FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:46 12:09 b

0.10 & 25% O

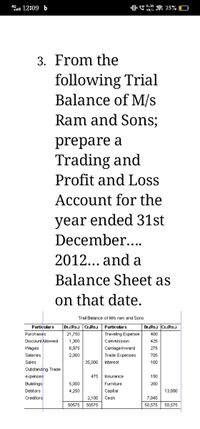

3. From the

following Trial

Balance of M/s

Ram and Sons;

prepare a

Trading and

Profit and Los

Account for the

year ended 31st

December..

2012... and a

Balance Sheet as

on that date.

Trail Balance of Mis ram and Sons

Dr.(Rs.) Cr.Rs.) Particulars

Traveling Expense

Particulars

DrRs.) Cr.(Rs.)

Purchases

21,750

400

Discount Allowed

1,300

Commission

425

Wages

6,975

Carriage Inward

275

Salaries

2,000

Trade Expenses

705

Sales

35,000

Interest

100

Outstand ng Trade

expenses

475

Insurance

150

Buildings

5,000

Furniture

200

Debtors

4,250

Capit al

13,000

Creditors

2,100

Cash

7,045

50575

50575

50,575

50,575

Transcribed Image Text:46 12:09 b

0.10 & 25% O

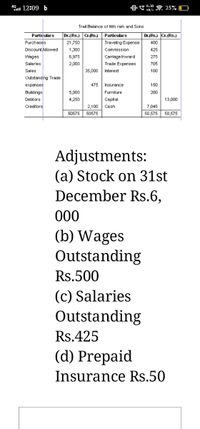

Trail Balance of Mis ram and Sons

Particulars

Dr.(Rs.)

CrRs.)

Particulars

DrARs.) Cr.(Rs.)

Purchases

Discount Allowed

21,750

Traveling Expense

400

1,300

Commission

425

Wages

6,975

Carriage Inward

275

Salaries

2,000

Trade Expenses

705

Sales

35,000

Interest

100

Outstand ng Trade

expenses

475

Insurance

150

Buildings

5,000

Furniture

200

Debtors

4,250

Capital

13,000

Creditors

2,100

Cash

7,045

50575

50575

50,575

50,575

Adjustments:

(a) Stock on 31st

December Rs.6,

000

(b) Wages

Outstanding

Rs.500

(c) Salaries

Outstanding

Rs.425

(d) Prepaid

Insurance Rs.50

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 17 A company purchased $4,600 worth of merchandise. Transportation costs were an additional $405. The company returned $315 worth of merchandise and then paid the invoice within the 1% cash discount period. The total cost of this merchandise is: 1 Multiple Choice polnts $4,510.00. $4.476.00. $4,644.00. $4,647.15. $4,690.00.arrow_forwardSh39arrow_forwardNonearrow_forward

- c. On 9/12 Year 7 $2,000 of ACCOUNTS PAYABLE is paid after the discount period. Phrase 1st: 2nd: Phrase 1st: Account 2nd: Accounts Account Category AL SER E contra AL SER E contra + Accounts Debit Affect d. On 9/28 Year 7 INVENTORY originally purchased for $4,000 on 9/1 Year 7 and was paid for on 9/10 Year 7 is returned by the purchaser and a debit memorandum (a debit to A/P) is received from the seller. [Hint: the amount of cash involved in this transaction must take the 2% discount into account.] Debit + Category AL SE RE contra AL SE RE contra + - + Affect Dr. or Cr. Dr Cr Dr Cr Credit Dr. or Cr. Credit Dr Cr Dr Crarrow_forwardPlease do not give solution in image format thankuarrow_forwardCompany A purchases goods for cash on January 15. They purchase 10 items at a cost of $50 per item. 5 of these items are sold on January 29 for $700 cash. What is/(are) the entry/(ies) on January 29 to record the sale of the goods? O Debit Cash $700 Credit Sales Revenue S700 O Debit Accounts Receivable $700 Credit Sales Revenue $700 Debit Cost of Goods Sold $250 Credit Inventory $250 Debit Cash $700 Credit Sales Revenue $700 Debit Cost of Goods Sold S250 Credit Inventory $250 O Debit Cash $700 Credit Sales Revenue $700 Debit Cost of Goods Sold $500 Credit Inventory 5500arrow_forward

- HAURA DESIGN COMPANY TRIAL BALANCE AS AT 30 JUNE 2020 Accounts Debit Credit RM RM Cash 21,050 Accounts Receivable 6,300 5,000 Inventory Accounts Payable 18,000 Vehicles 80,000 Accumulated Depreciation -Vehicles Humaira Capital Humaira Drawings Freight In Freight Out 32,000 51,800 1,150 800 1,600 Purchase Insurance 500 Sales Return and Allowances 2,100 Purchase Return and Allowances 2,000 Sales Discount 500 Purchase Discount 1400 Sales 70,200 Purchases 35,000 Insurance Expense 600 Interest Revenue 1,100 Salaries Expense 6,000 Rental Revenue 800 Depreciation Expense-Vehicle Bad Debt Expense Prepaid Insurance Salaries Payable Unearned Rental Revenue 16,000 400 1,200 500 400 178,200 178,200 Additional Informations : 1. Inventory as at June 30, 2020 is RM6,300. 2. Net income = RM 13,300 Required : 1. Prepare a Statement of Owner's Equity for the year ended June 30, 2020. 2. Prepare a Statement of Financial Position as at June 30, 2020.arrow_forwardMC Qu. 10-86 Zorn Inc. makes a sale for... Zorn Inc. makes a sale for $400. The company is required to collect sales taxes amounting to 9%. What is the amount that will be credited to the Sales Tax Payable account? Multiple Cholce $36 $33 $200 $39 ype here to search. W Trop storm warning DELLarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education