FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

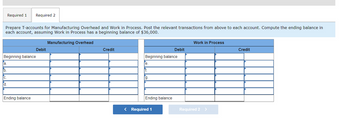

Transcribed Image Text:Prepare T-accounts for Manufacturing Overhead and Work in Process. Post the relevant transactions from above to each account. Compute the ending balance in

each account, assuming Work in Process has a beginning balance of $36,000.

Manufacturing Overhead

Required 1 Required 2

Beginning balance

a.

b.

C.

d.

Ending balance

Debit

Credit

Beginning balance

e.

rf.

g.

Ending balance

Debit

< Required 1

Work in Process

Required 2 >

Credit

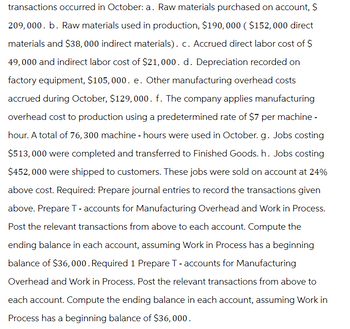

Transcribed Image Text:transactions occurred in October: a. Raw materials purchased on account, $

209,000. b. Raw materials used in production, $190,000 ($152, 000 direct

materials and $38,000 indirect materials). c. Accrued direct labor cost of $

49,000 and indirect labor cost of $21,000. d. Depreciation recorded on

factory equipment, $105,000. e. Other manufacturing overhead costs

accrued during October, $129,000. f. The company applies manufacturing

overhead cost to production using a predetermined rate of $7 per machine -

hour. A total of 76, 300 machine - hours were used in October. g. Jobs costing

$513,000 were completed and transferred to Finished Goods. h. Jobs costing

$452,000 were shipped to customers. These jobs were sold on account at 24%

above cost. Required: Prepare journal entries to record the transactions given

above. Prepare T - accounts for Manufacturing Overhead and Work in Process.

Post the relevant transactions from above to each account. Compute the

ending balance in each account, assuming Work in Process has a beginning

balance of $36,000. Required 1 Prepare T - accounts for Manufacturing

Overhead and Work in Process. Post the relevant transactions from above to

each account. Compute the ending balance in each account, assuming Work in

Process has a beginning balance of $36,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Statement of Cost of Goods Manufactured for a Manufacturing Company Cost data for Sandusky Manufacturing Company for the month ended January 31 are as follows: Inventories January 1 January 31 Materials $178,500 $155,300 Work in process 117,810 102,500 Finished goods 91,040 104,050 Direct labor $321,300 Materials purchased during January 342,720 Factory overhead incurred during January: Indirect labor 34,270 Machinery depreciation 20,710 Heat, light, and power 7,140 Supplies 5,710 Property taxes 5,000 Miscellaneous costs 9,280 a. Prepare a cost of goods manufactured statement for January. Sandusky Manufacturing Company Statement of Cost of Goods Manufactured For the Month Ended January 31arrow_forwardCost of Direct Materials Used in Production for a Manufacturing Company Sepulveda Manufacturing Company reported the following materials data for the month ending November 30: Materials purchased $236,400 Materials inventory, November 1 74,600 Materials inventory, November 30 62,200 Determine the cost of direct materials used in production by Sepulveda during the month ended November 30.arrow_forwardCost data for Firetree Manufacturing Company for the month ended March 31 are as follows: Inventories March 1 March 31 Materials $224,000 $199,360 Work in process 147,840 131,580 Finished goods 116,480 135,560 Line Item Description Amount Direct labor $403,200 Materials purchased during March 430,080 Factory overhead incurred during March: Line Item Description Amount Indirect labor 43,010 Machinery depreciation 25,980 Heat, light, and power 8,960 Supplies 7,170 Property taxes 6,270 Miscellaneous costs 11,650 Question Content Area a. Prepare a cost of goods manufactured statement for March. Firetree Manufacturing Company Statement of Cost of Goods Manufactured For the Month Ended March 31 Costs Type Amount Amount Amount $- Select - Direct materials: $- Select - - Select - $- Select - - Select - $- Select - - Select - Factory overhead: $- Select - - Select - - Select - - Select - - Select - - Select - Total factory overhead Total factory overhead Total…arrow_forward

