FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

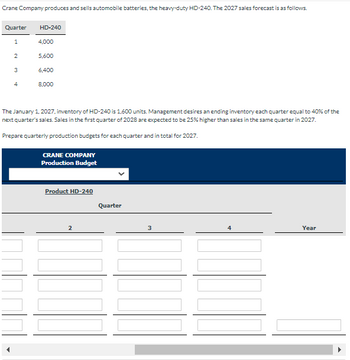

Transcribed Image Text:Crane Company produces and sells automobile batteries, the heavy-duty HD-240. The 2027 sales forecast is as follows.

Quarter HD-240

1

4,000

2

5,600

3

6,400

4

8,000

The January 1, 2027, inventory of HD-240 is 1,600 units. Management desires an ending inventory each quarter equal to 40% of the

next quarter's sales. Sales in the first quarter of 2028 are expected to be 25% higher than sales in the same quarter in 2027.

Prepare quarterly production budgets for each quarter and in total for 2027.

CRANE COMPANY

Production Budget

Product HD-240

Quarter

2

3

4

Year

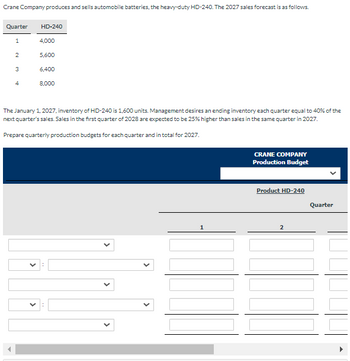

Transcribed Image Text:Crane Company produces and sells automobile batteries, the heavy-duty HD-240. The 2027 sales forecast is as follows.

Quarter

HD-240

1

4,000

2

5,600

3

6,400

4

8,000

The January 1, 2027, inventory of HD-240 is 1,600 units. Management desires an ending inventory each quarter equal to 40% of the

next quarter's sales. Sales in the first quarter of 2028 are expected to be 25% higher than sales in the same quarter in 2027.

Prepare quarterly production budgets for each quarter and in total for 2027.

CRANE COMPANY

Production Budget

Product HD-240

1

2

Quarter

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Products A and B are manufactured in a department. Sales for the year 2020 were planned as follows: (In Units) Product Quarter 1 Quarter 2 Quarter 3 Quarter 4 A 5000 7000 10000 8000 4000 6000 8000 5000 Selling price were OMR 10 per unit for A and OMR 20 per unit for B respectively. Average sales return are 10% of Sales and there is 20% increase in selling price every quarter. According to these revised estimates, which of the following is estimated Sales (OMR) in Quarter 4 for Product B? Select one: O a. OMR 124416 O b. OMR 155520 O c. None of the option O d. OMR 100000arrow_forwardPaddle Up, a retailer of paddle boards, has provided you with the following information: Budgeted Sales (units) February 2022 150 March 2022 110 April 2022 70 a) Paddle Up sells each board for $400 and purchases each board for $250. b) Paddle Up plans to maintain inventory on hand at the end of each month to be 20% of next month's sales volume. You can assume this to be the situation at the end of January 2022. c) 40% of sales are made on cash basis with the remaining 60% - on credit. All credit sales are collected in the month following the sale. d) 50% of inventory purchases are made on cash basis with the remaining 50% - on credit. All credit purchases are paid in the month following the purchase. e) The following cash expenses are incurred on a monthly basis: Rent ($5,300); Wages ($5,400); Utilities ($2,100); Insurance ($600). The business also recognises $3,000 of depreciation expense each month. f) The monthly drawings by the owner Paddle Up include: $2,000 cash and 1 board for…arrow_forwardViolet Sales Corp, reports the year-end information from 2023 as follows: Sales (35,500 units) $284,000 Cost of goods sold 105,000 Gross margin 179,000 Operating expenses 152,000 Operating income $27,000 Violet is developing the 2024 budget. In 2024 the company would like to increase selling prices by 3.5%, and as a result expects a decrease in sales volume of 14%. All other operating expenses are expected to remain constant. Assume that cost of goods sold is a variable cost and that operating expenses are a fixed cost. What is budgeted sales for 2024?arrow_forward

