FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Transcribed Image Text:unts

*

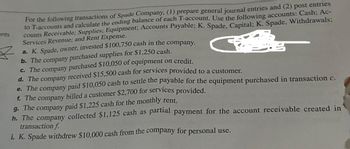

For the following transactions of Spade Company, (1) prepare general journal entries and (2) post entries

to T-accounts and calculate the ending balance of each T-account. Use the following accounts: Cash; Ac-

counts Receivable; Supplies; Equipment; Accounts Payable; K. Spade, Capital; K. Spade, Withdrawals;

Services Revenue; and Rent Expense.

a. K. Spade, owner, invested $100,750 cash in the company.

b. The company purchased supplies for $1,250 cash.

c. The company purchased $10,050 of equipment on credit.

d. The company received $15,500 cash for services provided to a customer.

e. The company paid $10,050 cash to settle the payable for the equipment purchased in transaction c.

f. The company billed a customer $2,700 for services provided.

g. The company paid $1,225 cash for the monthly rent.

h. The company collected $1,125 cash as partial payment for the account receivable created in

transaction f.

i. K. Spade withdrew $10,000 cash from the company for personal use.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Required information [The following information applies to the questions displayed below] The following transactions apply to Jova Company for Year 1, the first year of operation. 1. Issued $20,000 of common stock for cash. 2. Recognized $60,000 of service revenue earned on account. 3. Collected $54,000 from accounts receivable. 4. Paid operating expenses of $37,800. 5. Adjusted accounts to recognize uncollectible accounts expense. Jova uses the allowance method of accounting for uncollectible accounts and estimates that uncollectible accounts expense will be 2 percent of sales on account. The following transactions apply to Jova for Year 2 1. Recognized $67,500 of service revenue on account. 2. Collected $62,000 from accounts receivable: 3. Determined that $800 of the accounts receivable were uncollectible and wrote them off 4. Collected $300 of an account that had previously been written off. 5. Paid $47,500 cash for operating expenses. 6. Adjusted the accounts to recognize…arrow_forwardThe following T-account is a summary of the Cash account of Lily Company. Cash (Summary Form) Balance, Jan. 1 Receipts from customers Dividends on stock investments Proceeds from sale of equipment Proceeds from issuance of bonds payable Balance, Dec. 31 Net cash 7,400 368,400 Payments for goods 297,800 6,200 Payments for operating expenses 140,700 36,900 Interest paid 11,200 Taxes paid 499,700 Dividends paid 400,700 8,300 What amount of net cash provided (used) by financing activities should be reported in the statement of cash flows? (Show amount that decrease cash flow with either a-sign e.g. -15,000 or in parenthesis e.g. (15,000).) provided by financing activities $ 59,900arrow_forwardYard Professionals Incorporated experienced the following events in Year 1, its first year of operation: 1. Performed services for $26,000 cash. 2. Purchased $4,800 of supplies on account. 3. A physical count on December 31, Year 1, found that there was $1,040 of supplies on hand. Required: Based on this information alone: a. Record the events under an accounting equation. b. Prepare an income statement, balance sheet, and statement of cash flows for the Year 1 accounting per c. What is the balance in the Supplies account as of January 1, Year 2? d. What is the balance in the Supplies Expense account as of January 1, Year 2? Complete this question by entering your answers in the tabs below. Req A Req B1 Income statement Event Req B2 Balance sheet 1. Provided service 2. Purchased supplies 3. Used supplies Totals Record the events under an accounting equation. Note: Not all cells require input. Enter any decreases to account balances with a minus sign. Req B3 Statement of cash flows Cash…arrow_forward

