Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

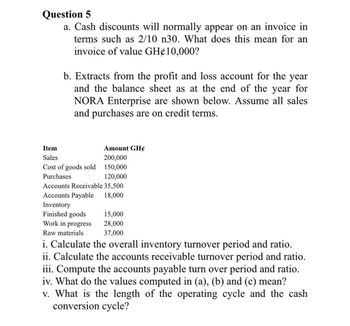

Transcribed Image Text:Question 5

a. Cash discounts will normally appear on an invoice in

terms such as 2/10 n30. What does this mean for an

invoice of value GH¢10,000?

b. Extracts from the profit and loss account for the year

and the balance sheet as at the end of the year for

NORA Enterprise are shown below. Assume all sales

and purchases are on credit terms.

Item

Sales

Amount GH¢

200,000

Cost of goods sold 150,000

Purchases

120,000

Accounts Receivable 35,500

Accounts Payable

18,000

Inventory

Finished goods

15,000

Work in progress

28,000

37,000

Raw materials

i. Calculate the overall inventory turnover period and ratio.

ii. Calculate the accounts receivable turnover period and ratio.

iii. Compute the accounts payable turn over period and ratio.

iv. What do the values computed in (a), (b) and (c) mean?

v. What is the length of the operating cycle and the cash

conversion cycle?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Gross Profit During the current year, merchandise is sold for $366,100 cash and $1,420,000 on account. The cost of the merchandise sold is $1,014,300. What is the amount of the gross profit? 5:58 PM 10/20/2020 Cop 8.arrow_forwardSaved JJ Company purchased on account merchandise with a list price of $10,000. Payment terms were 1/15, n/45. If payment occurs before the discount expires, what is the effect of the purchase discount on the balance sheet? Multiple Choice O Increases accounts payable Decreases accounts receivable O Increases cash Decreases inventoryarrow_forwardQuestion: During the current year, merchandise is sold for $194,200 cash and $454,200 on account. The cost of the merchandise sold is $505,800. What is the amount of the gross profit?arrow_forward

- JoJo's recorded credit sales of $10,000 on the gross method. Terms are 2/20, n/30. Select the correct statement about the entry to record this sale. Question 3 options: Accounts receivable increases $10,000. Sales increase $9,800 Sales discounts increase $200 All of the above are correctarrow_forwardQuestion: The cost of goods sold as a percentage of net sales revenue is (round your answer to two decimal places). Sales Revenue $420,000 Sales Returns and Allowances 1,400 Sales Discounts Net Sales Revenue Cost of Good Sold a) 62.45% b) 62.58% c) 61.90% d) 62.24% 850 417,750 260,000arrow_forwardA sale of merchandise on account for $12,000 is subject to an 8% sales tax. (a) Should the sales tax be recorded at the time of sale or when payment is received?At the time of sale (b) What is the amount of the sale?$fill in the blank 2 (c) What is the amount of the increase to Accounts Receivable? If required, round your answers to nearest whole value.$fill in the blank 3 (d) What is the title of the account in which the $960 (12,000 x 8%) is credited?Sales Tax Payablearrow_forward

- Merchandise subject to terms 4/15, n/28, FOB shipping point, is sold on account to a customer for $35,000. What is the amount of the cash discount allowed in case the customer pays within the discount period? Select one: a. $1,400 b. $9,800 c. $1,500 d. $5,250arrow_forward21-The buyer received an invoice from the seller for merchandise with list price of RO 7500 and credit terms of 2/10 and n/30. The number 10 in the credit term is: a. Percentage of Cash Discount b. Credit period c. Discount period d. Trade discountarrow_forwardSales-Related Transactions After the amount due on a sale of $172,675, terms 2/10, n/30, is received from a customer within the discount period, the seller consents to the return of the entire shipment. The cost of the merchandise returned was $103,605. If required, round your answers to nearest whole value. a. What is the amount of the refund owed to the customer? b. Illustrate the effects on the accounts and financial statements of the return and the refund. If no account or activity is affected, select "No effect" from the dropdown and leave the correspondir number entry box blank. Enter account decreases, net cash outflows, and all negative effects on net income as negative amounts. Balance Sheet Stockholders' Assets Liabilities Equity Cash v + Inventory v Est. Returns Inventory = Customer Refunds Payable v + No effect v Statement of Cash Flows Income Statement Operating v No effect varrow_forward

- c. On 9/12 Year 7 $2,000 of ACCOUNTS PAYABLE is paid after the discount period. Phrase 1st: 2nd: Phrase 1st: Account 2nd: Accounts Account Category AL SER E contra AL SER E contra + Accounts Debit Affect d. On 9/28 Year 7 INVENTORY originally purchased for $4,000 on 9/1 Year 7 and was paid for on 9/10 Year 7 is returned by the purchaser and a debit memorandum (a debit to A/P) is received from the seller. [Hint: the amount of cash involved in this transaction must take the 2% discount into account.] Debit + Category AL SE RE contra AL SE RE contra + - + Affect Dr. or Cr. Dr Cr Dr Cr Credit Dr. or Cr. Credit Dr Cr Dr Crarrow_forward1. Taking advantage of a 2/10, n/30 purchases discount is equal to a yearly savings rate of approximately a.20% b.2% c.24% d.36% 2. A sales invoice included the following information: merchandise price, $12,000; terms 1/10, n/eom, FOB shipping point with prepaid freight of $900 added to the invoice. Assuming that a credit for merchandise returned of $500 (before discount) is granted prior to payment and the invoice is paid within the discount period, what amount of cash should be received by the seller? a.$11,500 b.$12,285 c.$11,385 d.$10,480 3. Cumberland Co. sells $1,012 of merchandise to Hancock Co. for cash. Cumberland paid $730 for the merchandise. Under a perpetual inventory system, which of the following is the correct journal entry(ies)? a.debit Cash, $1,012; credit Merchandise Inventory, $730 b.debit Cash, $1,012; credit Sales, $1,012; and debit Cost of Merchandise Sold, $730; credit Merchandise Inventory, $730 c.debit Accounts Receivable, $1,012; credit Sales, $1,012; and…arrow_forward5. Sales on account, with 2/10, n/30 cash discount terms. (a) Merchandise is sold on account for $450. (b) The balance is paid within the discount period. (c) Merchandise is sold on account for $280. (d) The balance is paid after the discount period. Cash Accounts Receivable Sales Sales Discountsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education