FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Troy Engines, Ltd., manufactures a variety of engines for use in heavy equipment. The company has always produced all of the

necessary parts for its engines, including all of the carburetors. An outside supplier has offered to sell one type of carburetor to Troy

Engines, Ltd., for a cost of $39 per unit. To evaluate this offer, Troy Engines, Ltd., has gathered the following information relating to its

own cost of producing the carburetor internally:

21,000

Units

Per

Per

Unit

Year

$ 378,000

231,000

63,000

63,000

Direct materials

18

Direct labor

11

Variable manufacturing overhead

Fixed manufacturing overhead, traceable

Fixed manufacturing overhead, allocated

3

3*

6.

126,000

$ 861,000

Total cost

$

41

*One-third supervisory salaries; two-thirds depreciation of special equipment (no resale value).

Required:

1. Assuming the company has no alternative use for the facilities that are now being used to produce the carburetors, what would be

the financial advantage (disadvantage) of buying 21,000 carburetors from the outside supplier?

2. Should the outside supplier's offer be accepted?

3. Suppose that if the carburetors were purchased, Troy Engines, Ltd., could use the freed capacity to launch a new product. The

segment margin of the new product would be $210,000 per year. Given this new assumption, what would be the financial advantage

(disadvantage) of buying 21,000 carburetors from the outside supplier?

4. Given the new assumption in requirement 3, should the outside supplier's offer be accepted?

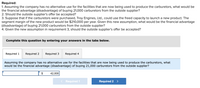

Transcribed Image Text:Required:

1. Assuming the company has no alternative use for the facilities that are now being used to produce the carburetors, what would be

the financial advantage (disadvantage) of buying 21,000 carburetors from the outside supplier?

2. Should the outside supplier's offer be accepted?

3. Suppose that if the carburetors were purchased, Troy Engines, Ltd., could use the freed capacity to launch a new product. The

segment margin of the new product would be $210,000 per year. Given this new assumption, what would be the financial advantage

(disadvantage) of buying 21,000 carburetors from the outside supplier?

4. Given the new assumption in requirement 3, should the outside supplier's offer be accepted?

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Required 3

Required 4

Assuming the company has no alternative use for the facilities that are now being used to produce the carburetors, what

would be the financial advantage (disadvantage) of buying 21,000 carburetors from the outside supplier?

$

42,000

< Required 1

Required 2

<>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Boston Executive, Inc., produces executive limousines and currently manufactures the mini-bar inset at these costs: Cost per Unit Variable costs Direct material Direct labor Variable overhead Total variable costs Fixed costs: Variable Costs Direct material Direct labor Variable overhead Depreciation of equipment Depreciation of building Supervisors salaries Total fixed costs Total cost The company received an offer from Elite Mini-Bars to produce the insets for $2,120 per unit and supply 1,100 mini-bars for the coming year's estimated production. If the company accepts this offer and shuts down production of this part of the business, production workers and supervisors will be reassigned to other areas. Assume that for the short-term decision-making process demonstrated in this problem, the company's total labor costs (direct labor and supervisor salaries) will remain the same if the bar inserts are purchased. Fixed Costs Equipment depreciation Building depreciation The specialized…arrow_forwardsolve both 1 and 2arrow_forwardTroy Engines, Limited, manufactures a variety of engines for use in heavy equipment. The company has always produced all of the necessary parts for its engines, including all of the carburetors. An outside supplier has offered to sell one type of carburetor to Troy Engines, Limited, for a cost of $35 per unit. To evaluate this offer, Troy Engines, Limited, has gathered the following information relating to its own cost of producing the carburetor internally: Per 15,000 Units Unit Per Year Direct materials $ 14 $ 210,000 Direct labor 10 150,000 Variable manufacturing overhead 11 3 45,000 Fixed manufacturing overhead, traceable 6* 90,000 Fixed manufacturing overhead, allocated 9 135,000 Total cost $ 42 $630,000 *One-third supervisory salaries; two-thirds depreciation of special equipment (no resale value). Required: 1. Assuming the company has no alternative use for the facilities that are now being used to produce the carburetors, what would be the financial advantage (disadvantage) of…arrow_forward

- Troy Engines, Limited, manufactures a variety of engines for use in heavy equipment. The company has always produced all of the necessary parts for its engines, including all of the carburetors. outside supplier has offered to sell one type of carburetor to Troy Engines, Limited, for a cost of $40 per unit. To evaluate this offer, Troy Engines, Limited, has gathered the following information relating to its own cost of producing the carburetor internally: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead, traceable Fixed manufacturing overhead, allocated 12 Total cost $ 50 *One-third supervisory salaries; two-thirds depreciation of special equipment (no resale value). Per Unit $18. 9 2 9* Required: 1. Assuming the company has no alternative use for the facilities that are now being used to produce the carburetors, what would be the financial advantage (disadvantage) of buying 18,000 carburetors from the outside supplier? 2. Should the outside…arrow_forwardInteliSystems manufactures an optical switch that it uses in its final product. InteliSystems incurred the following manufacturing costs when it produced 70,000 units last year as shown in the chart below: InteliSystems does not yet know how many switches it will need this year; however, another company has offered to sell InteliSystems the switch for $8.50 per unit. If InteliSystems buys the switch from the outside supplier, the manufacturing facilities that will be idle cannot be used for any other purpose; yet none of the fixed costs are avoidable. Requirements 1. Given the same cost structure, should InteliSystems make or buy the switch? Show your analysis. 2. Now, assume that InteliSystems can avoid $105,000 of fixed costs a year by outsourcing production. In addition, because sales are increasing, InteliSystems needs 75,000 switches a year rather than 70,000 switches. What should the company do now? 3. Given the last scenario, what is the most InteliSystems would be willing to…arrow_forwardPlease do not give image formatarrow_forward