- A Required information [The following information applies to the questions displayed below.] Required: 1. Prepare general journal entries to record the transactions of Spade Company by using the following accounts: Cash; Receivable; Supplies; Equipment, Accounts Payable; Common Stock; Dividends; Services Revenue; and Rent Expense 2. Post entries to T-accounts and the ending balances will be calculated. @ The transactions of Spade Company appear below. a. Kacy Spade, owner, invested $11,500 cash in the company in exchange for common stock. b. The company purchased supplies for $334 cash. c. The company purchased $6,360 of equipment on credit. d. The company received $1,357 cash for services provided to a customer. e. The company paid $6,360 cash to settle the payable for the equipment purchased in transaction c. f. The company billed a customer $2,438 for services provided. g. The company paid $530 cash for the monthly rent. h. The company collected $1,02Tash as partial payment for the…arrow_forwardThe following T-account is a summary of the Cash account of Pharoah Company. Cash (Summary Form) Balance, Jan. 1 8,500 Receipts from customers 362,500 | Payments for goods 255,900 Dividends on stock investments 6,800 | Payments for operating expenses 140,600 Proceeds from sale of equipment 36,400 | Interest paid 11,700 Proceeds from issuance of bonds payable 499,400 | Taxes paid 7,200 Dividends paid 59,900 Balance, Dec. 31 438,300 What amount of net cash provided (used) by financing activities should be reported in the statement of cash flows? (Show amount that decrease cash flow with either a - sign e.g. -15,000 or in parenthesis e.g. (15,000).) Net cash * by financing activities $arrow_forwardShow all your workings.arrow_forward

- The following selected financial data is available for Sneasle Company: Cash $20,000 Accounts receivable 13,400 Equipment 10,650 Prepaid expenses 5,000 Accounts payable 12,300 Unearned revenue 7,500 Long-term notes payable 10,000 Common stock 18,000 Revenue 11,700 Sales tax payable 6,000 Interest expense 4,500 Depreciation expense 1,000 What is the amount of the company's current assets? Group of answer choices $33,400 $47,800 $49,050 $38,400arrow_forwardRequired information [The following information applies to the questions displayed below.] The transactions of Spade Company appear below. a. K. Spade, owner, invested $19,750 cash in the company in exchange for common stock. b. The company purchased supplies for $573 cash. c. The company purchased $10,922 of equipment on credit. d. The company received $2,331 cash for services provided to a customer. e. The company paid $10,922 cash to settle the payable for the equipment purchased in transaction c. f. The company billed a customer $4,187 for services provided. g. The company paid $510 cash for the monthly rent. h. The company collected $1,759 cash as partial payment for the account receivable created in transaction f. i. The company paid a $1,100 cash dividend to the owner (sole shareholder). Required: 1. Prepare general journal entries to record the transactions of Spade Company by using the following accounts: Cash; Accounts Receivable; Supplies; Equipment; Accounts Payable; Common…arrow_forwardMake a t chart(balancing) Asset, Liabilty, and equityarrow_forward

- The following transactions were completed by the company: a. The owner invested $17,600 cash in the company. b. The company purchased supplies for $1,150 cash. c. The owner invested $11,300 of equipment in the company in exchange for more common stock. d. The company purchased $330 of additional supplies on credit. e. The company purchased land for $10,300 cash. Required: Enter the impact of each transaction on individual items of the accounting equation. Note: Enter decreases to account balances with a minus sign. a. b. Balance after a and b C. Transactions Number Balance after c d. Balance after d e. Balance after e Cash 0 0 + 0 + + + + + + 0 + + Assets Supplies 0 0 + Equipment + 0 + + + 0 + + + + + + 0 0 + 0 + + + + 0 + + + Land 0 0 = II 0 11 11 11 0 = 11 || 11 || Liabilities + Accounts Payable 0 + + 0 + + + 0 + + 0 + + + Common Stock 0 0 0 0 I - - 1 I 1 Equity Dividends 0 + 0 + + + + 0 + + + + 0 + Revenue 0 0 0 0 - T - I I F Expenses 0 0 0 0arrow_forwardAnswer only.arrow_forwardNo single ratio can predict the success or Failure of a company. What different types of Ratios are necessary for financial analysis? How is the Return on Assets (ROA) Ratio Calculated?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education