FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

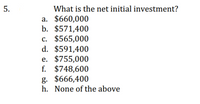

Transcribed Image Text:What is the net initial investment?

a. $660,000

b. $571,400

c. $565,000

d. $591,400

e. $755,000

f. $748,600

g. $666,400

h. None of the above

5.

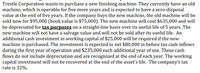

Transcribed Image Text:Trestle Corporation wants to purchase a new finishing machine. They currently have an old

machine, which is operable for five more years and is expected to have a zero-disposal

value at the end of five years. If the company buys the new machine, the old machine will be

sold now for $95,000 (book value is $75,000). The new machine will cost $635,000 and will

be depreciated for tax purposes on a straight-line basis over its useful life of 5 years. The

new machine will not have a salvage value and will not be sold after its useful life. An

additional cash investment in working capital of $25,000 will be required if the new

machine is purchased. The investment is expected to net $80,000 in before tax cash inflows

during the first year of operation and $235,000 each additional year of use. These cash

flows do not include depreciation and are recognized at the end of each year. The working

capital investment will not be recovered at the end of the asset's life. The company's tax

rate is 32%.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Your facility is undergoing a major expansion, which will require significant capitalinvestment into new machinery. The total cost of the machinery will be $7.2 Million, and theywill be purchased outright immediately. This machinery is considered a 7-year MACRSasset. However, you expect to use it for only six years before selling it for $1.5 Million. How much should the company deduct from their taxable income for depreciation expensesin year 3 for this machinery?a. $1,259,280b. $996,930c. $1,028,571d. $1,200,000arrow_forward(Capital gains tax) The J. Harris Corporation is considering selling one of its old assembly machines. The machine, purchased for $30,000 5 years ago, had an expected life of 10 years and an expected salvage value of zero. Assume Harris uses simplified straight-line depreciation (depreciation of $3,000 per year) and could sell this old machine for $35,000. Also assume Harris has a 34 percent marginal tax rate. a. What would be the taxes associated with this sale? b. If the old machine were sold for $25,000, what would be the taxes associated with this sale? c. If the old machine were sold for $15,000, what would be the taxes associated with this sale? d. If the old machine were sold for $12,000, what would be the taxes associated with this sale? a. If the old machine were sold for $35,000, there would be $ (...) (Round to the nearest dollar and select from the drop-down menu.)arrow_forwardCullumber, Inc. is considering the purchase of a warehouse directly across the street from its manufacturing plant. Cullumber currently warehouses its inventory in a public warehouse across town. Rent on the warehouse and delivering and picking up inventory cost Cullumber $50880 per year. The building will cost Cullumber $477000. Cullumber will depreciate the building for 20 years. At the end of 20 years, the building will have a $132500 salvage value. Cullumber's required rate of return is 12%. Click here to view the factor table. Using the present value tables, the building's net present value is (round to the nearest dollar) O $1017600. O $46077. O $393783. O $-83217.arrow_forward

- The Jones Company has just completed the third year of a five-year MACRS recovery period for a piece of equipment it originally purchased for $299,000. a. What is the book value of the equipment? b. If Jones sells the equipment today for $181,000 and its tax rate is 21%, what is the after-tax cash flow from selling it? Note: Assume that the equipment is put into use in year 1. a. What is the book value of the equipment? The book value of the equipment after the third year is $ (Round to the nearest dollar.)arrow_forwardThe Target Copy Company is contemplating the replacement of its old printing machine with a new model costing $60,000. The old machine, which originally cost $40,000, has 6 years of expected life remaining and a current book value of $24,000 versus a current market value of $28,000. Target's corporate tax rate is 40 percent. If Target sells the old machine at market value, what is the initial after-tax cash outlay for the new printing machine? Round it a whole dollar and do not include the $ sign.arrow_forwardThe Target Copy Company is contemplating the replacement of its old printing machine with a new model costing $80,000. The old machine, which originally cost $40,000, has 6 years of expected life remaining and a current book value of $25,000 versus a current market value of $17,000. Target's corporate tax rate is 40 percent. If Target sells the old machine at market value, what is the initial after-tax cash outlay for the new printing machine? Round it a whole dollar and do not include the $ sign.arrow_forward

