FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

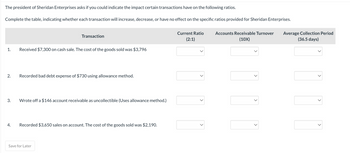

Transcribed Image Text:The president of Sheridan Enterprises asks if you could indicate the impact certain transactions have on the following ratios.

Complete the table, indicating whether each transaction will increase, decrease, or have no effect on the specific ratios provided for Sheridan Enterprises.

Transaction

1.

Received $7,300 on cash sale. The cost of the goods sold was $3,796

2.

Recorded bad debt expense of $730 using allowance method.

3.

Wrote off a $146 account receivable as uncollectible (Uses allowance method.)

4.

Recorded $3,650 sales on account. The cost of the goods sold was $2,190.

Save for Later

Current Ratio

(2:1)

Accounts Receivable Turnover

(10X)

Average Collection Period

(36.5 days)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Action Signs recorded credit sales of $10,000 on the gross method. Terms are 2/20, n/30. How would the entry to this sale be recorded? cash decreases by $3,000 sales discounts increase by $200 sales increases by $9,800 accounts receivable increases by $10,000arrow_forwardM6-2 (Algo) Reporting Net Sales with Sales Discounts, Credit Card Discounts, and Sales Returns L06-1 Total gross sales for the period include the following: Credit card sales (discount 34) Sales on account (2/15, n/60) $10,000 $10,200 Sales returns related to sales on account were $250. All returns were made before payment. One-half of the remaining sales on account were paid within the discount period. The company treats all discounts and returns as contra-revenues. What amount will be reported on the income statement as net sales? Note: Do not round intermediate calculations. Round your answer to 2 decimal places. Answer is complete but not entirely correct. $ 19,950.00 Net salesarrow_forwardLogan Sales provides the following information: Net credit sales: $770,000 Beginning net accounts receivable: $45,000.00 Ending net accounts receivable: $22,000 Calculate the accounts receivable turnover ratio. (Round your answer to the nearest whole number.) A. 23 times B. 35 times C. 33 times D. 17 timesarrow_forward

- M6-2 (Algo) Reporting Net Sales with Sales Discounts, Credit Card Discounts, and Sales Returns LO6-1 Total gross sales for the period include the following: Credit card sales (discount 3%) Sales on account (3/15, n/60) $ 10,300 $ 11,000 Sales returns related to sales on account were $200. All returns were made before payment. One- half of the remaining sales on account were paid within the discount period. The company treats all discounts and returns as contra-revenues. What amount will be reported on the income statement as net sales? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Net salesarrow_forwardcompany reported credit sale of 6252900 and cost of goods sold of 3300000 for the year. the acconunt receivable balance at the beginning and end of the year were 516000 and 581000. receivables turnover ratio is 1. 10.8 2. 6.0 3. 11.4 4. 5.7arrow_forwardThe following information has been extracted from the annual reports of Lilydale Ltd and Monbulk Ltd. Lilydale Ltd Monbulk Ltd $2 950 300 17 100 Sales (net credit) revenue for year Allowance for Doubtful Debts, 1/7/18 Allowance for Doubtful Debts, 30/6/19 Accounts receivable (gross) 1/7/18 Accounts receivable (gross) 30/6/19 $2 204 300 27 100 19780 28 100 722 650 368 000 485 800 384 200 (a) Calculate the receivables turnover ratio and average collection period for both companies. Comment on the difference in their collection experiences. (b) Compare the success or otherwise of their cash collection policies, given that the average receivables turnover for the industry in which the companies operated is 7. Credit terms for both companies are 2/10, n/30.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education