FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

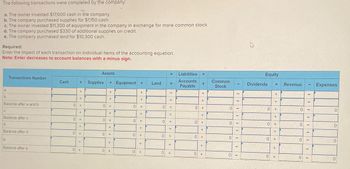

Transcribed Image Text:The following transactions were completed by the company:

a. The owner invested $17,600 cash in the company.

b. The company purchased supplies for $1,150 cash.

c. The owner invested $11,300 of equipment in the company in exchange for more common stock.

d. The company purchased $330 of additional supplies on credit.

e. The company purchased land for $10,300 cash.

Required:

Enter the impact of each transaction on individual items of the accounting equation.

Note: Enter decreases to account balances with a minus sign.

a.

b.

Balance after a and b

C.

Transactions Number

Balance after c

d.

Balance after d

e.

Balance after e

Cash

0

0

+

0

+

+

+

+

+

+

0 +

+

Assets

Supplies

0

0

+ Equipment +

0

+

+

+

0 +

+

+

+

+

+

0

0

+

0

+

+

+

+

0 +

+

+

Land

0

0

=

II

0

11

11

11

0 =

11

||

11

||

Liabilities +

Accounts

Payable

0

+

+

0

+

+

+

0 +

+

0 +

+

+

Common

Stock

0

0

0

0

I

-

-

1

I

1

Equity

Dividends

0

+

0

+

+

+

+

0 +

+

+

+

0 +

Revenue

0

0

0

0

-

T

-

I

I

F

Expenses

0

0

0

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- General entry please...arrow_forwardThe transactions of Spade Company appear below. Kacy Spade, owner, invested $18,250 cash in the company in exchange for common stock. The company purchased office supplies for $529 cash. The company purchased $10,092 of office equipment on credit. The company received $2,153 cash as fees for services provided to a customer. The company paid $10,092 cash to settle the payable for the office equipment purchased in transaction c. The company billed a customer $3,869 as fees for services provided. The company paid $530 cash for the monthly rent. The company collected $1,625 cash as partial payment for the account receivable created in transaction f. The company paid $900 cash in dividends to the owner (sole shareholder). Required: 1. Prepare general journal entries to record the transactions above for Spade Company by using the following accounts: Cash; Accounts Receivable; Office Supplies; Office Equipment; Accounts Payable; Common Stock; Dividends; Fees Earned; and Rent Expense. Use the…arrow_forwardUse the following information for Exercises 13-14 below. (Algo) Skip to question [The following information applies to the questions displayed below.]The transactions of Spade Company appear below. K. Spade, owner, invested $11,250 cash in the company in exchange for common stock. The company purchased supplies for $326 cash. The company purchased $6,221 of equipment on credit. The company received $1,328 cash for services provided to a customer. The company paid $6,221 cash to settle the payable for the equipment purchased in transaction c. The company billed a customer $2,385 for services provided. The company paid $530 cash for the monthly rent. The company collected $1,002 cash as partial payment for the account receivable created in transaction f. The company paid a $1,000 cash dividend to the owner (sole shareholder). Exercise 2-13 (Algo) Recording effects of transactions in T-accounts LO A1 Required:1. Prepare general journal entries to record the transactions of…arrow_forward

- The transactions of Spade Company appear below. K. Spade, owner, invested $14,500 cash in the company. The company purchased supplies for $421 cash. The company purchased $8,019 of equipment on credit. The company received $1,711 cash for services provided to a customer. The company paid $8,019 cash to settle the payable for the equipment purchased in transaction c. The company billed a customer $3,074 for services provided. The company paid $530 cash for the monthly rent. The company collected $1,291 cash as partial payment for the account receivable created in transaction f. K. Spade withdrew $1,200 cash from the company for personal use Post entries to T-accounts and the ending balances will be calculated. please complete answer with complete work answer in textarrow_forwardYou have just been hired as a financial analyst for Lydex Company, a manufacturer of safety helmets. Your boss has asked you to perform a comprehensive analysis of the company's financial statements, including comparing Lydex's performance to its major competitors. The company's financial statements for the last two years are as follows: Assets Current assets: Cash Marketable securities Accounts receivable, net Inventory Prepaid expenses Total current assets Plant and equipment, net Total assets Lydex Company Comparative Balance Sheet This Year Last Year $ 940,000 0 Liabilities and Stockholders' Equity Liabilities: Current liabilities Note payable, 10% Total liabilities Stockholders' equity: Common stock, $75 par value Retained earnings Total stockholders' equity Total liabilities and stockholders' equity Lydex Company 2,620,000 3,580,000 250,000 7,390,000 9,480,000 $ 16,870,000 $ 3,990,000 3,660,000 7,650,000 7,500,000 1,720,000 9,220,000 $ 16,870,000 $ 1,180,000 300,000 1,720,000…arrow_forwardConsider the following transactions for Julianne Corporation: a. Issue common stock for $15,000. b. Purchase equipment for $11,400 cash. c. Pay employees' salaries of $3,800. d. Provide services to customers for $6,800 cash. 1. Post the beginning Cash balance of $4,000 and then post the above transactions. 2. Calculate the ending balance of the Cash account. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Post these transactions to the Cash T-account. Assume the balance of Cash before these transac Beginning Balance Debit Cash Creditarrow_forward

- Practice help, please.arrow_forwardGive me three steps solution and explanationarrow_forwardLexington Company engaged in the following transactions during Year 1, its first year of operations. (Assume all transactions are cash transactions.) 1) Acquired $4,600 cash from issuing common stock. 2) Borrowed $3,000 from a bank. 3) Earned $3,900 of revenues. 4) Incurred $2,560 in expenses. 5) Paid dividends of $560. Lexington Company engaged in the following transactions during Year 2: 1) Acquired an additional $1,300 cash from the issue of common stock. 2) Repaid $1,860 of its debt to the bank. 3) Earned revenues, $5,300. 4) Incurred expenses of $3,070. 5) Paid dividends of $1,600. Total liabilities on Lexington's balance sheet at the end of Year 1 equal:arrow_forward

- Could you please help Me with this question?arrow_forwardThe following transactions were completed by the company: The owner invested $15,000 cash in the company in exchange for its common stock. The company purchased supplies for $500 cash. The owner invested $10,000 of equipment in the company in exchange for more common stock. The company purchased $200 of additional supplies on credit. The company purchased land for $9,000 cash. Required:Enter the impact of each transaction on individual items of the accounting equation. (Enter decreases to account balances with a minus sign.)arrow_forward[The following information applies to the questions displayed below.] The transactions of Spade Company appear below. a. K. Spade, owner, invested $19,250 cash in the company. b. The company purchased supplies for $558 cash. c. The company purchased $10,645 of equipment on credit. d. The company received $2,272 cash for services provided to a customer. e. The company paid $10,645 cash to settle the payable for the equipment purchased in transaction c. f. The company billed a customer $4,081 for services provided. g. The company paid $535 cash for the monthly rent. h. The company collected $1,714 cash as partial payment for the account receivable created in transaction f. 1. K. Spade withdrew $1,100 cash from the company for personal use. equired: 1. Prepare general journal entries to record the transactions of Spade Company by using the following accounts: Cash; Accounts Receivable; Supplies; Equipment; Accounts Payable; K. Spade, Capital; K. Spade, Withdrawals; Services Revenue; and…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education