FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Assume the perpetual inventory system is used unless stated otherwise. Round all numbers to the nearest whole dollar unless stated otherwise.

Preparing a multi-step income statement and journalizing closing entries

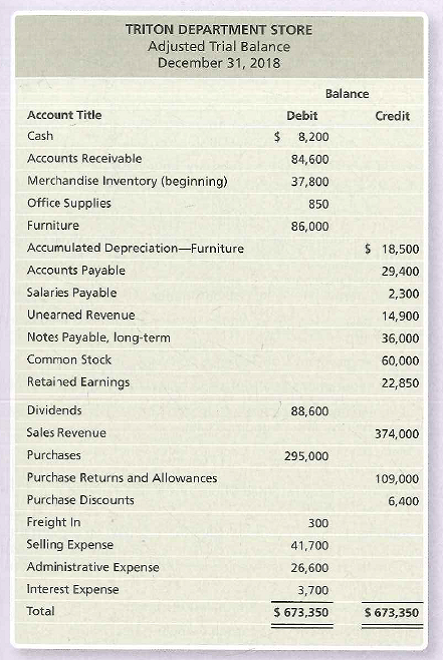

Triton Department Store uses a periodic inventory system. The adjusted

Requirements

- Prepare Triton Department Store’s multi-step income statement for the year ended December 31, 2018. Assume ending Merchandise inventory is $36,300.

- Journalize Triton Department Store’s closing entries.

Transcribed Image Text:TRITON DEPARTMENT STORE

Adjusted Trial Balance

December 31, 2018

Balance

Account Title

Debit

Credit

Cash

$ 8,200

Accounts Receivable

84,600

Merchandise Inventory (beginning)

37,800

Office Supplies

850

Furniture

86,000

Accumulated Depreciation-Furniture

$ 18,500

Accounts Payable

29,400

Salaries Payable

2,300

Unearned Revenue

14,900

Notes Payable, long-term

36,000

Common Stock

60,000

Retained Earnings

22,850

Dividends

88,600

Sales Revenue

374,000

Purchases

295,000

Purchase Returns and Allowances

109,000

Purchase Discounts

6,400

Freight In

300

Selling Expense

41,700

Administrative Expense

26,600

Interest Expense

3,700

Total

$ 673,350

$ 673,350

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 8 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 1. The Pattasar Electric Appliances company uses perpetual inventory system and first-in, first-out (FIFO) method to calculate cost of goods sold and for the ending inventory valuation. The company has made the following purchases and sales during the month of February 2018. Feb. 01: Inventory at the beginning of the month; 24 units @ $1,000 per unit. Feb. 04: Sales: 16 units. Feb. 07: Purchases; 12 units @ $1,020 per unit. Feb. 10: Purchases; 10 units @ $1,050 per unit. Feb. 14: Sales; 16 units. Feb. 23: Sales; 12 units. During the month, all sales have been made @ $1600 per unit. Instruction 1. Compute the cost of goods sold and the cost of inventory in hand at the end of the month of February 2018. 2. Prepare journal entries to record the above transactions under perpetual inventory system.arrow_forwardPrepare the journal entries for the following transactions using the following Inventory methods: 1. Periodic 2. Perpetual Problem: The transactions for the month of June. Use markup on sales of 20% for profit. June 1 Purchased merchandise from Ariva Marketing, list price, P 35,000, trade discount 20% terms: 2/10, n/30, FOB Shipping point, freight prepaid, 1200. June 3 Purchased merchandise from Montage Trading P17,500, terms 2/10, n/30, FOB destination. June 5 Sold merchandise on credit to Alice Enterprise, P6,250, terms: 2/10, n/30, FOB shipping point, freight prepaid, P450. Mark up on sales 20%. June 7 Returned defective merchandise to Montage Trading P1,500. June 9 Sold merchandise to Town Sales Company, P9,750, terms: 1/10, n/30, FOB destination. June 9 Paid freight costs on shipment to Towm Sales Company, P550. June 11 Paid Ariva Marketing, the invoice of June 1 less discount. June 11 Received defective merchandise returned by Town Sales Co., P800. June 11 Paid Montage Trading…arrow_forwardAssume the perpetual inventory system is used unless stated otherwise. Round all numbers to the nearest whole dollar unless stated otherwise. Estimating sales returns On December 31, Jack Photography Supplies estimated that approximately 2% of merchandise sold will be returned. Sales Revenue for the year was $80,000 with a cost of $48,000. Journalize the adjusting entries needed to account for the estimated returns.arrow_forward

- Fill in the blanks for question: Dec. 15: Received a check from Stewart Office Supply for full amount owed on Nov. 15 sale. Transactions with dates are in picture/ screenshot.arrow_forwardMadison Company's perpetual inventory records indicate that $531,630 of merchandise should be on hand on October 31. The physical inventory indicates that $508,250 is actually on hand. Journalize the adjusting entry for the inventory shrinkage for Madison Company for the year ended October 31. If an amount box does not requíre an entry, leave it blank. Oct. 31arrow_forwardBeginning inventory, purchases and sales data for T-shirts are as follows: April 3 Inventory 24 units @ $10 11 Purchase 26 units @ $12 14 Sale 36 units 21 Purchase 18 units @ $15 25 Sale 20 units Assuming the business maintains a periodic inventory system; calculate the cost of merchandise sold and ending inventory under the following assumptions: FIFO LIFO Average cost In your computations, round the average cost per unit to two decimal places and round your final answers to the nearest dollar.arrow_forward

- You have the following information for Tamarisk, Inc. for the month ended October 31, 2022. Tamarisk uses a periodic method for inventory. Date Description Units Unit Cost or Selling Price Oct. 1 Beginning inventory 60 24 Oct. 9 Purchase 115 26 Oct. 11 Sale 95 45 Oct. 17 Purchase 95 27 Oct. 22 Sale 60 50 Oct. 25 Purchase 70 29 Oct. 29 Sale 105 50 A(3) Calculate gross profit rate under each of the following: 1.LIFO 2.FIFO 3. Average-cost. Gross profit rate - LIFO% - FIFO% AND AVERAGE-COST %arrow_forwardThe perpetual inventory records of Penny Co. indicate that $415,000 of merchandise should be on hand on December 31. The physical inventory indicates that $370,000 of merchandise is actually on hand. Journalize the adjusting entry for the inventory shrinkage for the year ended December 31.arrow_forwardPlease make a LIFO chartarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education