- Troy Engines, Limited, manufactures a variety of engines for use in heavy equipment. The company has always produced all of the parts for its engines, including the carburetors. An outside supplier offered to sell one type of carburetor to Troy Engines, Limited, for a cost of $35 per unit. To evaluate this offer, Troy Engines, Limited, summarized the cost of producing the carburetor internally as follows: Per Unit 15,000 Units Per Year Direct materials $ 14 $ 210,000 Direct labor 10 150,000 Variable manufacturing overhead 3 45,000 Fixed manufacturing overhead, traceable 6* 90,000 Fixed manufacturing overhead, allocated 9 135,000 Total cost $ 42 $ 630,000 *One-third supervisory salaries; two-thirds depreciation of special equipment (no resale value). Required: If the company has no alternative use for the facilities being used to produce the carburetors, what would be the financial advantage (disadvantage) of buying 15,000 carburetors from the outside supplier?…arrow_forwardMunoz Company makes and sells lawn mowers for which it currently makes the engines. It has an opportunity to purchase the engines from a reliable manufacturer. The annual costs of making the engines are shown here. Cost of materials (13,100 Units × $19) $ 248,900 Labor (13,100 Units × $12) 157,200 Depreciation on manufacturing equipment* 25,000 Salary of supervisor of engine production 69,000 Rental cost of equipment used to make engines 27,000 Allocated portion of corporate-level facility-sustaining costs 82,000 Total cost to make 13,100 engines $ 609,100 *The equipment has a book value of $108,000 but its market value is zero.Required Determine the maximum price per unit that Munoz would be willing to pay for the engines. Determine the maximum price per unit that Munoz would be willing to pay for the engines, if production increased to 18,650 units. (For all requirements, Round your answers to 2 decimal places.)arrow_forwardCorrigan Enterprises is studying the acquisition of two electrical component insertion systems for producing its sole product, the universal gismo. Data relevant to the systems follow. Model number 6754: Variable costs, $16.00 per unit Annual fixed costs, $986,300 Model number 4399: Variable costs, $11.80 per unit Annual fixed costs, $1,114,300 Corrigan's selling price is $66 per unit for the universal gismo, which is subject to a 15 percent sales commission. (In the following requirements, ignore income taxes.) 2-a. Calculate the net income of the two systems if sales and production are expected to average 63,400 units per year. Model Number 6754 Model Number 4399 Net Incomearrow_forward

- Waterway Engine Incorporated produces engines for the watercraft industry. An outside manufacturer has offered to supply several component parts used in the engine assemblies, which are currently being produced by Waterway. The supplier will charge Waterway $315 per engine for the set of parts. Waterway's current costs for those part sets are direct materials, $140; direct labor, $80; and manufacturing overhead applied at 100% of direct labor. Variable manufacturing overhead is considered to be 20% of the total, and fixed overhead will not change if the part sets are acquired from the outside supplier. Required: a. What would be the net cost advantage or disadvantage if Waterway decided to purchase the parts? b. Should Waterway Engine continue to make the part sets or accept the offer to purchase them for $315? a. b. Waterway Engine Incorporated shouldarrow_forwardRiverbed Company manufactures equipment. Riverbed's products range from simple automated machinery to complex systems containing numerous components. Unit selling prices range from $ 200,000 to $ 1,500,000 and are quoted inclusive of installation. The installation process does not involve changes to the features of the equipment and does not require proprietary information about the equipment in order for the installed equipment to perform to specifications. Riverbed has the following arrangement with Winkerbean Inc. Winkerbean purchases equipment from Riverbed fora price of $ 1,100,000 and contracts with Riverbed to install the equipment. Riverbed charges the same price for the equipment irrespective of whether it does the installation or not. Using market data, Riverbed determines installation service is estimated to have a standalone selling price of $ 46,000. The cost of the equipment is $ 580,000. Winkerbean is obligated to pay Riverbed the $ 1,100,000 upon the delivery and…arrow_forwardIn its production process, Purple Tree Inc uses a specialized part in the manufacturing of their fancy widget. The costs to make a part are: direct material, $15; direct labor, $27; variable overhead, $15; and applied fixed overhead, $32. Purple Tree has received a quote of $60 from a potential supplier for this part. If Purple Tree buys the part, 75 percent of the applied fixed overhead would continue. They need 12,000 units of the specialized part. Purple Tree Company would be better off by Group of answer choices $60,000 to buy the part. $348,000 to buy the part. $30,000 to manufacture the part. $216,000 to manufacture the part.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education