FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

answer in text form please (without image)

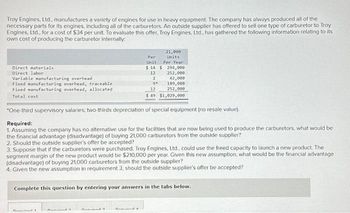

Transcribed Image Text:Troy Engines, Ltd., manufactures a variety of engines for use in heavy equipment. The company has always produced all of the

necessary parts for its engines, including all of the carburetors. An outside supplier has offered to sell one type of carburetor to Troy

Engines, Ltd., for a cost of $34 per unit. To evaluate this offer, Troy Engines, Ltd., has gathered the following information relating to its

own cost of producing the carburetor internally.

Direct materials

Direct labor

Variable manufacturing overhead

Fixed manufacturing overhead, traceable

Fixed manufacturing overhead, allocated

Total cost

Damiland 1

Per

Unit

Band

$14

*One-third supervisory salaries; two-thirds depreciation of special equipment (no resale value).

Required:

1. Assuming the company has no alternative use for the facilities that are now being used to produce the carburetors, what would be

the financial advantage (disadvantage) of buying 21,000 carburetors from the outside supplier?

Domiend 2

12

2

94

2. Should the outside supplier's offer be accepted?

3. Suppose that if the carburetors were purchased, Troy Engines, Ltd., could use the freed capacity to launch a new product. The

segment margin of the new product would be $210,000 per year. Given this new assumption, what would be the financial advantage

(disadvantage) of buying 21,000 carburetors from the outside supplier?

4. Given the new assumption in requirement 3, should the outside supplier's offer be accepted?

Bind

21,000

Units

Per Year

$294,000

252,000

42,000

189,000

252,000

Complete this question by entering your answers in the tabs below.

12

$ 49 $1,029,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- How do you make a two-dimensional columnar chart in excel?arrow_forwardAutoSave Off H Document2 - Word P Search (Alt+Q) Sign in File Design References Mailings Review View Help Grammarly Picture Format P Comments A Share Home Insert Draw Layout P Find - - A A Aa v A = - E - E G Times New Roman v 12 Normal No Spacing Heading 1 Replace = = 1E v Editor Open Grammarly Paste BIU I U v - 2. A - ab x, x' A . A Select v Undo Clipboard a Font Paragraph Styles Editing Editor Grammarly a. At the beginning of the year, Addison Company's assets are $200,000 and its equity is $150,000. During the year, assets increase $80,000 and liabilities increase $46,000. What is the equity at year-end? Assets Liabilities Equity Beginning $ 200,000 = 150,000 Change 80,000 = 46,000 + Ending Page 1 of 1 O words Text Predictions: On * Accessibility: Good to go O Focus 110% 9:58 PM P Type here to search 49°F 3/20/2022 近arrow_forwardsubject:accunting information system. Q: explainDocument flowcharts and give two examples.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education