FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

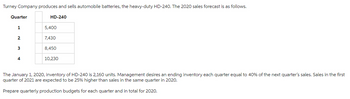

Transcribed Image Text:Turney Company produces and sells automobile batteries, the heavy-duty HD-240. The 2020 sales forecast is as follows.

Quarter

1

2

3

4

HD-240

5,400

7,430

8,450

10,230

The January 1, 2020, inventory of HD-240 is 2,160 units. Management desires an ending inventory each quarter equal to 40% of the next quarter's sales. Sales in the first

quarter of 2021 are expected to be 25% higher than sales in the same quarter in 2020.

Prepare quarterly production budgets for each quarter and in total for 2020.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The Company has two products: A and B. March sales forecast projects 15,000 units of A and 10,000 units of B are going to be sold at prices of $15 and $18, respectively. The desired ending inventory of A is 12% higher than the beginning inventory, which was 2000 units. How much are total March sales for A anticipated to be?arrow_forwardViolet Sales Corp, reports the year-end information from 2023 as follows: Sales (35,500 units) $284,000 Cost of goods sold 105,000 Gross margin 179,000 Operating expenses 152,000 Operating income $27,000 Violet is developing the 2024 budget. In 2024 the company would like to increase selling prices by 3.5%, and as a result expects a decrease in sales volume of 14%. All other operating expenses are expected to remain constant. Assume that cost of goods sold is a variable cost and that operating expenses are a fixed cost. What is budgeted sales for 2024?arrow_forwardcan you solve this pease ?arrow_forward

- At January 1, 2022, Oriole Company has beginning inventory of 3000 surfboards. Oriole estimates it will sell 11000 units during the first quarter of 2022 with a 10% increase in sales each for the following quarters. Oriole's policy is to maintain an ending finished goods inventory equal to 25% of the next quarter's sales. Each surfboard costs $100 and is sold for $155. What is the budgeted sales revenue for the third quarter of 2022 $2247500 $2063050 $13310 5542500arrow_forwardThe Martin Company expects its total sales in the first quarter of 2024 will be $200,000 . Martin estimates that , in each subsequent quarter , total sales will increase by 10 % of the sales in the immediately preceding quarter . Martin estimates that 60 % of each quarter's sales will be on account , and 40 % will be for cash . Of the amount on account , 75% will be collected in the same quarter the sale occurred , and 25 % will be collected in the following quarter . Assume Martin will have no accounts receivable at the beginning of 2024. The balance in the Accounts Receivable account at the end of the third quarter is expected to be: $42,000 $ 30,000 $36,300 $ 60,000 $108,900arrow_forwardNarai Co. has a desired ending inventory of 30% of the next months forecasted sales. In turn, their cost of goods sold is 60%, and their forecasted sales for the months of March, April, May, June, and July are as follows: $750,000, $880,000, $700,000, $800,000, and $900,000 respectively. Purchases for the months of February and March were $500,000 and $360,000 and their purchases are paid as follows: 10% during the month of the purchase 80% in the next month and the final 10% in the next month. Required: Prepare budget schedules for the months of April, May, and June for required purchases and also for disbursements for purchases.arrow_forward

- A shirt manufacturing company expects to be able to sell 15,000 shirts in April 2022. Sales volumes are expected to grow at 5% per month cumulatively thereafter throughout 2022. The following additional information is available. 1. The company intends to carry a stock of finished garments sufficient to meet 40% of the next month's sales. 2. The company intends to carry sufficient raw material stock to meet the following month's production. 3.Estimated costs and revenues per shirt are as follows: Sales price Per shirt K 30 Raw materials Fabric at K12 per square metre (12) Dyes and cotton Direct labour at K8 per hour Fixed overheads at K4 per hour Profit (3) (4) (2) K9 Required: Prepare the following budgets on a monthly basis for each of the three months July to September 2022: (i) A sales budget showing sales units and sales revenue; (ii) A production budget (in units); (iii) A fabric purchases budget (in square metres). (iv) Labour hours and cost budgetarrow_forwardConcord Company estimates that 2022 sales will be $34,400 in quarter 1, $41,280 in quarter 2, and $49,880 in quarter 3. Cost of goods sold is 50% of sales. Management desires to have ending merchandise inventory equal to 10% of the next quarter's expected cost of goods sold. Prepare a merchandise purchases budget by quarter for the first 6 months of 2022. v: v ✓ CONCORD COMPANY Merchandise Purchases Budget $ $ 1 Quarter $ $ 2 $ Six Monthsarrow_forwardTurney Company produces and sells automobile batteries, the heavy-duty HD-240. The 2017 sales forecast is as follows. Quarter HD-240 1 5,100 2 7,320 3 8,280 4 10,430 The January 1, 2017, inventory of HD-240 is 2,040 units. Management desires an ending inventory each quarter equal to 40% of the next quarter’s sales. Sales in the first quarter of 2018 are expected to be 25% higher than sales in the same quarter in 2017.Prepare quarterly production budgets for each quarter and in total for 2017. TURNEY COMPANYProduction Budgetchoose the accounting period Product HD-240 Quarter 1 2 3 4 Year select an opening Production Budget item Enter a number of units Enter a number of units Enter a number of units Enter a number of units select between addition and deduction…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education