) True (b) False.arrow_forwardPlease given full answerarrow_forward

- not use ai pleasearrow_forwardAn engineering firm has identified five ways to cut costs in its main office. Only one of the options can be implemented, however, since each involves significant training time for staff engineers. Data are provided in the table. Each option has a lifetime of seven years, and the firm sets a MARR at 15%. Option A B C D E Capital cost ($ million) 2.713 0.375 1.650 0.088 0.950 Annual cost ($ million/yr 0.093 0.275 0.132 0.147 0.228 Annual benefit ($ million/yr) 0.890 0.288 0.841 0.312 0.505 a) Solve by present worth analysis. b) Solve by annual cash flow analysis. c) Solve by incremental benefit-cost ratio analysis. d) Solve by an incremental rate of return analysis using the full detailed procedure �arrow_forwardWith the given information please calculate NPV, NPW, EUAW, and IRR for each alternative. The interest rate is 15%arrow_forward

- 12% per year. For the cash flows shown, use an annual worth comparison and an interest rate of First cost, $ Annual cost$, per year Overhaul cost every 5 years,$ Salvage value, $ Life, years X Y -100,000 -250,000 -40,000 -30,000 0 2,000 30,000 10,000 5 10 Z -500,000 -10,000 5,000 ∞ a) Determine the alternative that is economically best. b) Determine the first cost required for each of the two alternatives not selected in part a) so thatarrow_forwardYou are considering an open-pit mining operation. The cash flow pattern issomewhat unusual since you must invest in some mining equipment, conductoperations for two years, and then restore the sites to their original condition.You estimate the net cash flows to be as follows: N Cash flow 0 -$1,600,0001 1,500,0002 1,500,0003 -700,000 What is the approximate rate of return of this investment?(a) 25%(b)38%(c) 42%(d)62%arrow_forwardwith-given-formula-solutionpls explain tooarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning

Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning

Managerial Economics: Applications, Strategies an...

Economics

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:Cengage Learning