- Your facility is undergoing a major expansion, which will require significant capitalinvestment into new machinery. The total cost of the machinery will be $7.2 Million, and theywill be purchased outright immediately. This machinery is considered a 7-year MACRSasset. However, you expect to use it for only six years before selling it for $1.5 Million. What is the gains tax owed on the machinery sale at the end of year 6 if the tax rate is 21%? a. $45,108b. $169,692c. $315,000d. $0arrow_forwardYour company is contemplating the purchase of a large stamping machine. The machine will cost $167,000. With additional transportation and installation costs of $5,000 and $11,000, respectively, the cost basis for depreciation purposes is $183,000. Its MV at the end of five years is estimated as $34,000. The IRS has assured you that this machine will fall under a three year MACRS class life category. The justifications for this machine include $45,000 savings per year in labor and $29,000 savings per year in reduced materials. The before-tax MARR is 24% per year, and the effective income tax rate is 28%. Assume the stamping machine will be used for only three years, owing to the company's losing several government contracts. The MV at the end of year three is $47,000. What is the income tax owed at the end of year three owing to depreciation recapture (capital gain)? E Click the icon to view the GDS Recovery Rates (rg) for the 3-year property class. Choose the correct answer below. O…arrow_forwardHancheta Inc. is considering the purcase of a new vehicle for P350,000. The firm's old vehicle has a book value of P85,000, but can only be sold for P60,000. The new vehicle will be depreciated using a 5 year useful life and the straight line method. It is expected to save P62,000 after taxes from the reduced fuel and maintenance expenses. Tabletop Raul is in the tax bracket and has a 12% cost of capital. Compute for the accounting rate of return on initial investment.arrow_forward

- Mars Inc. is considering a 5-year project that requires a new machine that costs $65,000, and an additional net working capital of $4,000, which will be recovered when the project ends in 5 years. This project would increase the firm's revenues by $21,000 per year and its operating costs by $9,000 per year. Mars will use the 3-year MACRS to depreciate the machine, and it expects to sell the machine at the end of the project for $19,000. The firm's marginal tax rate is 28 percent, and the project's cost of capital is 14 percent. What is the net cash flow at year 5, the final year? MACRS 3-year schedule is as follows: 33%, 45%, 15%, and 7% for years 1 to 4, respectively. Question 14 options: $24,760 $25,460 $25,840 $26,320 $26,680 $27,140arrow_forwardMoore & Moore (MM) is considering the purchase of a new machine for $50,000, installed. MM will use the MACRS accelerated method to depreciate the machine, which is classified as 5-year property (see the following MACRS table for depreciation rates). MM expects to sell the machine at the end of its 4-year operating life for $10,000. If MM's marginal tax rate is 40%, what will the after-tax cash flow be when it disposes of the machine at the end of Year 4? Annual depreciation rates for years 1 through 6 are respectively as follows: 20%, 32%, 19%, 12%, 11%, 6%. A. $7,656 B. $8,059 C. $8,484 D. $8,930 E. $9,400arrow_forwardCullumber Lumber, is considering purchasing a new wood saw that costs $40,000. The saw will generate revenues of $100,000 per year for five yearsThe cost of materials and labor needed to generate these revenues will total $60,000 per yearand other cash expenses will be $10,000 per year. The machine is expected to sell for $2.000 at the end of its fiveyear life and will be depreciated on a straight-line basis over five years to zeroCullumber's tax rate is 26 percentand its opportunity cost of capital is 14.20 percent. What is the project's NPV(Do not round intermediate calculationsRound final answer to decimal places, e.g. 5,275)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education