FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

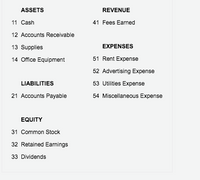

Transcribed Image Text:ASSETS

REVENUE

11 Cash

41 Fees Earned

12 Accounts Receivable

13 Supplies

EXPENSES

14 Office Equipment

51 Rent Expense

52 Advertising Expense

LIABILITIES

53 Utilities Expense

21 Accounts Payable

54 Miscellaneous Expense

EQUITY

31 Common Stock

32 Retained Earnings

33 Dividends

Transcribed Image Text:Transactions

Oct.

1

Paid rent for the month, $2,200.

4

Paid advertising expense, $550.

Paid cash for supplies, $1,200.

6

Purchased office equipment on account, $9,300.

12

Received cash from customers on account, $16,950.

20

Paid creditor on account, $3,500.

27

Paid cash for miscellaneous expenses, $520.

30

Paid telephone bill for the month, $325.

31

Fees earned and billed to customers for the month, $51,040.

31

Paid electricity bill for the month, $860.

31

Paid dividends, $1,500.

Journalize the preceding selected transactions for October 20Y2 in a two-column journal. Refer to the Chart of Accounts for exact wording of account

titles.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Maniarrow_forwardThe activity date, company, and amount for a credit card bill are shown below. The due date of the bill is July 10. On June 10, there was an unpaid balance of $987.81. Find the finance charge if the interest rate is 1.9% per month. (Round your answer to the nearest cent.) $ X Activity Date June 10 June 11 June 12 June 15 June 16 June 20 June 22 June 28 June 30 July 2 July 8 Company Unpaid balance Jan's Surf Shop Albertson's The Down Shoppe NY Times Sales Cardiff Delicatessen The Olde Golf Mart Lee's Hawaiian Restaurant City Food Drive Credit card payment Safeway Stores Amount 987.81 156.33 45.61 59,84 18.54 23.09 126.92 41.78 100.00 -1000.00 161.38 4arrow_forwardKathy Hansen has a revolving credit account. The finance charge is calculated on the previous month's balance, and the annual percentage rate is 12%. Complete the following account activity table for Kathy. Round your answers to the nearest cent. Previous Purchases New Balance Month's Finance and Cash Payments End of Month Balance Charge Advances and Credits Month May $540.00 $177.53 $585.00arrow_forward

- Kathy Hansen has a revolving credit account. The finance charge is calculated on the previous month's balance, and the annual percentage rate is 27%. Complete the account activity table for Kathy. (Round your answers to the nearest cent.) Previous Finance Purchases New Balance End of Month Month's and Cash Advances Payments and Credits Month Charge (in $) Balance (in $) (in $) April $642.17 $14.45 $39.45 $85.00 $611.07 May $ $ $289.33 $145.00 $arrow_forwardUse the unpaid balance method to find the finance charge on the credit card account for April. The starting balance from the previous month is $200. The transactions on the account for the month are given in the table to the right. Assume an annual interest rate of 18% on the account and that the billing date is April 1st. ..... Date Transaction April 3 Charged $125 for a coat April 11 Made payment of $142 April 21 Charged $34 for DVDs April 28 Charged $25 for groceries The finance charge for the month of April is $enter your response here.arrow_forwardFor the credit card account, assume one month between billing dates (with the appropriate number of days) and interest of 1.1% per month on the average daily balance Find (a) the average daily balance, (b) the monthly finance charge, and (e) the account balance for the next billing Previous Balance: $485.26 January 13 Billing Date January 15 Retums January 20 Clothes January 27 Bus Sickets February 2 Payment February 6 Flowers $105.09 $114.34 $76.83 $130 $64.41 (a) The average daily balance is (Round to the nearest cent as needed.) (b) The finance charge is (Round to the nearest cent as needed) (c) The account balance for the next billing is $ (Round to the nearest cent as needed.)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education