- Cost of Direct Materials Used in Production for a Manufacturing Company Walker Manufacturing Company reported the following materials data for the month ending June 30: Materials purchased Materials inventory, June 1 Materials inventory, June 30 $207,500 65,500 54,600 Determine the cost of direct materials used in production by Walker during the month ended June 30. $arrow_forwardRaw Materials Used: $84,404 Direct Labor: $143,978 Manufacturing Overhead Incurred: $324,608 Work-in-Process inventory, Jan 1: $53,982 Work-in-Process inventory, Dec 31: $75,011 Finished Goods inventory, Jan 1: $181,914 Finished Goods inventory, Dec 31: $147,712 What is Cost of Goods Manufactured for the year?arrow_forwardPrepare journal entries to record transactions a through h. a. Raw materials purchased on credit, $96,000. b. Direct materials used, $41,000. Indirect materials used, $18,600. c. Direct labor used, $32,000. Indirect labor used, $8,000. (Record using Factory Wages Payable.) d. Paid cash for other actual overhead costs, $8,000. e. Applied overhead at the rate of 120% of direct labor cost. f. Transferred cost of jobs completed to finished goods, $60,000. g. Sales of jobs on credit was $85,000. h. Cost of jobs sold was $60,000. View transaction list Journal entry worksheetarrow_forward

- Statement of Cost of Goods Manufactured for a Manufacturing Company Cost data for Sandusky Manufacturing Company for the month ended January 31 are as follows: Inventories January 1 January 31 Materials $151,500 $128,780 Work in process 101,510 86,280 Finished goods 77,270 86,280 Direct labor $272,700 Materials purchased during January 290,880 Factory overhead incurred during January: Indirect labor 29,090 Machinery depreciation 17,570 Heat, light, and power 6,060 Supplies 4,850 Property taxes 4,240 Miscellaneous costs 7,880 a. Prepare a cost of goods manufactured statement for January. Sandusky Manufacturing Company Statement of Cost of Goods Manufactured For the Month Ended January 31 $fill in the blank 9dc536060f91fdb_2 Direct materials: $fill in the blank 9dc536060f91fdb_4 fill in the blank 9dc536060f91fdb_6 $fill in the blank 9dc536060f91fdb_8 fill in the blank…arrow_forwardSelected data for Lemon Grass, Inc. for the year are provided below: Factory Utilities $2,100 Indirect Materials Used 32,500 Direct Materials Used 309,000 Property Taxes on Factory Building 5,400 Sales Commissions 83,000 Indirect Labor Incurred 20,000 Direct Labor Incurred 145,000 Depreciation on Factory Equipment 6,800 What is the total manufacturing overhead? A. $52,500 B. $14,300 C. $454,000 D.arrow_forwardSuperior Company provided the following data for the year ended December 31 (all raw materials are used in production as direct materials): Selling expenses $ 212,000 Purchases of raw materials $ 270,000 Direct labor ? Administrative expenses $ 152,000 Manufacturing overhead applied to work in process $ 376,000 Actual manufacturing overhead cost $ 358,000 Inventory balances at the beginning and end of the year were as follows: Beginning Ending Raw materials $ 51,000 $ 32,000 Work in process ? $ 32,000 Finished goods $ 31,000 ? The total manufacturing costs added to production for the year were $680,000; the cost of goods available for sale totaled $745,000; the unadjusted cost of goods sold totaled $666,000; and the net operating income was $39,000. The company’s underapplied or overapplied overhead is closed to Cost of Goods Sold. Required: Prepare schedules of cost of goods manufactured and cost of goods sold and an income statement.arrow_forward

- The following data pertain to Babor Company for the fiscal year ended December 31: Prior December 31 Current December 31 Purchases of materials $ 165,000 Direct labor 114, 000 Indirect labor 45,000 Factory insurance 8,000 Depreciation-factory 33,000 Repairs and maintenance-factory 11,000 Marketing expenses 144,000 General and administrative expenses 86,000 Materials inventory $ 23,000 55,000 Work - in - Process inventory 13, 000 16,000 Finished Goods inventory 17,000 24,000 Sales in the current year were $625,000. Required: Prepare a schedule of cost of goods manufactured and an income statement for the current year for Babor Company.arrow_forward#5-26 During May, the following transactions were completed and reported by Jerico Company: Materials purchased on account, $60,100. Materials issued to production to fill job-order requisitions: direct materials, $50,000; indirect materials, $8,800. Payroll for the month: direct labor, $75,000; indirect labor, $36,000; administrative, $28,000; sales, $19,000. Depreciation on factory plant and equipment, $10,400. Property taxes on the factory accrued during the month, $1,450. Insurance on the factory expired with a credit to the prepaid insurance account, $6,200. Factory utilities, $5,500. Advertising paid with cash, $7,900. Depreciation on office equipment, $800; on sales vehicles, $1,650. Legal fees incurred but not yet paid for preparation of lease agreements, $750. Overhead is charged to production at a rate of $18 per direct labor hour. Records show 4,000 direct labor hours were worked during the month. Cost of jobs completed during the month, $160,000.…arrow_forwardThe following costs were incurred by ABC Company in January: Direct materials Direct labor Manufacturing overhead Selling expense Administrative salaries Determine ABC's total product cost. Oa. $272,000 Ob. $282,000 Oc. $252,000 Od. $302,000 $100,000 79,000 73,000 25,000 5,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education