Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

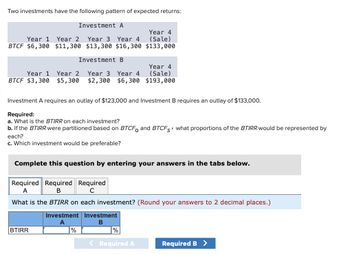

Transcribed Image Text:Two investments have the following pattern of expected returns:

Investment A

Year 1 Year 2

Year 3 Year 4

Year 4

(Sale)

BTCF $6,300

$11,300 $13,300 $16,300 $133,000

Investment B

Year 4

Year 1

Year 2 Year 3 Year 4

(Sale)

BTCF $3,300

$5,300

$2,300

$6,300

$193,000

Investment A requires an outlay of $123,000 and Investment B requires an outlay of $133,000.

Required:

a. What is the BTIRR on each investment?

b. If the BTIRR were partitioned based on BTCFO and BTCFS what proportions of the BTIRR would be represented by

each?

c. Which investment would be preferable?

Complete this question by entering your answers in the tabs below.

Required Required Required

A

B

C

What is the BTIRR on each investment? (Round your answers to 2 decimal places.)

Investment Investment

A

B

BTIRR

%

%

< Required A

Required B >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 4 images

Knowledge Booster

Similar questions

- You are evaluating an investment project, which has a cost of $161,000 today and is expected to provide after-tax annual cash flows of $20,000 for seven years. In order to compute the MIRR, you are modifying the cash flows. Assuming the cost of capital is 9.1 percent, what is the terminal cash flow of the modified cash flows? Question 12 options: $173,074 $176,474 $178,474 $180,974 $182,874 $184,574arrow_forwardAn investor is considering two investment projects. Project A requires an initial payment of £12,000. In return, the investor will receive a payment of £17,400 after one year. Project B requires an initial payment of £10,300. In return, the investor will receive a payment of £1,240 at the end of every month for one year. Calculate the cross-over rate of the projects 数字 Enter a percentage correct to 1 decimal place. % What is the payback period of each project? Project A:数字 Project B:数字 months monthsarrow_forwardA real estate investment has the following expected cash flows: Year Cash Flows 1 $14,000 2 19,000 3 19,000 4 25,000 The discount rate is 3 percent. What is the investment’s present value? Round your answer to 2 decimal placesarrow_forward

- For your ongoing business, the required investments are $420,000 for X1, $550,000 for X2, $720,000 for X3, and $800,000 for X4. X0 denotes the do-nothing alternative. Moreover, you had information about the internal rates of return for the incremental projects: IRR for X1-XO is 18%, IRR for X2-XO is 20%, IRR for X3-XO is 25%, IRR for X4-XO is 30%, IRR for X2-X1 is 10%, IRR for X3-X1 is 21%, IRR for X4-X1 is 19%, IRR for X3- X2 is 18%, IRR for X4-X3 is 14%, IRR for X4-X2 is 23%. Using the information above, if the MARR is 15%, what system should be selected? а) ХО O b) X2 с) XЗ d) None of the answers are correct e) X1 O f) X4arrow_forwardYou’re trying to choose between two different investments, both of which have upfront costs of K75,000. Investment G returns K135,000 in six years. Investment H returns K195,000 in 10 years. Which of these investments has the higher return?arrow_forwardAn investment will pay $600 at the end of each of the next 2 years, $700 at the end of Year 3, and $1,000 at the end of Year 4. What is its present value if other investments of equal risk earn 6 percent annually? a. $1,821.82 b. $1,913.83 c. $2,297.07 d. $2,479.86 e. $2,735.85arrow_forward

- Annual cash inflows that will arise from two competing investment projects are given below: Year Investment A Investment B 1 $7,000 $ 10,000 2 8,000 3 9,000 4 10,000 $ 34,000 9,000 8,000 7,000 $ 34,000 The discount rate is 7%. Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using tables. Required: Compute the present value of the cash inflows for each investment.arrow_forwardPRESENT AND FUTURE VALUES OF A CASH FLOW STREAM An investment will pay $150 at the end of each of the next 3 years, $250 at the end of Year 4, $350 at the end of Year 5, and $550 at the end of Year 6. a. If other investments of equal risk earn 10% annually, what is its present value? Round your answer to the nearest cent. $ b. If other investments of equal risk earn 10% annually, what is its future value? Round your answer to the nearest cent. $arrow_forwardTerri Allessandro has an opportunity to make any of the following investments: The purchase price, the lump-sum future value, and the year of receipt are given below for each investment. Terri can earn a rate of return of 6% on investments similar to those currently under consideration. Evaluate each investment to determine whether it is satisfactory, and make an investment recommendation to Terri. The present value, PV Data table Investment A Purchase Price Future Value Year of Receipt $20,032 $28,000 5 B $402 $1,000 21 с $3,266 $7,000 11 D $4,173 $20,000 46 (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Print Done ×arrow_forward

- An investor is considering two investment projects. Project A requires an initial payment of £15,000. In return, the investor will receive a payment of £19,600 after one year. Project B requires an initial payment of £10,700. In return, the investor will receive a payment of £1,210 at the end of every month for one year. Calculate the cross-over rate of the projects 数字 Enter a percentage correct to 1 decimal place. % What is the payback period of each project? Project A: Project B:数字 months monthsarrow_forwardAn investor is considering two investment projects. Project A requires an initial payment of £11,000. In return, the investor will receive a payment of £15,200 after one year. Project B requires an initial payment of £10,000. In return, the investor will receive a payment of £1,120 at the end of every month for one year. Calculate the cross-over rate of the projects 数字 Enter a percentage correct to 1 decimal place. % What is the payback period of each project? Project A: Project B: months monthsarrow_forwardConsider the 6 divisible investment alternatives shown below. The planning horizon is 8 years. The MARR is 15%. $60,000 is available for investment. Solve, a. What proportion of each investment is to be included in the optimum investment portfolio? b. Solve part a when full or partial investment cannot be made in more than 3 of the investments. c. Solve part a when investments P and R are mutually exclusive.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education