SWFT Comprehensive Vol 2020

43rd Edition

ISBN: 9780357391723

Author: Maloney

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

A

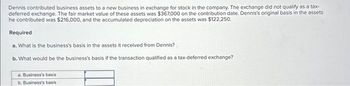

Transcribed Image Text:Dennis contributed business assets to a new business in exchange for stock in the company. The exchange did not qualify as a tax-

deferred exchange. The fair market value of these assets was $367,000 on the contribution date. Dennis's original basis in the assets

he contributed was $216,000, and the accumulated depreciation on the assets was $122,250.

Required

a. What is the business's basis in the assets it received from Dennis?

b. What would be the business's basis if the transaction qualified as a tax-deferred exchange?

a. Business's basis

b. Business's basis

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- As part of a transaction that qualifies under Section 351, Ann transfers property with a tax basis of $95,000 and a market value of $125,000 to Acme Corporation in exchange for Acme stock and $7,000 in cash. Acme also assumes a liability of $14,000 that is attached to the property transferred. What is Acme's tax basis in the property received in the exchange? $88,000 $95,000 $102,000 $116,000arrow_forwardOmega Corporation purchased a motor vehicle worth P1,400,000 for the use of its executive. It was registered under the executive’s name despite the agreement that it should be used partly for the company’s benefit. How much is the fringe benefits tax?arrow_forwardTristan transfers property with a tax basis of $1,160 and a falr market value of $1,720 to a corporation In exchange for stock with a falr market value of $1,160 and $390 In cash in a transaction that qualifies for deferral under section 351. The corporation assumed a liability of $170 on the property transferred. What Is the corporation's tax basis In the property recelved In the exchange? Multiple Cholce $1,720 $1,550 $1,330 $1,160arrow_forward

- Which of the following is true with respect to the related party rules? a.A disallowed loss on a related party transaction can be used to offset any future gain when the property is sold to an unrelated party. b.Bill sells stock to his sister for a $3,000 loss. Bill can deduct the loss on his tax return. c.A taxpayer's uncle is a related party for purposes of Section 267. d.Under the constructive ownership rules of Section 267, a shareholder owns 10 percent of the stock owned by a corporation in which he or she is a shareholder. e.None of these choices are correct.arrow_forward1. George operates a business that generated revenues of $50 million and allocable taxable income of $560,000. Included in the computation of allocable taxable income were $900,000 of business interest expense, $20,000 of business interest income, and $180,000 of depreciation. What is the maximum business interest deduction that George will be eligible to claim this year if the business does not qualify under the gross income test? a) $168,000 b) $560,000 c) $612,000 d) $452,000 2. Mike started a calendar-year business on September 1stSeptember 1st of this year by paying 12 months of rent on his shop at $550 per month. What is the maximum amount of rent that Mike can deduct this year under each type of accounting method? a) $6,600 under the cash method and $6,600 under the accrual method b) $6,600 under the cash method and $2,200 under the accrual method c) $2,200 under the cash method and $2,200 under the accrual method d) $2,200 under the cash method and zero under the…arrow_forwardHello, I need help solving this accounting problem.arrow_forward

- Casey transfers property with a tax basis of $2,840 and a fair market value of $6,600 to a corporation in exchange for stock with a fair market value of $4,800 and $450 in cash in a transaction that qualifies for deferral under section 351. The corporation assumed a liability of $1,350 on the property transferred. Casey also incurred selling expenses of $372. What is the amount realized by Casey in the exchange? Multiple Choice $6,600 $6,228 $6,128 $5,678arrow_forwardEf 65.arrow_forwardLiO Company transferred an old asset with a $13,600 adjusted tax basis in exchange for a new asset worth $11,000 and $1,500 cash. Which of the following statements are true? a) If the exchange is taxable, LiO recognizes an $1,100 loss. b) If the exchange is nontaxable, LiO recognizes no loss. c) If the exchange is nontaxable, LiO’s tax basis in the new asset is $12,100 d) If the exchange is nontaxable, LiO recognizes a $1,500 Lossarrow_forward

- When incorporating Spotfree, a cleaning company, Jayne transferred accounts receivable (fair market value $20,000 and $0 tax basis) and $12,000 of accounts payable from her cash-method sole proprietorship to Spotfree in exchange for Spotfree stock valued at $8,000. Assume the transfer qualifies under §351. Note: Leave no answer blank. Enter zero if applicable. Required: What is the amount of the gain Jayne must recognize on the exchange and its character? What is Jayne's basis in the Spotfree stock received in the exchange?arrow_forwardFor an accrual basis taxpayer, the all events test is not met until economic performance occurs. Economic performance occurs: (a.) When a corporation receives its completed tax return from its accountant (b.) When the employees of self-insured corporation receive medical treatment (c.) When a corporation purchases a $5 million annuity in settlement of $20 million award to a plaintiff/customer in a production liability lawsuit (d.) On March 1, when a corporation uses a leased copy machine to make 12,000 copies for the month of March and it must pay $.10 per copy for copies mad in excess 10,000 plus a flat fee of $500/month.arrow_forwardAntoine transfers property with a tax basis of $524 and a fair market value of $647 to a corporation in exchange for stock with a fair market value of $569 in a transaction that qualifies for deferral under section 351. The corporation assumed a liability of $78 on the property transferred. What is Antoine's tax basis in the stock received in the exchange? Multiple Choice O $647 O $524 $569 O$446.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you