- Al-Morooj Co. has the following sales forecasts for its hip waders next year: First Quarter 11000 units Second Quarter 4% increase over first quarter Third Quarter 8% decrease from first quarter Fourth Quarter 4% decrease over first quarter Required: Calculate the Al-Morooj's estimated sales in units for next year.arrow_forwardCalculate the annual economic order quantity from the attached provided belowarrow_forwardAt January 1, 2022, Oriole Company has beginning inventory of 3000 surfboards. Oriole estimates it will sell 11000 units during the first quarter of 2022 with a 10% increase in sales each for the following quarters. Oriole's policy is to maintain an ending finished goods inventory equal to 25% of the next quarter's sales. Each surfboard costs $100 and is sold for $155. What is the budgeted sales revenue for the third quarter of 2022 $2247500 $2063050 $13310 5542500arrow_forward

- The Martin Company expects its total sales in the first quarter of 2024 will be $200,000 . Martin estimates that , in each subsequent quarter , total sales will increase by 10 % of the sales in the immediately preceding quarter . Martin estimates that 60 % of each quarter's sales will be on account , and 40 % will be for cash . Of the amount on account , 75% will be collected in the same quarter the sale occurred , and 25 % will be collected in the following quarter . Assume Martin will have no accounts receivable at the beginning of 2024. The balance in the Accounts Receivable account at the end of the third quarter is expected to be: $42,000 $ 30,000 $36,300 $ 60,000 $108,900arrow_forwardA June sales forecast projects that 8,000 units are going to be sold at a price of $11.00 per unit. The desired ending inventory of units is 12% higher than the beginning inventory of 900 units. Merchandise purchases for June are projected to include how many units? O 8,000 units O 8,108 units O 7,892 units O 9,008 units O 8,450 unitsarrow_forwardA shirt manufacturing company expects to be able to sell 15,000 shirts in April 2022. Sales volumes are expected to grow at 5% per month cumulatively thereafter throughout 2022. The following additional information is available. 1. The company intends to carry a stock of finished garments sufficient to meet 40% of the next month's sales. 2. The company intends to carry sufficient raw material stock to meet the following month's production. 3.Estimated costs and revenues per shirt are as follows: Sales price Per shirt K 30 Raw materials Fabric at K12 per square metre (12) Dyes and cotton Direct labour at K8 per hour Fixed overheads at K4 per hour Profit (3) (4) (2) K9 Required: Prepare the following budgets on a monthly basis for each of the three months July to September 2022: (i) A sales budget showing sales units and sales revenue; (ii) A production budget (in units); (iii) A fabric purchases budget (in square metres). (iv) Labour hours and cost budgetarrow_forward

- Two products X and Z are manufactured in a department. Sales for the year 2022 were planned as follows: Product Quarter 1 Quarter 2 Quarter 3 Quarter 4 X 8000 10000 11000 14000 Z 6000 8000 7500 5500 Selling prices in Quarter 1 were estimated as OMR 20 per unit for X and OMR 30 for Z respectively. Average sales return are 5% of Sales and 10% decrease in selling price in each quarter compared to previous one. According to these estimates, which of the following is estimated Sales (OMR) in Quarter 4 for Product X? Select one: a. 266000 b. 159600 c. 185600 d. 193914arrow_forwardTurney Company produces and sells automobile batteries, the heavy-duty HD-240. The 2017 sales forecast is as follows. Quarter HD-240 1 5,100 2 7,320 3 8,280 4 10,430 The January 1, 2017, inventory of HD-240 is 2,040 units. Management desires an ending inventory each quarter equal to 40% of the next quarter’s sales. Sales in the first quarter of 2018 are expected to be 25% higher than sales in the same quarter in 2017.Prepare quarterly production budgets for each quarter and in total for 2017. TURNEY COMPANYProduction Budgetchoose the accounting period Product HD-240 Quarter 1 2 3 4 Year select an opening Production Budget item Enter a number of units Enter a number of units Enter a number of units Enter a number of units select between addition and deduction…arrow_forwardSales in December (2019) were 4000 units @ sar10 per unit. Monthly sales for the first four months of the next year (2020) are forecasted as follows: Months units January 5,000 February 8,000 March 6, 000 April 5, 000 Unit selling price SAR 10 The following information given to you as follows: Normally 60% of sales are collected in the month incurred and the remainders are collected in the month following the sales. Dallah groups wants closing stock equals 10% of the following month’s budgeted sales in units. on December 31 st , 400 units were on hand. Material required for the required production units are 3,500 Mts , 4,500 Mts., and 6,500 Mts.…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education